Real Estate

Freedom from unfair housing

Protection from discrimination when buying, renting

June 19. Freedom Day. Jubilee Day. Cel-Liberation Day. It commemorates the end of slavery when on June 19, 1865, Union general Gordon Granger finally made it to Galveston, Texas to read federal orders from 1861 announcing that all previously enslaved people were free. It is the oldest nationally celebrated commemoration of the ending of slavery in the United States.

Yes, this was two and a half years after President Lincoln’s Emancipation Proclamation that became official on Jan. 1, 1863. The Proclamation had little impact on Texas due to the minimal number of Union troops there to enforce the new order. With the surrender of General Lee and the arrival of General Granger’s regiment, the forces were finally numerous and strong enough to overcome the resistance.

On this year’s June 19, and with the world focused on equality for all, it is important for us also to talk about equality in the home buying process. Despite being given the freedom from slavery in 1865, it wasn’t until 1968—52 years ago—that the Fair Housing Act was passed. The Act, in simplest terms, protects people from discrimination when they are renting or buying a home, getting a mortgage, seeking housing assistance, or engaging in other housing-related activities. It prohibits discrimination in housing based on race, color, national origin, religion, sex, familial status, and/or disability.

Discrimination can come in two forms—direct and indirect. Direct is purposefully and impermissible basing the sale on a protected class/characteristic. Indirect is unconsciously applying a requirement or rule in the sale or rental of housing.

Direct is easy to understand. If an agent or mortgage officer steers you to one area, discourages you from others, or flat out refuses to show you homes in an area, it is fairly easy to see how that is a violation of fair housing. As a renter, no landlord can refuse to accept a housing voucher if that voucher is applicable to the price point and area assigned.

Indirect can be much harder to detect. It can be treating clients differently in subtle ways. For example, as agents, our clients often ask us about schools, crime rates, and the demographic make up of a neighborhood or a building. On the surface, a buyer typically asks these types of questions for a variety of sincere reasons. Many of our clients are relocating to an area and they are looking to their real estate agent as a trusted source of information—and they know agents love to be helpful. As innocent and sincere as these questions may be, your agent should never answer them. Why you may ask? Answering these could steer a buyer toward an area, or away from a home, toward or away from a condo building, or even toward or away from an entire neighborhood. Answering questions on crime, schools, and regarding people are violations of fair housing even if the intent was to be helpful to you as a buyer. What your agent should do instead is assist you with finding resources that can help you as the buyer with finding the information you want and need. They can direct you to sites that track crime, sites that offer insights on school rankings,and other neighborhood resources so you can learn about the areas in which you are considering a purchase.

Are we still seeing fair housing violations today? Unfortunately, yes. Even ones that aren’t meant to hurt or harm. Even agents are discriminated against as we are often treated differently in a listing presentation or at the buyer agent selection interview process.

As a Realtor, helping people find their vision of home is a responsibility and a privilege. Treating everyone with equal respect and dignity is paramount. Everyone deserves a wonderful place to call home in the neighborhood of their choice. Homeownership is more than shelter; it is a gateway to emotional and economic opportunities. Homeownership enriches lives, supports communities, strengthens culture, and enhances society. Additionally, owning a home is a wealth builder as a home is often the largest asset of a homeowner’s net worth.

At Coldwell Banker, we are proud to stand up for Fair Housing. Our company has designed an entire education module that includes training, a pledge for all employees and agents to stand up for Fair Housing, and a certification course that takes the education and that pledge even further.

Equality, respect, and dignity—three tenants that are of the utmost importance in housing, and on this June 19.

Sherri Anne Green is an award-winning Realtor with Coldwell Banker Residential Brokerage having earned the prestigious International President’s Circle Award designating her among the top 5% internationally. She provides impeccable, high-touch service tailored to her clients’ unique situations. Reach her at 202-798-1288, [email protected], on Facebook and on Instagram.

Real Estate

Convert rent check into an automatic investment, Marjorie!

Basic math shows benefits of owning vs. renting

Suppose people go out for dinner and everyone is talking about how they are investing their money. Some are having fun with a few new apps they downloaded – where one can round up purchases and then bundle that money into a weekly or monthly investment that grows over time, which is a smart thing to do. The more automatic one can make the investments, the less is required to “think about it” and the more it just happens. It becomes a habit and a habit becomes a reward over time.

Another habit one can get into is just making that rent check an investment. One must live somewhere, correct? And in many larger U.S. cities like New York, Chicago, D.C., Los Angeles, Miami, Charlotte, Atlanta, Dallas, Nashville, Austin, or even most mid-market cities, rents can creep up towards $2,000 a month (or more) with ease.

