Opinions

Modest D.C. tax revision plan only a small remedy

Will D.C. Council and Mayor Gray fail to embrace tax reform, relief?

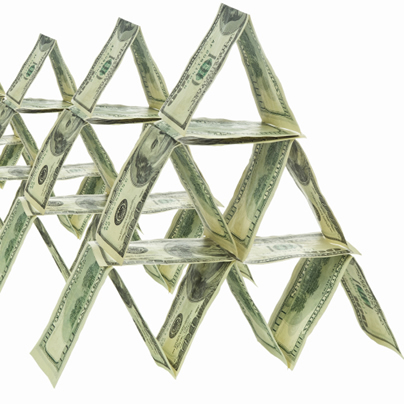

A first step in reducing D.C. business and personal tax rates is long overdue, if inadequate, and is deserving of support – and does offer enterprise a modicum of relief. (Photo by iStock)

Following nearly a year-and-a-half of deliberations and almost 30 public hearings, the D.C. Tax Revision Commission last week issued preliminarily detailed city revenue reform recommendations unanimously adopted for approval by D.C. Council members and Mayor Gray. A full report is scheduled for early January.

While disappointing in its modest magnitude — particularly in mitigating the negative business taxation environment and D.C. anti-enterprise reputation — the proposed reforms offer some improvement.

The compromise plan represents a mere $48.8 million in net revenue reductions out of local tax collections in excess of $6 billion. Mayor Gray’s initiative earlier this year, approved by the Council, setting aside $18 million in the current budget toward underwriting tax revisions slashes the bottom-line cost to $30.8 million, less upwardly revised tax collections.

In fact, outgoing District CFO Natwar Gandhi issued his final projections last week indicating $19.8 million in additional revenue this fiscal year and an estimated $42.7 million surplus the next.

Any tax modifications would be incorporated in the District’s FY2015 budget, effective beginning next October. The narrowed list of proposals, whittled down due to lack of agreement among commissioners, are designed to “provide for fairness in apportionment of taxes, broaden the tax base, make the District’s tax policy more competitive with surrounding jurisdictions, encourage business growth and job creation, and modernize, simplify, and increase transparency in the District’s tax code.”

Former Mayor Anthony Williams, credited with restoring D.C.’s fiscal footing during two terms in office ending January 2007, chaired 10 appointed tax policy experts, business community representatives and advocates from liberal policy groups. Divergent perspectives culled an initial 63 recommendations to only about a dozen measures comprising a balanced plan thought within the realm of political viability.

Unfortunately, these consensus recommendations are expected to encounter opposition by politicians longing for more money to toss around in an election year. Frustrated by spending constraints requiring expenditure prioritization, Council members have taken to creating an annual budget “wish list” well in excess of potential revenue surpluses to pay for them.

Williams was quoted last week as saying, “to be the competitive city we want to be, we’ve got to have government within the proper bounds in terms of the private-public sector relationship, and I don’t think we’re really cognizant of that.” In other words, officials still don’t “get” it.

While the Commission proposes to reduce the business franchise tax from an astounding 9.975 percent of net income to 8.25 percent, this merely matches high-tax Maryland. While arguing that cutting the tax is “a signal that D.C. is ‘open for business’,” it doesn’t lower it to be competitive with Virginia’s 6 percent rate. D.C. business taxes are worst in the region and among the highest nationwide and this proposal is an inadequate remedy.

Worse, a reduction in business taxes is partially offset by levy of a local services fee to be imposed on all employers – including non-profits and other tax-exempt entities – by assessing a quarterly payment of $25 per employee for those with more than four. While the intent to generate revenue from tax-exempt organizations not currently contributing to city service benefits is a good thing, it diminishes the lessening of the business tax burden.

In addition, instead of preserving the general sales tax rate when expanding taxable businesses to include those currently exempt – such as hair salons, health clubs, bowling alleys, carwashes, construction and carpentry contractors, upholstery cleaners and storage facilities – the current 5.75 percent rate is recommended for return to 6 percent.

