Living

New year new you

Kickstart your image resolutions with our self-improvement guide

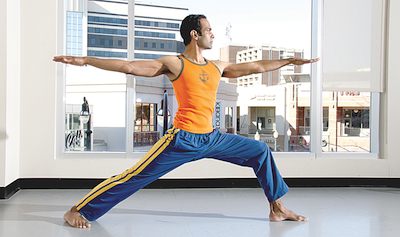

Daniel Phoenix Singh says keeping your workout gear handy helps you squeeze in quick exercise breaks when windows of time open up unexpectedly. (Blade photo by Pete Exis; special thanks to the Maryland Youth Ballet))

Lean locals share fitness tips

After the inevitable holiday excess, many among us are bemoaning the ab definition we lost after the eggnog and peanut butter balls. But fitness topics are not esoteric — we pretty much know what to do. It’s a matter of finding the motivation to do it. That’s where little tips and tricks can come in handy.

Maintaining Herculean abs and guns can take over your life but what about all those local LGBT folks who always look fit and trim no matter when you see them? We asked a few of them to share their favorite workout and diet tips in the hope that something will click for you.

“I am not a good example for eating,” says Scott Beard, a concert pianist. “Breakfast is usually coffee. I would say the best thing is to be in a regular workout routine. Make time for it. And mix up your workouts so your body is ‘surprised’ by new exercises. Also watch the alcohol intake. A beer is like drinking a loaf of bread.”

Brian Watson of Transgender Health Empowerment was one of those lucky few who managed to stay naturally thin without working out. But he just turned 30 and decided he could use some ab definition.

“Something I think helps is that I drink a lot of water,” he says. “Whenever I eat, I have a glass of water. I think that not only has that helped keep me thin, but healthy. It eliminates a lot of the sugar, caffeine, etc., that a lot of people put in their bodies everyday. I’m also one of those people who don’t mind taking the stairs instead of the elevator.”

Clark Ray of the Greater Washington Sports Alliance believes in moderation, structure and maintenance.

“Eat what you want but be sensible,” he says. “For structure, make a schedule and stick to it. And with maintenance, you have to be persistent. Work to maintain the personal achievement you’ve made and set goals for new desires and results.”

Realtor Evan Johnson is an avid runner. He runs 3.5 miles six days per week and augments it with 30-minute weight training exercises five-to-six days per week. He says working out very early — before the sun is up — works well for him.

Ebone Bell (Capital Queer Prom) lost 42 pounds over the past six months. She was going for a “slim and healthy look,” and achieved it by sticking to a low-calorie diet (less than 2,000 calories per day), going to the gym three-to-four times per week and balancing cardio and strength training.

“And don’t sleep on Zumba,” she says. “It’s a fun way to burn a lot of calories in just an hour.”

Lesbian Anya Maleknasri is a trainer at Gold’s Gym in Manassas and has several tips. She says finding a gym near work is better than home.

“If you’re driving toward the house, you’re more likely to pass it up for the couch,” she says. “But if it’s near your work, you’ll consider it still work time.”

She also suggests organic, grass-fed meats, healthy fats, nuts, vegetables and fruit.

“Our bodies were intended to eat,” she says. “Fat does not make you fat. Processed food and sugar makes you fat.”

Also, “workouts should be short and intense,” she says. “If it’s easy, it’s probably not going to create any change. But three-to-four days of 20-30 minutes of hard work with a clean diet and you will see change in only a few days. Staying fit and healthy is not a resolution. There are no quick fixes or special pills you can take. But everyday is a new start and there is no end point. Stay realistic and change your lifestyle and your health will turn into a life-long reality.”

Josh Bennett, a singer and dancer with the Gay Men’s Chorus of Washington — he’s the one they always put in the scantily clad attire since he’s so buff, says getting into a healthy routine is “an entire lifestyle change.”

“You have to be ready to change your diet and to push your body to new limits,” he says. “It’s never easy but the health rewards are great. The single biggest hurdle is motivation. It’s never easy to get off the couch and put down the chips but think of an event or person whom you want to look good for and post pictures of them on your phone/TV/computer or mirror. Use that motivator as a constant reminder to clear the junk food out of your kitchen and get on your feet.”