Well, do the math. At $2,000 per month over one year, that’s $24,000. If someone stays in that apartment (with no rent increases) for even three years, that amount triples to $72,000. According to Rentcafe.com, the average rent in the United States at the end of 2025 was around $1,700 a month. Even that amount of rent can total between $60,000 and $80,000 over 3-4 years.

What if that money was going into an investment each month? Now, yes, the argument is that most mortgage payments, in the early years, are more toward the interest than the principal. However, at least a portion of each payment is going toward the principal.

What about closing costs and then selling costs? If a home is owned for three years, and then one pays out of pocket to close on that home (usually around 2-3% of the sales price), does owning it for even three years make it worth it? It could be argued that owning that home for only three years is not enough time to recoup the costs of mostly paying the interest plus paying the closing costs.

Let’s look at some math:

A $300,000 condo – at 3% is $9,000 for closing costs.

One can also put as little as 3 or 3.5% down on a home – so that is also around $9,000.

If a buyer uses D.C. Opens Doors or a similar program – a down payment can be provided and paid back later when the property is sold so that takes care of some of the upfront costs. Knowledgeable lenders can often discuss other useful down payment assistance programs to help a buyer “find the money.”

Another useful tactic many agents use is to ask for a credit from the seller. If a property has sat on the market for weeks, the seller may be willing to give a closing cost credit. That amount can vary. New construction sellers may also offer these closing cost credits as well.

And that, Marjorie, just so you will know, and your children will someday know, is THE NIGHT THE RENT CHECK WENT INTO AN INVESTMENT ACCOUNT ON GEORGIA AVENUE!

Joseph Hudson is a referral agent with Metro Referrals. Reach him at 703-587-0597 or [email protected].

Real Estate

Top buyer-friendly markets for the LGBTQ community

Home should be a place where you can be fully yourself

Buying or selling a home is one of the most meaningful financial and emotional decisions a person can make. For LGBTQ+ individuals and families, that journey can also come with unique considerations — from finding truly inclusive neighborhoods to working with professionals who understand and respect who you are.

The good news? Across the United States, there are increasingly buyer-friendly housing markets where LGBTQ+ home buyers and sellers can find opportunity, affordability, and community. When paired with the right representation, these markets can offer not only strong financial value, but peace of mind.

For more than 30 years, GayRealEstate.com has been the leading source of LGBTQ+ real estate representation, helping LGBTQ+ buyers and sellers connect with vetted, LGBTQ+ friendly real estate agents who understand the nuances of fair housing, legal protections, and inclusive service.

Below, we explore top buyer-friendly markets for the LGBTQ+ community, along with practical tips to help you navigate the process with confidence.

What Makes a Market Buyer-Friendly?

A buyer-friendly market isn’t just about lower prices — especially for LGBTQ+ home buyers. It often includes:

- Increased housing inventory (more choices, less pressure)

- Slower price growth or stabilized pricing

- Greater negotiating power for buyers

- Established or emerging LGBTQ+ communities

- Local protections and inclusive policies

- Access to LGBTQ+ friendly real estate agents and resources

Markets that combine affordability with inclusivity can be especially attractive for first-time gay home buyers, same-sex couples, and LGBTQ+ families planning for long-term stability.

Top Buyer-Friendly Markets for LGBTQ Home Buyers

1. Austin & San Antonio, Texas

Once known for extreme competition, many Texas metros have shifted into more buyer-friendly territory due to increased inventory.

Why it works for LGBTQ+ buyers:

- Strong LGBTQ+ communities, especially in Austin

- More negotiating leverage than in prior years

- Diverse neighborhoods at varying price points

Tip: Texas does not have statewide LGBTQ+ housing protections, making it especially important to work with an experienced LGBTQ+ friendly realtor through GayRealEstate.com.

2. Columbus & Cincinnati, Ohio

Ohio cities continue to attract buyers looking for value without sacrificing culture or inclusivity.

Why it works:

- Lower median home prices

- Growing LGBTQ+ populations

- Strong healthcare, education, and job markets

These cities are particularly appealing for LGBTQ+ buyers relocating from higher-cost coastal markets.

3. Richmond, Virginia

Richmond has become a standout for LGBTQ+ home ownership thanks to affordability, history, and progressive growth.

Highlights:

- Inclusive local culture

- Buyer-friendly price trends

- Walkable neighborhoods popular with LGBTQ+ professionals

4. Minneapolis–St. Paul, Minnesota

The Twin Cities consistently rank high for LGBTQ+ quality of life and legal protections.