And while the vast majority of revenue reductions, totaling nearly $100 million, originate from a laudable cut in the income tax rate for low and middle-income earners by adding new tax brackets, the existing too-high rates for taxpayers earning more are untouched.

A first step in reducing D.C. business and personal tax rates is long overdue, if inadequate, and is deserving of support – and does offer enterprise a modicum of relief.

At least it’s a start.

Mark Lee is a long-time entrepreneur and community business advocate. Follow on Twitter: @MarkLeeDC. Reach him at [email protected].

Opinions

USAID’s demise: America’s global betrayal of trust with LGBTQ people

Trump-Vance administration dismantled agency after taking office

The U.S. Agency for International Development — proudly my institutional home for several years of my international development career and an American institutional global fixture since November 1961 — is no more.

How will USAID’s closure impact LGBTQI+ people around the world, especially in poor, struggling countries (“the Global South”)? Time will tell, but “dire,” “appalling,” and “shameful” are appropriate adjectives, given the massive increase in HIV/AIDS deaths that follow the callous, abrupt, and unspeakably cruel cut-off of funding for USAID’s health and humanitarian programming in HIV/AIDS prevention, treatment, and care.

Regarding LGBTQI+ people and issues, USAID worked in a tough neighborhood. In Africa alone, more than 30 countries in which USAID had programming still criminalize same-sex relationships, often to the point of imposing the death penalty. These fiercely anti-LGBTQI+ countries share harsh anti-LGBTQI+ punishments with most countries in the Middle East and North Africa. Other countries where USAID formerly worked retain colonial-era sodomy laws.

Where did USAID fit into all this turbulence? The agency was not allowed to transgress local laws, so how could it support the human rights of local LGBTQI+ people? USAID did so by building close and trusting relationships with local LGBTQI+ civil society, and by “superpower advocacy” for the universal human rights of all people, including those of us in the queer community.

I served at USAID’s Africa Bureau under the Obama administration, becoming the only openly transgender political appointee in USAID’s history. In that role, I was privileged to have a platform that caught the astounded attention of both queer people and of anti-LGBTQI+ governments around the world. If the president of the United States can elevate a transgender woman to such a senior position within the U.S. government, that open declaration of acceptance, inclusion, worth, and recognition set a precedent that many in the LGBTQI+ community worldwide hoped their countries would emulate.

Serving as an openly queer person at USAID also afforded me the opportunity to meet with many fiercely anti-LGBTQI+ senior politicians and government officials from African countries who sought USAID funding. Uganda’s first woman speaker of the parliament, Rebecca Alitwala Kadaga and her whole delegation came to see me at USAID in Washington about such funding. I had some very frank (and USAID-approved) “talking points” to share with her and her team about President Obama’s strong and secular commitment to equal human rights for all people. My tense meeting with her was also an opportunity to educate her as to the nature of the transgender, nonbinary, and intersex community — we who are simply classified and discriminated against as “gay” people in Uganda and in most countries in the Global South. I also had the chance to represent USAID in the “inter-agency” LGBTQI+ human rights task team led by openly gay U.S. Ambassador David Pressman, whose effective leadership of that Obama-era initiative was inspirational.

Working closely with professional, capable, and caring USAID career employees such as Ajit Joshi and Anthony Cotton, and with the strong and open support of the USAID Deputy Administrator Don Steinberg, I helped to craft and promote USAID’s very first LGBTQI+ policy. Under President Obama, USAID also created the LGBT Global Development Partnership, a public-private partnership supporting LGBTQI+ civil society groups throughout the Global South. USAID funding also increased for programs promoting LGBTQI+ inclusion, anti-violence, and relevant human rights protections. This programming expanded further (albeit never adequately funded) during the Biden administration under the able leadership of USAID Senior LGBTQI+ Coordinator Jay Gilliam and his team.

So what did it all mean? Has USAID left a footprint for the global LGBTQI+ community? Will its absence matter?

