Living

Should I sell or hold onto my rental property?

Doing the math reveals surprising numbers

Earlier this year, I wrote about the question of renting vs. buying a home in D.C. In this column, I’ll address the other side of that equation—leasing out vs. selling a property.

Earlier this year, I wrote about the question of renting vs. buying a home in D.C. In this column, I’ll address the other side of that equation—leasing out vs. selling a property.

Washington is a city with many small real estate investors holding one or two properties. Imagine that you’ve owned a rental town home for a while that has suffered from deferred maintenance, and that now needs an overall facelift to continue being rentable. You’re trying to decide whether to spend $100,000 on renovations or to sell the property as-is for its market value of $600,000. What should you do?

There is no absolute right or wrong answer to this question. Your decision will be informed by a number of factors:

• Your current financial situation—how much do you need the full amount right now? Are you using the property for current cash flow? Do you have all the money for renovation or will you refinance with a conventional loan to get a $100,000 cash out or will you wrap your existing loan into a 203k loan (with the renovation cost built in)?

• Your long-term financial situation—are you planning to use the property as part of your retirement, whether for cash flow or for a nest egg to sell?

• Your tax situation—Do you need the property as a tax shelter? If you sell now, will you do a 1031 exchange or will you have to pay capital gains?

• Your patience—Do you have the energy to manage a construction project (if only as the client of the general contractor) and all the many renovation design choices you will have to make?

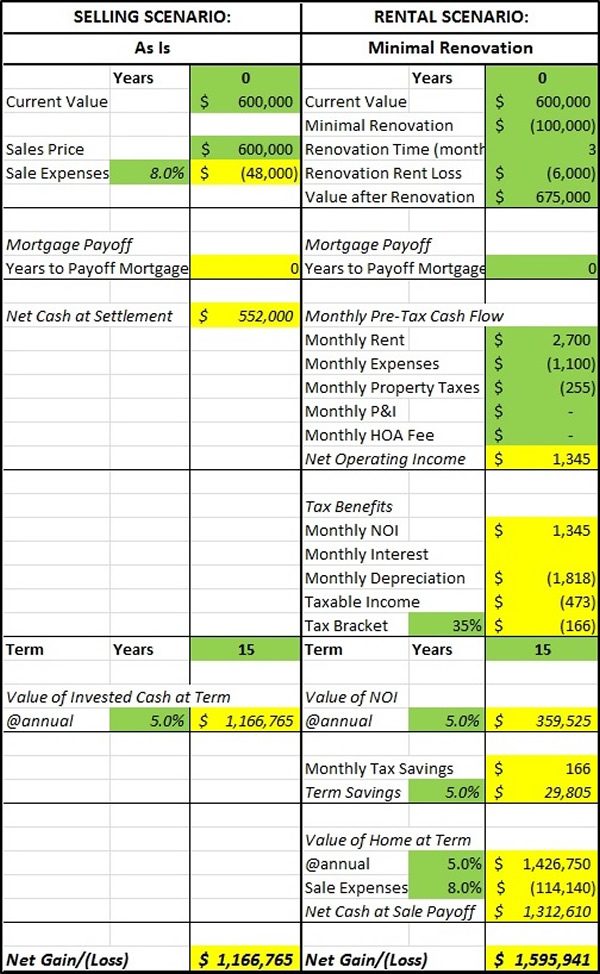

From a purely financial aspect, the numbers are clear that you will do better to lease and hold rather than to sell and invest (unless it’s in another rental property). Let’s take a look at the numbers for a 15-year comparison, based on the chart here.

First, let’s consider the sales scenario, which is quite simple: Let’s say you sell the town home for the current market value of $600,000. With 8 percent selling costs (6 percent for brokerage fees and 2 percent for other fees, including the city transfer tax), that would leave you with net cash at settlement of $552,000. If you invested that cash in a fund paying 5 percent, after 15 years you would have $1,166,765.

First, let’s consider the sales scenario, which is quite simple: Let’s say you sell the town home for the current market value of $600,000. With 8 percent selling costs (6 percent for brokerage fees and 2 percent for other fees, including the city transfer tax), that would leave you with net cash at settlement of $552,000. If you invested that cash in a fund paying 5 percent, after 15 years you would have $1,166,765.