Why LGBTQ+ buyers love it:

- Strong anti-discrimination laws

- Stable home values

- Excellent resources for LGBTQ+ families

Minnesota offers one of the safest environments for LGBTQ+ home buyers and sellers navigating the real estate process.

5. Jacksonville & Tampa Bay, Florida

Florida remains complex for LGBTQ+ buyers, but some metros still offer strong buyer opportunity.

What to know:

- Increased inventory = more negotiating power

- Coastal lifestyle at lower cost than South Florida

- Local LGBTQ+ communities continue to grow

Because statewide protections vary, partnering with a GayRealEstate.com LGBTQ+ friendly real estate agent is essential.

Finding LGBTQ-Friendly Neighborhoods

Not every “affordable” neighborhood is inclusive — and safety, comfort, and belonging matter.

When searching for LGBTQ+ friendly neighborhoods:

- Look for visible LGBTQ+ organizations, events, and businesses

- Research local non-discrimination ordinances

- Ask your agent about lived experiences, not just statistics

- Talk to neighbors and local LGBTQ+ groups

Agents in the Gay Real Estate Network often provide insight that listing data alone cannot.

The Importance of LGBTQ Real Estate Representation

While fair housing laws exist, LGBTQ+ housing discrimination still happens — sometimes subtly, sometimes overtly.

Working with an LGBTQ+ friendly real estate agent helps ensure:

- Respectful communication

- Advocacy during negotiations

- Awareness of legal protections

- A safer, more affirming experience

GayRealEstate.com has spent over three decades building the most trusted network of gay realtors, lesbian real estate agents, and LGBTQ+ friendly real estate professionals nationwide.

Legal Protections Every LGBTQ Buyer and Seller Should Know

Federal protections now include sexual orientation and gender identity under the Fair Housing Act, but enforcement and local laws vary.

Before buying or selling:

- Understand your state and local protections

- Know how to document discriminatory behavior

- Work with professionals who take advocacy seriously

- Use trusted LGBTQ+ real estate resources

GayRealEstate.com agents are experienced in helping clients navigate these realities with confidence.

Tips for LGBTQ Home Buyers & Sellers

- Get pre-approved early to strengthen your buying position

- Interview agents and ask direct questions about LGBTQ+ experience

- Don’t ignore your instincts — comfort matters

- Plan long-term: community, schools, healthcare, and protections

- Use LGBTQ+-specific resources rather than generic searches

Buyer-friendly markets create opportunity — but representation creates security.

Whether you’re a first-time gay home buyer, a same-sex couple relocating, or an LGBTQ+ seller preparing for your next chapter, choosing the right market and the right representation makes all the difference.

For over 30 years, GayRealEstate.com has been the trusted leader in LGBTQ+ real estate, connecting buyers and sellers with professionals who understand the importance of inclusion, advocacy, and respect.

Your home should be more than a place to live — it should be a place where you can be fully yourself.

Scott Helms is president and owner of Gayrealestate.com.

Real Estate

Stress-free lease renewals during winter months

A season when very few tenants typically move

January has a way of waking everyone up. After weeks of holiday noise, travel, family visits, and a general blur of activity, the new year arrives with its usual mix of resolutions, optimism, and responsibility. People start looking at their calendars again. To-do lists reappear. And tucked away in there is something many tenants didn’t give much thought to in December, their lease renewal.

Renewals in winter matter more than most people realize. It is a season when very few tenants typically move. The weather is unpredictable, schedules are tight, and most people are trying to regain their footing after the holidays. Because of this, renewal conversations tend to be more productive and more grounded.

Many landlords think of spring and summer as the heart of leasing season, and while that’s certainly when moves are most common, winter renewals hold their own kind of importance. A well-timed renewal does more than keep a unit occupied. It provides predictability for the year ahead, strengthens relationships, and reduces the costly turnover that smaller landlords want to avoid.

In my experience, tenants who might hesitate during another time of year are often relieved to secure housing before the pressures of spring and summer begin. Uncertainty is one of the prime causes of unnecessary turnover. If tenants don’t hear from their landlord, they often start browsing listings “just in case,” or asking friends about other options. Once that door is opened, it can be hard to close. Initiating the renewal process early helps anchor tenants before doubts start creeping in.

Tenants often make clearer decisions in January than they would in November or December. During the holidays, people are distracted and stretched thin; emails are skimmed, not absorbed; and anything involving planning often gets deferred until “after the new year.” When tenants return home in January, they have a better sense of their plans, their budget, and their needs for the coming months. This makes it a much easier moment to start or restart a renewal conversation.

The practical reality is that most tenants don’t want to move in the winter. Who wants to haul furniture across icy sidewalks or deal with last-minute moving delays due to storms? Beyond the weather, January is a time when people are reorganizing finances, filing paperwork, and settling into routines. The thought of a major transition simply doesn’t fit. Landlords can use this natural reluctance to create a smoother, more collaborative renewal process.