Kevin Platte, founder and director of the eternally shirtless D.C. Cowboys, advises healthful foods in smaller amounts.

“It’s all about portion sizes,” he says. “As we get older, we don’t need to eat like we did when we were teenagers. And remember — drinking a cocktail is like eating a dessert.”

He advises a solid exercise program with a special focus on abs.

Jerry Zremski, a gay D.C.-based reporter for the Buffalo News, finds it helpful to make fitness part of a daily routine. Working out at the same time each day helps him stick to a plan. He also eats meals at regular times and doesn’t snack.

“Consider hiring a trainer if you want to add muscle,” he says. “I did and it worked, even at my advanced age, which I am not revealing.”

His other favorite tip, which works great for D.C., is — “if your destination is less than a mile away, walk.”

Gay dancer Daniel Phoenix Singh (he has his own eponymous dance company), maintains his trim physique by augmenting the workout he gets from dancing with yoga, cardio and weight training. He’s also a vegetarian.

“I watch what I put in my mouth,” he says with a sly chuckle.

“Also be ready to work out any time,” he says. “I always keep my yoga mat, workout clothes and sneakers in my car so there is never an excuse. Because believe you me, I’m just like everyone else — I’d rather spend the evening watching YouTube videos if I could find an excuse to skip working out.”

— COMPILED BY JOEY DiGUGLIELMO

Freezing the fat

Achieve your New Year’s goal with safe, new procedure

By DR. KHALIQUE ZAHIR

The New Year brings many resolutions. Looking good is the first and most important one. Exercising and dieting can help, but there are some areas that won’t change, no matter how many Pilates classes you attend. The desire to look perfect can be frustrating, because you can only change so much on your own.

CoolSculpting by ZELTIQ is one of the non-invasive ways to reduce fat in targeted areas of the body that results in a natural-looking fat reduction in the areas treated. This method uses a cooling technology that targets fat cells through a process that does not harm the surrounding tissue. This procedure can reduce unwanted abdominal fat, love handles and back fat. It is performed in a dermatology office with a topical applicator that cools targeted fat cells under the skin. Only those areas targeted get fat reduction. All individuals can resume normal daily routines after the procedure. Patients may start to see changes as quickly as three weeks after their treatment, and will experience the most dramatic results after two months. The body continues to flush fat cells and will continue doing so for up to four months.

Some areas are not necessarily best suited for this freezing technique and are better handled with more immediate micro lipo-contouring procedures to remove bulges quickly. Identifying your specific needs is the most important thing, and can only be done after an evaluation. In many places, you can have a complimentary consultation with a cosmetic team. Some areas not suited for the Coolsculpting method are best treated using a tumescent lipo-contouring method. Many of these procedures can be performed with you awake and pain free in office, with minimal to no down time. Certain areas of the chest, neck and the abdomen respond best with this treatment and offer results within the first week.

Using the newer modalities in reduction of swelling and bruising has made outpatient body contouring popular and achievable for anyone with the challenges of unwanted body fat. Establishing a regimen best suited for your lifestyle needs with a board certified plastic surgeon is the first step toward succeeding in getting through the New Year’s resolution list. With all the newer innovative technology available, treat yourself to a procedure that can help you in your efforts to look as good as you can, quickly, effectively, and today.

In addition to getting the body you want this year, getting your skin in picture perfect condition is always right up there on the list. Smoother, softer, more even, unblemished and younger-looking skin are what people seek. There are so many things that can be done now to achieve the skin you want.

Lasers, combined with a good skin care regimen, can often solve almost any problem, or get you close to the desired result you’re looking for. Lasers can even out pigmentation, reduce redness, brighten, tighten, reduce and smooth out scarring, reduce or eliminate age spots, and much more. The most important thing when it comes to lasers it to go a dermatologist’s office, with board-certified dermatologists. Many states differ in their regulations on who can perform lasers, but you want to go to a dermatology practice if there is going to be someone performing lasers on your skin. Dermatologists see the skin differently than anyone else, and it is important for you to get someone who can look at your skin comprehensively, with an expert eye.

Dr. Khalique Zahir is with the Dermatology Center and Rockledge MedSpa with three Locations: Northwest D.C., Bethesda and Germantown. Visit dermskin.com or call 301-968-1200 for more information.

