Opinions

D.C. may undermine support for ‘Obamacare’

Proposal to force workers into health exchange will shock, anger

Controversy concerning implementation of the Affordable Care Act in D.C. could spread as quickly as a virulent flu outbreak in coming months.

Upheaval in local approval of Obamacare is the potential result of a little known development currently brewing behind the scenes within the city government bureaucracy.

Although a majority of Americans maintain that President Obama’s signature legislative achievement will make things worse for taxpayers, businesses, those currently insured and medical professionals, it is widely presumed that the law enjoys a relatively unique level of public support in D.C.

However, the District’s newly established Health Insurance Exchange Board may soon single-handedly undercut local support for the health care law if the seven appointed members vote to adopt recommendations proposed by the Mayor’s Health Reform Implementation Committee (HRIC).

The local mandate under consideration would affect all employees currently covered by District employers under group plans of 100 or fewer workers. It would also require that all individual plans and small group coverage be provided exclusively by the exchange.

The mayor’s panel has advised the board that the health insurance exchange “should be the sole marketplace in the District for the purchase of individual and small group health insurance plans” and recommends increasing the threshold for affected group plans from the standard of 50 employees to 100.

Following the U.S. Supreme Court decision to largely uphold the controversial federal law, D.C. small business advocates began sounding the alarm over these local proposals. The D.C. Chamber of Commerce and other business representatives, as well as human resource advisers, insurance coverage consultants and others argue that the proposed policy would severely restrict coverage choice and raise costs for small businesses.

The District’s small population and relatively low number of uninsured have created government concern regarding the financial viability of its insurance exchange. As a result, regulators contend program sustainability requires mandating an expansion of the risk pool by fiat.

However, that scenario dictates that more than 36 percent will be forced out of the private insurance market and into the city’s health care exchange. Workers employed in the District covered under affected group plans, individual plan holders and individuals required to purchase coverage would all be affected.

The HRIC “Report and Recommendations on the Health Insurance Market Structure of the District of Columbia” does not discuss the potential for blowback by consumers. It does, however, acknowledge that the recommended policy would increase the cost of applicable group plans.

Particularly troubling for local business advocates is curtailment of employer health plan choices – including high deductible plans, health savings account plans and other plans that employers currently offer – and reducing competition.

An unintended consequence would be the inevitable reduction or elimination of employer-provided health insurance benefits. Under the federal law, employers with fewer than 50 qualifying employees are not required to offer coverage. The District scheme to raise the exchange participation requirement from 50 to 100, if approved, would indirectly extend this benefit vulnerability to a larger number of workers, further destabilizing the small group market.

Employers currently offering coverage might reduce benefits or opt out at a net savings due to “rate shock” resulting from an additionally proscribed merging of the small group and individual markets within the D.C. exchange. In addition, employers with multiple state worksites might purchase coverage elsewhere, simplifying selection and application complexities.

These pending policies provide a perfect prescription for generating opposition – a government decree forcing a directed change in current health plan coverage while both restricting coverage options and increasing costs.

Creating an operational exchange next year in advance of the 2014 federal insurance requirement necessitates that the District’s appointed governing board must decide the overall marketplace structure by October.

If D.C., as a surrogate, reneges on President Obama’s frequent fundamental pledge that those with health care coverage would be able to “keep the insurance you currently have” under the federal law, significant political fallout may result.

A broken promise of this magnitude, even at the hands of local agency implementers, would likely shock many D.C. residents, business owners and those employed in the District into startled distrust and disapproval of the federal health care law.

Mark Lee is a local small business manager and long-time community business advocate. Reach him at [email protected].

Commentary

BookMen DC: Still going strong at 25

Celebrating the longest-running LGBTQ literary group in the area

On May 11, 1999, what was originally known as the Potomac Gay Men’s Book Group convened for its first meeting. A lot has changed over the ensuing quarter-century, starting with our name. But our identity remains true to the description on our blog: “an informal group of men who are interested in gay literature (both fiction and non-fiction).”