Next, the rental scenario: For the sake of simplicity, let’s say you already own the town home outright and you have the ($100,000) cash needed for renovation. Doing the renovation will take three months, so that means (3 x $2000=$6000) in lost rental income, but your renovated town home will be worth $675,000, so let’s assume that you can now command $2700 in monthly rent for the renovated space. With monthly expenses and property taxes costing around ($1355), your monthly net operating income (NOI) is $1345. Let’s say that your monthly depreciation on your property is ($1818), which subtracted from your NOI gives ($473) in monthly taxable income. For a 35 percent tax bracket, that translates into ($166) tax savings per month.

If you invest your $1345 monthly NOI (net income after operating expenses and property taxes) at a 5 percent rate of return, in 15 years you will have $359,525. Over the same period, you will have saved $29,805 in income tax. At that point, your rental property should have appreciated in market value to $1,426,750, assuming an average 5 percent increase per year. (For Washington as a whole, average sale prices have appreciated 6.4 percent over the last six years from December 2009 to December 2015.) In order to end up with a cash-to-cash comparison, let’s say you sell the town home for market value at this 15-year point. With 8 percent selling expenses, that would leave you with $1,312,610. Adding together the 15-year value of the net operating income, tax savings, and net cash from the town home sale—and then subtracting the renovation cost and lost rental income during renovation—you would realize a net gain of $1,595,941.

In this comparison, leasing and holding yields a 36.7 percent improvement over selling and investing. But remember, your circumstances may not be the same as those assumed in these scenarios. Your best option is to consult your tax adviser, as well as a Realtor knowledgeable in investment properties.

Happy hunting!

Ted Smith is a licensed Realtor with Real Living | at Home specializing in mid-city D.C. Reach him at [email protected] and follow him on Facebook, YouTube or @TedSmithSellsDC. You can also join him on monthly tours of mid-city neighborhood open houses, as well as monthly seminars geared toward first-time homebuyers. Sign up at meetup.com.

Valentine’s Day is often portrayed as a celebration of romantic love — flowers, chocolates, and candlelit dinners. But for many LGBTQ+ individuals and couples, Valentine’s Day can also be a moment to reflect on something deeper: the love that creates a safe, welcoming home.

For LGBTQ+ home buyers and sellers, homeownership is more than a financial milestone—it is an act of belonging, resilience, and pride. Owning a home can mean finally having a place where you can hold hands with your partner on the front porch, decorate with your authentic style, and build a life free from judgment. In this way, buying or selling a home is one of the most meaningful love stories many LGBTQ+ people will ever write.

This Valentine’s Day, whether you’re a first-time gay home buyer, a same-sex couple upgrading your space, or an LGBTQ+ seller moving on to your next chapter, it’s worth thinking about how love, identity, and real estate intersect—and how to navigate that journey with confidence, protection, and the right support.

Love, Identity, and the Meaning of ‘Home’

For generations, LGBTQ+ people were denied equal access to housing, homeownership, and legal protections. Even today, many LGBTQ+ home buyers still face subtle bias, uncomfortable interactions, or outright discrimination in the real estate process.

That’s why finding LGBTQ+ friendly real estate and an affirming gay friendly realtor or lesbian realtor matters so much. A home isn’t just a building—it’s a personal sanctuary. Working with LGBTQ+ real estate agents who understand your lived experience can make all the difference between a stressful transaction and a joyful one.

For over 30 years, GayRealEstate.com has been the leading gay real estate network, connecting LGBTQ+ home buyers and sellers with gay real estate agents, lesbian real estate agents, and LGBTQ+ friendly realtors who truly “get it.” Their mission has always been simple yet powerful: to ensure that every LGBTQ+ person has access to safe, respectful, and inclusive real estate services.

Finding Your Match: Choosing the Right LGBTQ+ Friendly Realtor

Much like dating, finding the right real estate agent is about compatibility, trust, and communication. Here are some key tips for choosing the best LGBTQ+ real estate representation:

- Look for experience with LGBTQ+ clients. Search for a gay realtor near me or lesbian realtor near me through GayRealEstate.com, where agents are vetted for cultural competency and community commitment.

- Ask about their experience with same-sex couple home buying. A strong agent should understand issues like joint ownership, legal protections, and financing considerations.

- Choose someone who listens. You should feel safe sharing your priorities—whether that includes proximity to LGBTQ+ nightlife, affirming schools, or lesbian-friendly neighborhoods.

