National

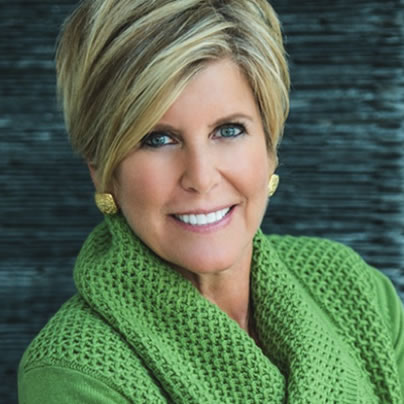

Orman: Marriage discrimination is ‘absolutely inexcusable’

Out CNBC host spoke on tax-filing deadline day

CNBC host Suze Orman on Monday said the Defense of Marriage Act “unnecessarily” costs gays and lesbians millions of dollars.

“The social and civil discrimination that goes on when it comes to gay marriage is absolutely inexcusable,” she said. “The financial discrimination just really really adds injury to insult.”

Orman is among those who spoke during a Respect for Marriage Coalition conference call with reporters that highlighted the inequities same-sex couples continue to face in federal and state tax systems.

Some states in which gays and lesbians can legally marry allow same-sex couples to file joint tax returns, but Orman noted there are roughly 1,100 ways they “are discriminated against” within the federal tax-paying system. These include the up to $7,000 more in taxes each year a gay person would have to pay if they placed their same-sex partner or spouse on their health insurance plan, the inability to rollover an IRA and collect Social Security survivor benefits she said “just as you do if you’re heterosexual.”

Orman, who married her partner Kathy Travis in South Africa three years ago, added she and other gays and lesbians would have to pay additional estate taxes that heterosexual couples do not because the federal government does not recognize their marriage.

“For many people that are in my situation, it is absolutely ridiculous that upon my death K.T. is going to have to pay estate tax on the majority of my estate and I’m going to have to pay estate tax on the majority of her estate,” Orman said. “If we were married and recognized on a federal level, we would not owe one penny.”

Orman spoke on the same day millions of Americans were filing their federal and state taxes before the midnight deadline.

The U.S. Supreme Court on March 27 heard oral arguments in a case filed by New York City widow Edith Windsor that challenges the constitutionality of DOMA. Windsor, who married her partner of more than 40 years, Thea Spyer, in Canada in 2007, paid $363,000 in estate taxes after her 2009 death.

Mark Maxwell and Timothy Young-Maxwell of Winston-Salem, N.C., noted during the call they are also unable to file a joint state tax return because North Carolina does not recognize their D.C. marriage.

The couple, who has lived together in the Tarheel State for more than two decades and have four adopted sons, noted their tax accounting fees cost twice the amount of money because they cannot file jointly. Maxwell also noted the costs associated with adding his spouse to his employer’s health insurance plan are also high.

“We spend more money because the money that I receive to pay for his insurance is taxed,” Young-Maxwell said. “We could use that to pay down our mortgage or pay for our children’s college education.”

The two men are the sole legal guardians for two of their four children because they cannot jointly adopt them under North Carolina law. The state gives adoptive families an annual stipend of $2,400 for each child until they turn 18 to help them offset the costs of caring for them, but the non-adoptive parent is ineligible to receive it because the Tarheel State does not recognize same-sex marriages or second-parent adoptions.

“We feel at this time that we’re unfortunately second class citizens in our country and our children are treated as second class citizens as well,” Maxwell said.

Elda Di Re and Karyn Twaronite of Ernst and Young LLP also took part in the teleconference.

U.S. Supreme Court

Supreme Court to consider bans on trans athletes in school sports

27 states have passed laws limiting participation in athletics programs

The U.S. Supreme Court on Thursday agreed to hear two cases involving transgender youth challenging bans prohibiting them from participating in school sports.

In Little v. Hecox, plaintiffs represented by the ACLU, Legal Voice, and the law firm Cooley are challenging Idaho’s 2020 ban, which requires sex testing to adjudicate questions of an athlete’s eligibility.

The 9th U.S. Circuit Court of Appeals described the process in a 2023 decision halting the policy’s enforcement pending an outcome in the litigation. The “sex dispute verification process, whereby any individual can ‘dispute’ the sex of any female student athlete in the state of Idaho,” the court wrote, would “require her to undergo intrusive medical procedures to verify her sex, including gynecological exams.”

In West Virginia v. B.P.J., Lambda Legal, the ACLU, the ACLU of West Virginia, and Cooley are representing a trans middle school student challenging the Mountain State’s 2021 ban on trans athletes.

The plaintiff was participating in cross country when the law was passed, taking puberty blockers that would have significantly reduced the chances that she could have a physiological advantage over cisgender peers.

“Like any other educational program, school athletic programs should be accessible for everyone regardless of their sex or transgender status,” said Joshua Block, senior counsel for the ACLU’s LGBTQ and HIV Project. “Trans kids play sports for the same reasons their peers do — to learn perseverance, dedication, teamwork, and to simply have fun with their friends,” Block said.