Our founder, Bill Malone, worked at the Whitman-Walker Clinic and started the group using donations of remainder books from a wholesaler in New York. Soon after that, members decided to get their own books, and began purchasing them through Lambda Rising, which offered a discount for such orders until it closed in 2010. The group later renamed itself BoysnBooks, and then became BookMen DC in 2007, which is also when we started our blog.

Following Bill’s tenure, Tom Wischer, Greg Farber and Tim Walton (who set up our blog) have served as our facilitators. I succeeded Tim in that role in 2009, and am grateful to him and all my predecessors for laying such a solid foundation for our group.

Twenty-five years after our founding, we are the longest-running LGBTQ literary group in the DMV. So far, we have discussed nearly 400 books, ranging from classics like Plato’s Symposium to graphic novels, gay history and memoirs, and novels by James Baldwin, Michael Cunningham, E.M. Forster and Edmund White—to name just a few of the many authors and genres we’ve explored.

Currently, we have more than 120 names on our mailing list, of whom about a quarter attend meetings at least occasionally. (Average attendance at our meetings is about 10.) Our members variously consider themselves gay, queer, bisexual, or transgender, and those varying perspectives enhance our discussions. I would be remiss if I didn’t acknowledge that, like many LGBTQ organizations, we are not nearly as diverse as I wish we were. Although we do have young members and people of color within our ranks, we are predominantly white and middle-aged or older. We have tried various forms of outreach to further diversify our membership, and will keep working on that.

How has BookMen DC not just survived, but thrived, when so many other book clubs and LGBTQ groups have foundered? I would identify several factors.

First and foremost, we are welcoming. We have no minimum attendance requirements and charge no dues. And we expressly encourage members to join us at meetings even if they haven’t finished the selection we’re discussing.

We are also collaborative. Each fall, members nominate titles for the next year’s reading list; I then compile those suggestions into a list for members to weigh in on, and the results of that vote determine what we will read.

Finally, we are flexible and adaptable. Over the years, we have met in locations all over the District. Currently, we meet on the first Wednesday of each month at the Cleveland Park Library (3310 Connecticut Ave. NW) from 6:30-7:30 p.m. to discuss entire books; afterward, those interested go to dinner at a neighborhood restaurant.

When the pandemic struck four years ago, we took a break for a couple of months before moving operations online. (Thank God for Zoom!) Even after the venues where we’d been meeting reopened, we have continued to meet virtually on the third Wednesday of each month, from 7-8 p.m. During those Zoom sessions, we discuss sections of anthologies of poetry and short stories, as well as short standalone works (e.g., plays and novellas).

If you enjoy LGBTQ literature and would like to try us out, visit our blog: https://bookmendc.blogspot.com/ and click the link to email me. We’d love to meet you!

Steven Alan Honley, a semi-retired musician, editor, and writer, has been a member of BookMen DC since 2000 and its facilitator since 2009.

Opinions

Rosenstein: Vote for Angela Alsobrooks and April McClain-Delaney

Two strong, accomplished women for Maryland

I am endorsing two strong accomplished women for Maryland. The first is Angela Alsobrooks, for United States Senate. Second is April McClain-Delaney for Congress in Maryland’s 6th District. Both women are superbly qualified, and will fight hard for, and be a credit to, the people of Maryland.

Angela Alsobrooks is county executive of Prince George’s County. She was born and raised in Maryland. She is a graduate of Duke University, and the University of Maryland, School of Law. She was the first full-time Assistant State’s Attorney to handle domestic violence cases in Prince George’s County. She made history as the youngest, and first woman, to be elected Prince George’s County State’s Attorney where she stood up for families, taking on some of Maryland’s worst criminals, while treating victims and the accused with dignity and respect. Under her tenure, violent crime dropped by 50 percent.