- Prioritize respect and transparency. Your agent should advocate for you, not just push a quick sale.

The right gay friendly real estate agent isn’t just helping you buy a house—they’re helping you find a place to build your life.

Best Cities for LGBTQ+ Home Buyers

If love is your compass, location is your map. Some of the best cities for LGBTQ+ home buyers consistently offer strong community presence, legal protections, and welcoming neighborhoods:

- Wilton Manors, Florida – A hub for LGBTQ+ culture with thriving LGBTQ+ real estate opportunities

- Palm Springs, California – A long-standing LGBTQ+ retirement and second-home destination

- Provincetown, Massachusetts – Historic LGBTQ+ community with progressive housing protections

- Asheville, North Carolina – Growing market with inclusive real estate services

- Fort Lauderdale, Florida – Diverse, welcoming, and highly sought-after for LGBTQ+ home ownership

Working with GayRealEstate.com allows you to connect with local LGBTQ+ real estate experts who know these markets inside and out.

Navigating Legal Protections in LGBTQ+ Real Estate

Love is universal—but legal protections are not always consistent. Understanding your rights is essential when buying or selling a home as an LGBTQ+ person.

Key protections include:

- Fair Housing Act (FHA): Prohibits discrimination based on sex, which courts have increasingly interpreted to include sexual orientation and gender identity.

- State and local protections: Many cities and states offer additional safeguards against LGBTQ+ housing discrimination.

- Same-sex couple legal considerations: If you are married, joint ownership is typically straightforward. If not, consult an attorney about co-ownership agreements.

A knowledgeable LGBTQ+ friendly realtor from GayRealEstate.com can help guide you through these complexities and connect you with trusted legal professionals when needed.

Buying a Home as an LGBTQ+ Person: Practical Tips

If you’re embarking on your home-buying journey this Valentine’s season, here are smart, practical steps to take:

- Clarify your priorities. Do you want a vibrant LGBTQ+ neighborhood, quiet suburbs, or access to queer community spaces?

- Get pre-approved for a mortgage. This strengthens your position in competitive markets.

- Work with an LGBTQ+ real estate agent. Searching “finding a gay real estate agent” or “finding a lesbian real estate agent” through GayRealEstate.com is a great first step.

- Research inclusive communities. Some neighborhoods are more welcoming than others.

- Know your rights. If you experience bias, document it and seek legal guidance.

Buying a home is an act of self-love—and community love.

Selling a Home as an LGBTQ+ Person

Selling can be just as emotional as buying, especially if your home represents years of memories with your partner, friends, or chosen family.

When selling a home as an LGBTQ+ person, consider:

- Working with a gay friendly realtor who will market your home inclusively

- Highlighting LGBTQ+ community appeal in listings

- Being prepared for potential buyer bias (and knowing how to respond)

- Leaning on GayRealEstate.com’s LGBTQ+ real estate services for trusted guidance

Your story—and your home—deserve respect.

Real Estate for LGBTQ+ Families

More LGBTQ+ couples are raising children, fostering, or building blended families. This makes homeownership even more meaningful.

When searching for real estate for LGBTQ+ families, consider:

- LGBTQ+ affirming school districts

- Family-friendly queer communities

- Safe neighborhoods with inclusive values

- Access to LGBTQ+ resources and social networks

GayRealEstate.com specializes in helping LGBTQ+ families find homes that truly fit their lives.

Love, Pride, and Homeownership

At its core, Valentine’s Day is about connection. For LGBTQ+ people, homeownership can be one of the most profound expressions of love—love for yourself, your partner, your family, and your future.

Whether you are a first-time gay home buyer, a same-sex couple relocating, or an LGBTQ+ seller moving forward, you deserve an experience rooted in dignity, fairness, and celebration.

For over three decades, GayRealEstate.com has stood as the leading source for LGBTQ+ real estate, gay real estate, lesbian real estate, and LGBTQ+ home buying and selling representation. Their nationwide network of gay real estate agents, lesbian-friendly real estate agents, and LGBTQ+ friendly realtors ensures that your real estate journey is guided by professionals who understand your heart—and your home.

This Valentine’s Day, let your next chapter be written in a place where you can truly belong. Because when love leads the way, home is never far behind.

Scott Helms is president and owner of Gayrealestate.com.

Dear Michael,

I keep getting rejected on the apps. I don’t want to put myself out there anymore.