In my view, that answer is an emphatic yes. International development and humanitarian response go to the heart of recognizing, respecting, and caring about universal human dignity. USAID converted those ethical commitments into tangible and meaningful action, again and again, and modelled for the world what it means to truly include all persons.

My time serving at USAID was a high point of my career, being surrounded by the best of American civil servants and foreign service officers. For me, “USAID Forever” remains my battle cry. Let’s start thinking of how we will rebuild it, beginning in three years.

Chloe Schwenke is a professor at Georgetown University’s McCourt School of Public Policy.

Opinions

Community comes together to repair WorldPride history exhibition

Vandals damaged pictures, timeline walls on June 22

Earlier this month, vandals shouting homophobic slurs damaged the 8-foot hero cubes and timeline walls of the Rainbow History Project’s (RHP) WorldPride exhibition “Pickets, Protests, and Parades: The History of Gay Pride in Washington.” The week’s incident was the fifth homophobic attack on the exhibition chronicling DC’s LGBTQ+ History, the vandalism damage was only made worse by the storms this past week.

In response, RHP posted a call online for volunteers and donations and over a dozen volunteers showed up on Saturday to repair the exhibition in its final stretch.

It took three hours, but the group assembled during a heat advisory to bend the fences back into place, fix the cubes and zip tie all the materials together to keep them safe. Some of those who came out to volunteer, Slatt said, were known RHP volunteers but most were total strangers who had attended an event here or there or just wanted to get involved for the first time, one was even in D.C. as an out-of-town guest and after seeing the Instagram call, decided to spend their day lifting some heavy fencing back into place.

When asked why they showed up, volunteer Abbey said: “especially during Pride month, it’s so important to come together as a community, not just to celebrate, but to support each other. To know that this historic exhibit is even able to exist right now under this administration is really amazing. The fact that we’re just able to help continue it in its last leg of being out here is really important.”

“Rainbow History Project does a lot of work for the community,” another volunteer Ellie said, “they show up in a lot of ways that I think we really need right now, so in terms of being asked to come out and do a couple hours of lifting, that is something that we can easily support and do.”

“We put out a call asking for support from the community, and so we didn’t know what we’d get,” Slatt continued, “but strangers have shown up. We were upset, we were crying. We were trying to come up with a battle plan and more and more people have shown up with open arms and empty hands to do this. It’s 95 degrees, we are melting in the heat. It’s just amazing the number of people who have come here.”

If anything, the anonymous exhibit designer said, the people who vandalized the exhibit made the community stronger and mobilized members passionate about preserving and sharing our histories. Their efforts backfired in a big way — bringing together people who had only attended one or two RHP events or had read about the organization online to actively contribute to the work.

It’s a meaningful representation of the history of D.C.’s LGBTQ+ community, one that often starts with a small group of people who come together to protest but soon mobilize their communities and enact monumental change in the nation’s capital.

“If Pride in D.C. started with 10 people picketing the White House,” Slatt remarked, “you just got 12 more to join the gay history movement.”

This was especially poignant, another volunteer Mattie said, on the week that the Supreme Court issued a decision allowing Tennessee to ban puberty blockers and hormone therapy for minors seeking gender affirming care. It was a devastating moment for the LGBTQ+ community who mobilized once more in front of the Supreme Court this past Friday.

“It’s been actually really important to see this community come together in the face of direct attack on our history in the wake of direct attacks on our rights,” Mattie said, “and we stand up to that. We come together, and we represent. That is so important to maintaining our strength and our community throughout trying times now and ahead.”

When asked about how community members can support RHP’s work and repair the damage long-term to the exhibit, Slatt urged people to donate to RHP, to volunteer as exhibit monitors, and to come visit the exhibit.

“We’ve been doing this for 25 years. This is our 25th anniversary, and if it weren’t for volunteers donating their time and their talents, if it weren’t for small dollar donors, we would never have gotten anything done,” Slatt said. “I’d say to anyone out there that we are on this plaza all through Independence weekend, we are here through the Smithsonian Folklife Festival, people can come on down.”