One thing I’ve learned over the years is that clarity is a landlord’s best tool. Tenants don’t need lengthy explanations, legal jargon, or complicated attachments. They simply want to know:

- Are the terms changing?

- If so, how?

- What does their timeline look like?

- Would the landlord consider another set of terms?

A concise, well-laid-out renewal offer does two things. First, it demonstrates transparency, which builds trust. Second, it keeps the conversation focused and productive. When tenants understand exactly what’s being proposed, there is less back-and-forth, fewer misunderstandings, and a quicker path to a signed agreement.

Tenants are more receptive when they feel they’re being treated fairly and openly. If there’s a rent adjustment, a brief explanation helps tenants see the reasoning behind it, such as increased operating costs, significant maintenance completed during their stay or alignment with the market.

Lease renewals are moments of connection. The best landlord-tenant relationships are built over time through small exchanges, transparency, and mutual respect. Renewal season offers an opportunity to reinforce that.

A simple acknowledgement of the tenant’s care for the home or their timely payments can set a positive tone. Even a short note of appreciation signals that you see them not as a lease term, but as a partner in maintaining the property. These gestures cost very little but create a sense of goodwill that carries through maintenance requests, policy reminders, and everyday communication.

Many landlords underestimate how much tenants value being treated as individuals rather than account numbers. A thoughtful, personal touch during the renewal process can make a tenant feel recognizednand more inclined to stay.

Renewals aren’t only about securing another term lease.They’re also a natural moment to check in on the overall health of the property and the tenant’s experience. J anuary provides a quiet space to step back and ask:

• Are there maintenance concerns the tenant hasn’t mentioned yet or that have not been fully resolved?

• Is the property due for upgrades or any preventative work?

• Are there responsibilities or expectations worth revisiting?

These conversations don’t need to be long or formal, but they help prevent the small issues of one year from becoming the larger problems of the next. A tenant who feels heard is more likely to take good care of the home, communicate proactively, and renew again in future years.

While landlords must maintain structure and protect their assets, a bit of flexibility can go a long way during the renewal process. Tenants are often rebalancing budgets after holiday spending. Offering digital signatures, Having brief calls to clarify terms, being flexible, or a few extra days to make a decision can ease stress without compromising the landlord’s position.

Flexibility is about recognizing human realities. Most tenants appreciate being treated with patience and professionalism, and often reward that consideration with prompt decisions and smoother communication. There are many reasons why a full year renewal may not coincide with their plans. Being able to work out mutually agreeable renewal terms makes the solution a win for both parties.

For landlords, especially smaller ones, stability is the foundation of successful property investing. A vacant unit, even briefly, costs more than most people realize. There are marketing expenses, cleaning, repairs, lost rent, and the unpredictable timeline of finding the right new tenant. By contrast, securing a renewal with an existing reliable tenant protects cash flow, reduces risk, and creates predictability in planning.

January renewals, when handled well, deliver this stability right at the beginning of the year. They give landlords a clear roadmap for budgeting, maintenance scheduling, and forecasting. They also give tenants the security of knowing exactly where they stand, which reduces stress on both sides.

A lease renewal may seem like a small moment in the life of a property, but in practice, it shapes the experience of the year ahead. When the process is organized, honest, and respectful, it sets a tone that carries through every interaction until the next renewal date.

January is a time to consider leaning into this approach. The pace is slower, the mindset is clearer, and both landlord and tenant are ready to step into the year with more intention. A renewal handled thoughtfully now paves the way for a smoother, quieter, more predictable twelve months, something every landlord and every tenant can appreciate.

Scott Bloom is owner and senior property manager at Columbia Property Management.

-

Opinions5 days ago

Opinions5 days agoICE agents murder another American citizen in Minneapolis

-

Honduras5 days ago

Honduras5 days agoCorte IDH reconoce a Thalía Rodríguez como familia social de Leonela Zelaya

-

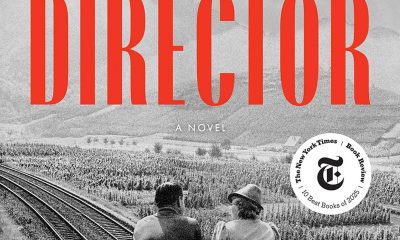

Books5 days ago

Books5 days ago‘The Director’ highlights film director who collaborated with Hitler

-

LGBTQ Non-Profit Organizations4 days ago

LGBTQ Non-Profit Organizations4 days agoTask Force urges renewed organizing amid growing political threats