He added, “Categorically excluding kids from school sports just because they are transgender will only make our schools less safe and more hurtful places for all youth. We believe the lower courts were right to block these discriminatory laws, and we will continue to defend the freedom of all kids to play.”

“Our client just wants to play sports with her friends and peers,” said Lambda Legal Senior Counsel Tara Borelli. “Everyone understands the value of participating in team athletics, for fitness, leadership, socialization, and myriad other benefits.”

Borelli continued, “The U.S. Court of Appeals for the Fourth Circuit last April issued a thoughtful and thorough ruling allowing B.P.J. to continue participating in track events. That well-reasoned decision should stand the test of time, and we stand ready to defend it.”

Shortly after taking control of both legislative chambers, Republican members of Congress tried — unsuccessfully — to pass a national ban like those now enforced in 27 states since 2020.

Federal Government

UPenn erases Lia Thomas’s records as part of settlement with White House

University agreed to ban trans women from women’s sports teams

In a settlement with the Trump-Vance administration announced on Tuesday, the University of Pennsylvania will ban transgender athletes from competing and erase swimming records set by transgender former student Lia Thomas.

The U.S. Department of Education’s Office for Civil Rights found the university in violation of Title IX, the federal rights law barring sex based discrimination in educational institutions, by “permitting males to compete in women’s intercollegiate athletics and to occupy women-only intimate facilities.”

The statement issued by University of Pennsylvania President J. Larry Jameson highlighted how the law’s interpretation was changed substantially under President Donald Trump’s second term.

“The Department of Education OCR investigated the participation of one transgender athlete on the women’s swimming team three years ago, during the 2021-2022 swim season,” he wrote. “At that time, Penn was in compliance with NCAA eligibility rules and Title IX as then interpreted.”

Jameson continued, “Penn has always followed — and continues to follow — Title IX and the applicable policy of the NCAA regarding transgender athletes. NCAA eligibility rules changed in February 2025 with Executive Orders 14168 and 14201 and Penn will continue to adhere to these new rules.”

Writing that “we acknowledge that some student-athletes were disadvantaged by these rules” in place while Thomas was allowed to compete, the university president added, “We recognize this and will apologize to those who experienced a competitive disadvantage or experienced anxiety because of the policies in effect at the time.”

“Today’s resolution agreement with UPenn is yet another example of the Trump effect in action,” Education Secretary Linda McMahon said in a statement. “Thanks to the leadership of President Trump, UPenn has agreed both to apologize for its past Title IX violations and to ensure that women’s sports are protected at the university for future generations of female athletes.”

Under former President Joe Biden, the department’s Office of Civil Rights sought to protect against anti-LGBTQ discrimination in education, bringing investigations and enforcement actions in cases where school officials might, for example, require trans students to use restrooms and facilities consistent with their birth sex or fail to respond to peer harassment over their gender identity.

Much of the legal reasoning behind the Biden-Harris administration’s positions extended from the 2020 U.S. Supreme Court case Bostock v. Clayton County, which found that sex-based discrimination includes that which is based on sexual orientation or gender identity under Title VII rules covering employment practices.

The Trump-Vance administration last week put the state of California on notice that its trans athlete policies were, or once were, in violation of Title IX, which comes amid the ongoing battle with Maine over the same issue.

New York

Two teens shot steps from Stonewall Inn after NYC Pride parade

One of the victims remains in critical condition

On Sunday night, following the annual NYC Pride March, two girls were shot in Sheridan Square, feet away from the historic Stonewall Inn.

According to an NYPD report, the two girls, aged 16 and 17, were shot around 10:15 p.m. as Pride festivities began to wind down. The 16-year-old was struck in the head and, according to police sources, is said to be in critical condition, while the 17-year-old was said to be in stable condition.

The Washington Blade confirmed with the NYPD the details from the police reports and learned no arrests had been made as of noon Monday.

The shooting took place in the Greenwich Village neighborhood of Manhattan, mere feet away from the most famous gay bar in the city — if not the world — the Stonewall Inn. Earlier that day, hundreds of thousands of people marched down Christopher Street to celebrate 55 years of LGBTQ people standing up for their rights.

In June 1969, after police raided the Stonewall Inn, members of the LGBTQ community pushed back, sparking what became known as the Stonewall riots. Over the course of two days, LGBTQ New Yorkers protested the discriminatory policing of queer spaces across the city and mobilized to speak out — and throw bottles if need be — at officers attempting to suppress their existence.

The following year, LGBTQ people returned to the Stonewall Inn and marched through the same streets where queer New Yorkers had been arrested, marking the first “Gay Pride March” in history and declaring that LGBTQ people were not going anywhere.

New York State Assemblywoman Deborah Glick, whose district includes Greenwich Village, took to social media to comment on the shooting.

“After decades of peaceful Pride celebrations — this year gun fire and two people shot near the Stonewall Inn is a reminder that gun violence is everywhere,” the lesbian lawmaker said on X. “Guns are a problem despite the NRA BS.”