As the days grow longer and buyers re-emerge from winter hibernation, the spring market consistently proves to be one of the strongest times of year to sell a home. Increased inventory, motivated buyers, and picture-perfect curb appeal make it a prime window for homeowners ready to list.

The good news? Preparing your home for spring doesn’t require a full renovation or a contractor on speed dial. A few thoughtful, cost-effective updates can dramatically elevate your home’s appeal and market value.

Here are smart, inexpensive ways to get your property market-ready:

Fresh Paint: The Highest Return on a Small Investment

Few improvements transform a home as quickly and affordably as paint. Neutral tones remain the gold standard, but today’s buyers are gravitating toward warmer tan hues that create an inviting, elevated feel without overwhelming a space. Soft sandy beiges and warm greige-leaning tans provide a clean backdrop that photographs beautifully and allows buyers to envision their own furnishings in the home.

Freshly painted walls signal care and maintenance — two qualities buyers subconsciously look for when touring properties.

Removable Wallpaper: Style Without Commitment

For homeowners wanting to introduce personality without permanence, removable wallpaper offers a stylish solution. A subtle textured pattern in a powder room, a soft botanical print in a bedroom, or a modern geometric accent wall can add depth and character. Because it’s easily removed, it appeals to both sellers and buyers — creating visual interest without long-term risk.

Upgrade Light Fixtures for Instant Modernization

Outdated lighting can age a home instantly. Swapping builder-grade fixtures for modern, streamlined options is one of the simplest ways to refresh a space. Consider warm metallic finishes or matte black accents to create a cohesive, updated look. Proper lighting not only enhances aesthetics but also ensures your home feels bright and welcoming during showings.

Elevate Curb Appeal: First Impressions Matter Most

Spring buyers often decide how they feel about a home before they ever step inside. Refreshing curb appeal doesn’t require major landscaping. Simple updates such as fresh mulch, trimmed shrubs, seasonal flowers, a newly painted front door, and updated house numbers can dramatically improve first impressions. Power washing the driveway and walkways also delivers a clean, well-maintained appearance for minimal cost. Even if you don’t have a curb to appeal- think potted plants on your patio, balcony and change out your door mat.

Deep Clean & Declutter (Seriously, It Matters)

A deep, top-to-bottom cleaning is basically free and one of the most impactful things you can do. Scrub floors, windows, grout, baseboards, appliances, bathrooms, and everything in between. Don’t forget to clean windows inside and out — natural light is a huge selling point. Declutter by packing up excess stuff, clearing off countertops, and minimizing personal items so buyers can see the space, not your life.

Let the Light Shine

Make your home feel bright and inviting by cleaning windows, opening blinds, and replacing dark or dated light fixtures with contemporary, budget-friendly options. Swapping in LED bulbs offers brighter light and lower utility costs — a small change that buyers appreciate. Pro tip: I always recommend removing widow screens to allow as much light in as possible

Neutralize Scents

Make sure the home smells fresh. Neutralizing odors — whether from pets, cooking, or moisture — creates a clean, welcoming atmosphere. Light natural scents like citrus or subtle florals can be inviting during showings. Think of how your favorite hotel smells and go for that.

Spring market rewards preparation. By focusing on high-impact, low-cost improvements, sellers can position their homes to stand out in a competitive environment. With thoughtful updates and strategic presentation, homeowners can maximize both buyer interest and potential sale price — all without overextending their renovation budget.

As activity increases and inventory begins to rise, now is the time to prepare. A little polish today can translate into significant results tomorrow.

Justin Noble is a Real Estate professional with Sotheby’s International Realty Servicing Washington D.C., Maryland, and the beaches of Delaware.

Advice

Dry January has isolated me from my friends

Is it possible to have social life without alcohol?

Dear Michael,

Some of my friends and I decided to do Dry January.

The six of us are a posse, we’ve been friends for years. Many boyfriends and even a husband or two have come and gone but we get together all the time and travel together.

I think we all agreed that drinking is too big a part of our social lives and thought we’d give Dry January a shot.

So … I am feeling better and it’s only been three weeks.

I’ve actually lost a little weight, and it’s nice not to wake up with a hangover four mornings a week. I’m pushing 40 and no surprise, my body feels relieved.

But, I’m also the only one of us who is still doing it.