Slatt and other volunteers will be leading tours each evening at 7 p.m. at Freedom Plaza, and people can pre-order the exhibition catalog right now, which will be delivered in time for LGBTQ+ History Month in October.

Emma Cieslik is a D.C.-based museum worker and public historian.

Independence Day, commonly known as the Fourth of July, is a federal holiday commemorating the ratification of the Declaration of Independence by the Second Continental Congress on July 4, 1776, establishing the United States of America. The delegates of the Second Continental Congress declared the 13 colonies are no longer subject (and subordinate) to the monarch of Britain, King George III and were now united, free, and independent states. The Congress voted to approve independence by passing the Lee resolution on July 2, and adopted the Declaration of Independence two days later, on July 4.

Today we have a felon in the White House, who wants to be a king, and doesn’t know what the Declaration of Independence means. Each day we see more erosion of what our country has fought to stand for over the years. We began with a country run by white men, where slavery was accepted, and where women weren’t included in our constitution, or allowed to vote. We have come far, and next year will celebrate 250 years. Slowly, but surely, we have moved forward. That is until Nov. 5, 2024, when the nation elected the felon who now sits in the Oval Office.

There are some who say they didn’t know what he would do when they voted for him. They are the ones who were either fooled, believing his lies, or just weren’t smart enough to read the blueprint which laid out what he would do, Project 2025. It is there for everyone to see. There should be no surprise at what he is doing to the country, and the world. Last Friday his Supreme Court, and yes, it is his, the three people he had confirmed in his first term, gave him permission to be the king he wants to be. The kind of king our Declaration of Independence said we were renouncing. A man who with the stroke of a pen can ruin thousands of lives, and change the course of America’s future. A man who has set back our country by decades, in just a few months.

So, I understand why many are suggesting there is nothing to celebrate this Fourth of July. How do we have parties, and fireworks, celebrating the 249th year of our independence when so many are being sidelined and harmed by the felon and his MAGA sycophants in the Congress, and on the Supreme Court. Yes, there are those celebrating all he is doing. Those who want to pretend transgender people don’t exist, and put their lives in danger; those who think it’s alright to take away a women’s right to control her body, and her healthcare; those who think parents should be able to interfere on a daily basis with their children’s schooling and wipe out the existence of gay people for them. Those who pretend there was a mandate in the last election, when it was only won by about 1 percent. Those who think disparaging veterans, firing them, and taking away their healthcare, is ok. Those in the LGBTQ community like Log Cabin Republicans, who think supporting a racist, sexist, homophobe is the right thing to do.

So, what do we, as decent caring people, do this Fourth of July. What do we say to those who are being harmed as we celebrate. What do we say to those trans people, those women, those immigrants who came here to escape their own dictators, and are now finding they have come to a country with its own would-be dictator. I say to them, please don’t give up on America. Don’t give up on the possibility decent loving people in our country will finally wake up and say, “enough.” That the majority of Americans will remember we fought a revolution to escape a king, and we fought a civil war to end slavery. That we moved forward and gave women the right to vote, and gave the LGBTQ community the right to marry. Don’t give up on the people that did all that, and think they won’t rise up again, and tell the felon, racist, homophobe, misogynist, found liable for sexual assault, now in the White House, and his sycophants in congress, and his cult, that we will take back our country in the 2026 midterm elections. That we will vote in large numbers, and demand our freedom from the tyranny that he is foisting on our country.

So yes, I will celebrate this Fourth of July not for what is happening in our country today, but rather for what our country actually stands for. Not for birthday parades, and abandonment of the heroes in Ukraine in support of dictators like Putin. But for the belief the decent people in our country will rise up and vote. That is what I will celebrate and pray for this Fourth of July. That is what I think the fireworks will mean this July Fourth. I refuse to accept defeat the same way our revolutionary soldiers wouldn’t, and the way our troops in the civil war wouldn’t till the confederacy was defeated.

I will celebrate this Fourth of July because I refuse to accept we will not defeat those who would destroy our beautiful country, and what it really stands for.

Peter Rosenstein is a longtime LGBTQ rights and Democratic Party activist.