I don’t understand gay men. I think they behave really badly.

Guys stop replying in the middle of a text conversation and then un-match me. Guys don’t show up when we make a plan to meet. After a date or even a hookup that it seems clear we both enjoyed, I never hear from the guy again.

I am a pretty good looking and successful guy. I’m not a model or a billionaire but I’m sincerely wanting to date and eventually share a life with someone.

Unfortunately, everyone I am meeting, even if they say they have similar aspirations for a partner, acts like they’re looking over my shoulder for something better, and drops me for I-don’t-know-what reason.

I don’t have a lot of trust in the sincerity of gay men.

I know I sound bitter but I’ve been at this for a while and it keeps happening.

I know there’s a saying that if it keeps happening to you, you must be the problem. Logically that makes sense.

Except, I think this keeps happening so often and so predictably that it’s not me. These people hardly know me. It’s more along the lines of, if everything about me isn’t exactly what they want, or some little thing that I say, think, or do offends them, they vanish.

I’m lonely, but what’s out there is awful. Maybe it’s best to not keep trying.

If you have a different way of seeing it that’s honest, not just some fluff to make me feel better and be hopeful, please enlighten me.

Michael replies:

I agree with you, there is a lot of this kind of behavior out there. I hear stories similar to yours all the time. Though people do find great relationships online, relying on apps to meet a partner can be tricky.

Hookup apps have little to do with any kind of real connection. Often, they don’t even have much to do with sex. For a lot of people, they’re more about trying to fill up some kind of emptiness and seeking validation. They also, obviously, objectify men, which is the opposite experience of what you’re seeking.

And dating apps lend themselves to a sort of takeout menu concept of dating. You get to specify exactly what you’re looking for—a little of this, a lot of that, please omit something else—and then believe you should get what you ordered. As if that really exists. And when something isn’t just what you wanted, forget it.

But life doesn’t work that way. Nor do people: You can enter the exact criteria for the man of your dreams, but he will surprise you or let you down at times in some major ways. That’s how it goes. Part of being in a relationship is accepting that we all have to deal with imperfection.

All that said, hordes of people are going to keep using all sorts of apps and keep looking for “perfect” partners and keep ditching perfectly fine guys for the most minuscule of reasons.

But that doesn’t mean that you have to stay on the apps if it’s demoralizing you and leaving you hopeless.

Before you sign off, perhaps you would like to have some fun and be creative. Just for example, you could write in your profile that you’re interested in meeting a guy who isn’t looking for perfection and is looking for a decent soul rather than a set of stats. You still might encounter a lot of guys who ghost you for no apparent reason, but you also might have some luck finding a sincere someone with relationship goals that are similar to yours.

Another, complimentary strategy: Toughen up your attitude to stop letting let these rejections get under your skin. They have little to do with who you are (unless you are oblivious to some major issue about yourself), so you needn’t take them personally. In other words, expect this to keep happening; and when it does, laugh and keep moving forward.

I understand you are feeling like giving up on gay men in general. Keep in mind that while there are a lot of reasons why many gay men focus more on sex and less on commitment, that isn’t true across the board. In my work over the years, I have met many gay men who are looking for what you’re seeking. You could strive to be hopeful that if you keep looking, you are likely to cross paths with some of them.

And where you look may play a role.

Whether or not you stay on the apps, I suggest you seek additional ways to meet a potential boyfriend. Before apps existed, people did find other ways to meet romantic partners, and these ways do still exist. I know that this path is not an easy one. The whole dating endeavor isn’t easy. But difficult is not impossible.

There are social and activity groups for gay men that are organized around some sort of shared interest. They aren’t overtly sexual, so often attract people who are interested in and looking for a deeper connection. Even if you don’t meet a boyfriend there, you might make some like-minded friends, and one thing may lead to another in all sorts of ways.

There’s also plenty you can do as a human being (not simply as a gay man) in the offline world that might interest and even uplift you, where you just might meet a man you like. Again, you might also simply make some friends, and through having a bigger social life, might ultimately meet your guy.

Simply put: Don’t let yourself feel like or be a victim. Don’t keep putting yourself in miserable situations. And figure out what it means for you to do your best to make what you’d like to happen, happen.