Which means they are all going out and I am not. So I am feeling lonely.

I could join them in going out but first of all, I don’t really want to hang out with them when they’re drunk and I’m trying to be alcohol free; and also, there’s a part of me that is afraid I will give in to temptation and have a drink. And then it will be back to business as usual.

But, I spent this past weekend, and every night this week, alone.

All of this has me thinking: what do I do in February? I really don’t want to start drinking again.

But, if I don’t, how do I stay part of my friend group? If they’re buzzed (or drunk) and I’m not, am I still going to fit in?

I’m disappointed in my friends. We were all in this together, I thought, but one thing after another came up for them.

Some special event where “everyone was drinking,” a work dinner where “I didn’t want to deal with everyone’s questions about why I wasn’t drinking,” “too much work stress not to have a martini,” etc. In the end they were all laughing about it and now they’re basically poking fun at me and essentially betting how long I will last. That doesn’t feel good. It’s like the whole thing was a whim or a joke to them.

Also, heavy alcohol use is pretty typical of our community. If I’m not drinking then how do I have a social life?

Appreciate your thoughts.

Michael replies:

It can be hard to be different. For example, to be gay in a straight world, or not to drink in a world where alcohol plays such a big part.

I’m a believer in living in a way that respects whom you actually are. This means doing what you think is important to do, even when there are consequences you don’t like. Only you can decide the boundary where the consequences of your living with integrity become intolerable.

Yes, many gay men drink a lot. So if you decide you don’t want to hang out where alcohol is involved, you will be reducing your options for socializing.

Some possibilities:

- Discuss this situation with your friends. Ask them if they’re willing to spend some time with you and without alcohol. (Not all the time — that would be way too much to ask, given that they clearly enjoy drinking.) Perhaps if you explain why your request is important to you, they’ll be willing to lean in your direction at least some of the time. That they’re now mocking you for not drinking suggests I am a bit too optimistic about this possibility. But who knows? And, what have you to lose by asking?

- See if you can tolerate hanging out with people who are drinking without picking up a drink yourself, and if you can actually enjoy such interactions.

- Start looking for some new friends. There are, in fact, lots of gay men in this world whose social lives don’t revolve around alcohol (or other substances.)

On a separate but related note: given your fear that you will start drinking again, and your concerns about navigating life without alcohol, might you consider Alcoholics Anonymous to get some support?

I’ve seen AA and other 12-step groups help many friends and clients, and I think they work in two main ways.

First, attending meetings gives you support and a feeling of community. You’ll meet others who are working to be sober, hear their stories and share your own struggles with them. You’re likely to feel less alone in your effort to stop drinking, learn tools for staying sober, and make friends you can reach out to when you’re feeling vulnerable. You’ll also have a sponsor, your guide and advocate in the program, whom you talk with regularly.

Second, the program lays out “12 steps” of recovery that are a path to greater self-awareness and personal growth. Like good psychotherapy, the steps give you a framework for looking at your behavior patterns and taking responsibility for yourself.

If you are intrigued, the best way to learn more is to attend several 12-step meetings. There are many in our area, including gay groups (for example, the Triangle Club.) As I mentioned, if you do get involved in AA, a side benefit is that you’re likely to make some new friends who share your desire to build a life without alcohol.

Of course, making new friends does not have to mean cutting off your posse. But if you’re changing in ways that make them less of a great fit, it would be great to find some new folks who might be more on your wavelength to connect with.

Michael Radkowsky, Psy.D. is a licensed psychologist who works with couples and individuals in D.C., Maryland, Virginia, and New York. He can be found online at michaelradkowsky.com. All identifying information has been changed for reasons of confidentiality. Have a question? Send it to [email protected]

Real Estate

2026: prices, pace, and winter weather

Lingering snow cover, sub-freezing temperatures have impacted area housing market

The D.C. metropolitan area’s housing market remains both pricey and complex. Buyers and sellers are navigating not only high costs and shifting buyer preferences, but also seasonal weather conditions that influence construction, inventory, showings, and marketing time.

Seasonality has long affected the housing market across the U.S. Activity typically peaks in spring and summer and dips in winter; however, January and February 2026 brought unusually cold spells to our area, with extended freezing conditions.