Alsobrooks has said, “This year we know the rights of women to control their own bodies and healthcare, is at the top of the list of concerns for so many Marylanders, and decent people across the country, both men and women.” Because of this Maryland must elect a strong woman to ensure we win the fight on this issue. There are many reasons to support Alsobrooks. One is if we look at the United States Senate, what is clearly missing, is an African-American woman. That is a disgrace. Marylanders have the ability to make that right by voting for Angela Alsobrooks.

But there are other reasons to vote for Angela. She understands how federal policy impacts states and counties, directly impacting her constituents, because she has dealt with the issues that arise from the bills Congress passes. Angela is a pragmatic progressive, and will work across the aisle to get things done. Nothing prepares you more for negotiating with Republicans in Congress, than negotiating with a county council and community activists, and she has done both successfully for many years. She will continue to fight for LGBTQ equality having named the first LGBTQ liaison in PG County. She supports legislation to fight climate change, and supports student loan forgiveness. Maryland leaders know Alsobrooks is the right candidate. She has been endorsed by Gov. Wes Moore, Lt. Gov. Aruna Miller, Sen. Chris Van Hollen and former Sen. Barbara Mikulski, Congressmen Jaimie Raskin, Steny Hoyer and Glenn Ivey; and an overwhelming number of local legislators and leaders in PG County. They all know how good she is, and how much she will do for Maryland, and the nation. I urge a vote for Angela Alsobrooks in the Democratic Senate primary.

I also join a hero of mine, former Speaker Nancy Pelosi, Congressmen Steny Hoyer and Dutch Ruppersberger, along with a host of Maryland legislators and office holders, who have endorsed April McClain-Delaney. She has more than 30 years’ experience in communications law, regulatory affairs, and advocacy, across a broad spectrum of government, private sector, and non-profit engagements. She has served as the Washington director and a board member of Common-Sense Media, a leading non-profit dedicated to how media impacts kids health and wellbeing. Her policy and advocacy efforts have spanned digital citizenship, bridging the digital divide, and tech equity issues, privacy matters, spectrum, and internet governance. She has served as assistant general counsel and regulatory affairs director at Orion Satellite where she oversaw domestic and international regulatory efforts in approximately 20 countries, and served as one the founding board members of the International Satellite Association.

In addition to her professional endeavors, she has served on numerous boards and councils. These include the Meridian Women’s Leadership Council; Georgetown Institute for Women, Peace and Security; Georgetown Law Center (past chair); Northwestern University Board of Trustees; the International Center for Research on Women; Innocents at Risk; and the Sun Valley Community School. She is a graduate of Northwestern University and has her JD from Georgetown Law Center. Delaney is the best candidate to win the 6th District for Democrats. Delaney understands rural Maryland having grown up on a farm in Iowa. She understands government today, serving as the Deputy Assistant Secretary for Communications and Information, U.S. Department of Commerce, in the Biden administration.

When it comes to the issue of protecting a woman’s right to control her own body and healthcare, no one will match April in her vigilance. She is a mother fighting for the rights for her four daughters. She is a strong supporter of LGBTQ rights, and will support policies to fight climate change, support debt relief for students, and will work to protect our national security. She understands what it means to work across the aisle without giving up any of her principles. She is the kind of person we need in Congress. I urge a vote for April McClain-Delaney in Maryland’s 6th Congressional District, Democratic primary.

Peter Rosenstein is a longtime LGBTQ rights and Democratic Party activist. He writes regularly for the Blade.

Opinions

Unique financial planning challenges for trans community

Overcoming roadblocks in journey to living an authentic life

Approximately 2.6 million Americans identify as transgender, according to the U.S. Census Bureau Household Pulse Survey in 2023. This community faces many financial, legal, and estate planning challenges, resulting in higher rates of financial instability compared to the general population. However, these challenges are not generally understood or even discussed.