Michael Radkowsky, Psy.D. is a licensed psychologist who works with couples and individuals in D.C., Maryland, Virginia, and New York. He can be found at michaelradkowsky.com. All identifying information has been changed for reasons of confidentiality. Have a question? Send it to [email protected].

Real Estate

New year, new housing landscape for D.C. landlords

Several developments expected to influence how rental housing operates

As 2026 begins, Washington, D.C.’s rental housing landscape continues to evolve in ways that matter to small landlords, tenants, and the communities they serve. At the center of many of these conversations is the Small Multifamily & Rental Owners Association (SMOA), a D.C.–based organization that advocates for small property owners and the preservation of the city’s naturally occurring affordable housing.

At their December “DC Housing Policy Summit,” city officials, housing researchers, lenders, attorneys, and housing providers gathered to discuss the policies and proposals shaping the future of rental housing in the District. The topics ranged from recent legislative changes to emerging ballot initiatives and understanding how today’s policy decisions will affect housing stability tomorrow.

Why Housing Policy Matters in 2026

If you are a landlord or a tenant, several developments now underway in D.C., are expected to influence how rental housing operates in the years ahead.

One of the most significant developments is the Rebalancing Expectations for Neighbors, Tenants and Landlords (RENTAL) Act of 2025, a sweeping piece of legislation passed last fall and effective December 31, 2025, which updates a range of housing laws. This broad housing reform law will modernize housing regulations and address long-standing court backlogs, and in a practical manner, assist landlords with shortened notice and filing requirements for lawsuits. The Act introduces changes to eviction procedures, adjusts pre-filing notice timelines, and modifies certain tenant protections under previous legislation, the Tenant Opportunity to Purchase Act.

At the same time, the District has expanded its Rent Registry, to have a better overview of licensed rental units in the city with updated technology that tracks rental units subject to and exempt from rent control and other related housing information. Designed to improve transparency and enforcement, Rent Registry makes it easier for all parties to verify rent control status and compliance.

Looking ahead to the 2026 election cycle, a proposed ballot initiative for a two-year rent freeze is generating significant conversation. If it qualifies for the ballot and is approved by voters, the measure would pause rent increases across the District for two years. While still in the proposal phase, it reflects the broader focus on tenant affordability that continues to shape housing policy debates.

What This Means for Rental Owners

Taken together, these changes underscore how closely policy and day-to-day operations are connected for small landlords. Staying informed about notice requirements, registration obligations, and evolving regulations isn’t just a legal necessity. It’s a key part of maintaining stable, compliant rental properties.

With discussions underway about rent stabilization, voucher policies, and potential rent freezes, long-term revenue projections will be influenced by regulatory shifts just as much as market conditions alone. Financial and strategic planning becomes even more important to protect your interests.

Preparing for the Changes

As the owner of a property management company here in the District, I’ve spent much of the past year thinking about how these changes translate from legislation into real-world operations.

The first priority has been updating our eviction and compliance workflows to align with the RENTAL Act of 2025. That means revising how delinquent rent cases are handled, adjusting notice procedures, and helping owners understand how revised timelines and court processes may affect the cost, timing, and strategy behind enforcement decisions.

Just as important, we’re shifting toward earlier, more proactive communication around compliance and regulatory risk. Rather than reacting after policies take effect, we’re working to flag potential exposure in advance, so owners can make informed decisions before small issues become costly problems.

A Bigger Picture for 2026

Housing policy in Washington, D.C., has always reflected the city’s values from protecting tenants to preserving affordability in rapidly changing neighborhoods. As those policies continue to evolve, the challenge will be finding the right balance between stability for renters and sustainability for the small property owners who provide much of the city’s housing.

The conversations happening now at policy summits, in Council chambers, and across neighborhood communities will shape how rental housing is regulated. For landlords, tenants, and legislators alike, 2026 represents an opportunity to engage thoughtfully, to ask hard questions, and to create a future where compliance, fairness, and long-term stability go hand-in-hand.

-

Baltimore4 days ago

Baltimore4 days ago‘Heated Rivalry’ fandom exposes LGBTQ divide in Baltimore

-

Real Estate4 days ago

Real Estate4 days agoHome is where the heart is

-

District of Columbia4 days ago

District of Columbia4 days agoDeon Jones speaks about D.C. Department of Corrections bias lawsuit settlement

-

European Union4 days ago

European Union4 days agoEuropean Parliament resolution backs ‘full recognition of trans women as women’