Persistent snow and ice-covered roads and sidewalks have gone for days, and in some cases weeks, before melting. While snow accumulation normally averages only a few inches this time of year, this winter saw below-normal temperatures and lingering snow cover that has significantly disrupted normal activity.

Rather than relying on neighborhood teenagers to shovel snow to make some extra money, the “snowcrete” has required ice picks, Bobcats, and snow removal professionals to clear streets and alleys, free our cars from their parking spaces, and restore availability of mass transit.

These winter conditions have had an adverse impact on the regional housing market in several ways.

- Construction slowdown: New builds and exterior improvements often pause during extended cold, resulting in delayed housing starts when we need affordable housing in the worst way.

- Listing preparation: Cleaning crews, sign installers, photographers, and stagers with trucks full of furniture may be unable to navigate roads and need to postpone service.

- Showings and open houses: Simply put, buyers are less inclined to schedule visits in hazardous conditions. Sellers must ensure walkways and parking areas are clear and de-iced and be able to vacate the property while viewings are taking place.

- Inspection and appraisal delays: Like buyers and sellers, ancillary professionals may be delayed by unfavorable weather, slowing timelines from contract to close.

- Maintenance and repairs: Properties with winter damage (e.g., ice dams or frozen pipes) may experience repair delays due to contractor availability and supply chain schedules. Snow and cold can also affect properties with older and more delicate systems adversely, leading some sellers to delay listing until better conditions arrive.

- Availability of labor: Increasingly, construction, landscaping, and domestic workers are reluctant to come into the District, not because of ice, but because of ICE.

Overall, the District has shown a notable increase in days on the market compared with past years. Homes that once sold in a week or less are now often listed for 30+ days before obtaining an offer, especially in the condominium and mid-range house segments. While part of this shift can be attributed to weather and climate, interest rates, uncertain employment, temporary furloughs, and general economic conditions play key roles.

Nonetheless, we continue to host some of the region’s most expensive residences. Historic estates, including a Georgetown mansion that sold for around $28 million, anchor the luxury segment and reflect ongoing demand for premium urban property.

But even in this high-end housing sector, marketing strategies are evolving based on seasonal realities. Price reductions on unique or niche properties, such as undersized or unconventional homes, reflect a broader market adjustment where competitive pricing can shorten selling time.

For example, a beautifully renovated, 4-story brick home with garage parking and multiple decks that overlook the Georgetown waterfront sold in early February for 90 percent of the list price after 50 days on the market.

At the other end of the spectrum, a 2-bedroom investor-special rowhouse in Anacostia only took eight days to sell for under $200,000, down 14 percent from its original list price. In addition, four D.C. homes took more than 250 days to sell, including an 8-bedroom rooming house that was on the market for 688 days and closed after a 23 percent downward price adjustment.

Some frustrated sellers are simply taking their homes off the market rather than dropping prices below their mortgage balances, although we are beginning to see the resurgence of short sales for those who must sell.

Condominiums and cooperatives offer many opportunities for buyers and investors, with 1,100 of them currently on the market in D.C. alone. List prices run the gamut from $55,000 for a studio along the Southwest Waterfront to nearly $5 million for five bedrooms, four full baths, and 4,400 square feet at the Watergate.

So, while Washington metro area prices remain high, the pace of sales now reflects both seasonal and economic realities. Homes taking longer to sell, in part caused by elements of winter, signal a shifting market where buyers can take more time to decide which home to choose and have a better negotiating posture than in recent years.

Accordingly, sellers must continue to price strategically, primp and polish their homes, and prepare for additional adverse circumstances by reviewing fluctuating market conditions with their REALTOR® of choice.

Valerie M. Blake is a licensed Associate Broker in DC, MD & VA with RLAH @properties. Call or text her at (202) 246-8602, email her at [email protected] or follow her on Facebook at TheRealst8ofAffairs.

-

Virginia5 days ago

Virginia5 days agoArlington LGBTQ bar Freddie’s celebrates 25th anniversary

-

National4 days ago

National4 days agoSupreme Court deals blow to trans student privacy protections

-

District of Columbia4 days ago

District of Columbia4 days agoD.C. Black Pride theme, performers announced at ‘Speakeasy’

-

Opinions4 days ago

Opinions4 days agoWhy innovation matters for Black health