At JPMorgan Chase, we’re dedicated to providing awareness and education to help all communities — including members of the LGBTQ+ community — reach their financial goals. Our team at J.P. Morgan Wealth Management recently published a new white paper to offer actionable tips for transgender adults to help them overcome some of the specific obstacles they face with planning.

Here are some key takeaways:

Inaccurate identity documents create a foundational problem

Hundreds of thousands of transgender people in the U.S. do not have a single piece of identification that correctly identifies their gender or chosen name. Many people, including those in the broader LGBTQ+ population, have never thought about what their lives would be like if they lacked accurate identity documents.

Having accurate identity documents is essential for so many aspects of everyday life – applying for school or a job, finding a place to live, exercising the right to vote and boarding a plane. Presenting inaccurate identification in these situations can subject transgender individuals to unfair discrimination and harassment. But correcting name and gender markers on identity documents can be complicated, expensive, time-consuming, and in some cases, impossible.

The U.S. State Department has adopted one of the most simple and progressive policies for correcting gender markers in the world. Since June 2021, medical certification is not required to change the gender marker in one’s passport. Transgender people should consider updating their U.S. Passport book or card immediately and use that document as primary identification. Passport books and cards are valid for 10 years, even if policies change during that time.

Credit issues are common for trans community

Transgender individuals who are able to successfully obtain new identity documents still frequently face credit issues. Unlike changes to one’s last name after a marriage or divorce, informing banks or other creditors of a change to one’s first name on accounts does not automatically cause credit reporting agencies to update that person’s credit file. The credit reporting system can often be problematic for transgender people after a name change, with many reporting that credit files are never updated or that their credit scores decline.

This can create a cascading effect in numerous areas of one’s financial life, and it goes beyond borrowing. Credit files are frequently checked in employment decisions, pricing insurance, establishing utility and phone service and applying to rent a home.

Until policies change, transgender individuals should directly contact each creditor and credit reporting agency and follow each organization’s specific procedures and documentation requests. And they should carefully monitor that the changes are actually made and do not result in a credit score change.

Emergency and end-of-life documents should be carefully reviewed

Transgender people often have special health care needs and face unique forms of disparate treatment in accessing care, and cannot speak for themselves in these circumstances. End-of-life planning is often difficult to think about, but it’s especially critical that this community works with their attorneys and trusted advisors to create customized emergency and end-of-life legal documents.

The people named in these documents who could become decision-makers – typically trusted friends or supportive family members – should be empowered to direct health care providers to meet the patient’s wishes and preserve their chosen name and gender identity, as well as service providers, such as funeral home employees, to honor the deceased’s wishes about their appearance during memorial services.

The laws for these documents are complicated, and they vary depending on the state or territory. If possible, these documents should be prepared by experienced attorneys who routinely work with members of the LGBTQ+ community.

The bottom line

Transgender individuals in the United States face unique financial, legal and estate planning challenges that create roadblocks in their journey to living an authentic life. Careful planning can help mitigate some, but not all, of these obstacles.

JPMorgan Chase & Co., its affiliates, and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC.

Joseph Hahn is executive director of Wealth Planning & Advice at J.P. Morgan Wealth Management.

-

The White House2 days ago

The White House2 days agoEXCLUSIVE: White House Press Secretary Karine Jean-Pierre on speaking out and showing up

-

Middle East2 days ago

Middle East2 days agoTel Aviv authorities cancel Pride parade

-

Maryland4 days ago

Maryland4 days agoTrone discusses transgender niece

-

The White House3 days ago

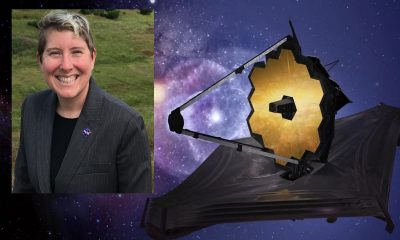

The White House3 days agoJane Rigby awarded Presidential Medal of Freedom