Local

Activists rally for gay minister facing eviction

Faith Temple pastor opened home of 24 years for Bible study, church events

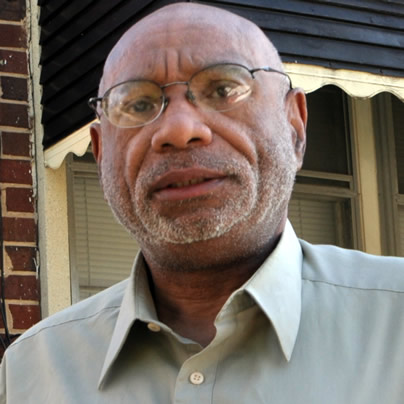

Faith Temple pastor Robert Michael Vanzant opened his home of 24 years for Bible study, church events, but now he may lose that home. (Washington Blade photo by Michael Key)

Rev. Robert Michael Vanzant, 59, the outreach pastor for D.C.’s Faith Temple, a Christian church with a special outreach to the African-American LGBT community, says he’s doing his “very best” to keep his spirits up at a time of need.

His Northeast Washington home of 24 years is in foreclosure and the Bank of America, which holds the mortgage, is taking steps to have him evicted.

“I’ve spent my entire life serving God and my community,” Vanzant said in an open letter to the bank that he released last week. “When I became disabled and my income dropped, I reached out and asked for a modification so that I could continue to pay my mortgage. You denied my request and set me up for foreclosure and eviction.”

Last week, friends and associates at Faith Temple joined the D.C. anti-foreclosure group Occupy Our Homes in staging a protest demonstration on his behalf outside the Bank of America’s loan office on U Street, N.W., just off 14th Street.

The protest organizers say Bank of America appears to have violated a city law that requires lenders to enter into a mediation process with borrowers who have fallen behind on their mortgage.

An official with the city agency that administers the mediation program said its intent is to determine whether a borrower is qualified for one of nearly a dozen federal programs that encourage and in some cases pay lenders to modify the terms of a mortgage to lower the monthly payments and enable a mortgage holder to keep the home.

Vanzant has served as a pastor at Faith Temple since the church was founded in 1982. He said he moved into his house on the 5500 block of 5th Street, N.E., in 1988 as a tenant before buying the semi-detached townhouse in 2003 from his landlord.

Isaiah Poole, a longtime member of the church and friend of Vanzant’s, said Vanzant has long opened his house for church functions, including Bible study classes. Poole said Vanzant also has opened his home as a shelter for people in need.

Vanzant told the Blade his problems began in 2008 when he became disabled due to illness and was later approved for disability status. He said that although he was no longer able to keep his full-time day job with the Metro transit agency, for the next year and a half he managed to continue making his mortgage payments through a disability insurance policy he had and later through Social Security disability benefits.

“I called the bank in early 2009 and said my income was going to change soon and I needed to talk about streamlining my mortgage,” he said. According to Vanzant, bank officials told him there were no mortgage assistance programs available for people who were current on their payments.

He said he next contacted several mortgage counseling organizations that promoted themselves as experts in helping people at risk for foreclosure. One of the organizations advised him to withhold his mortgage payments and place the money in a savings or escrow account, with the intent of working out a mortgage modification plan with the bank at a later date.

“And so that’s what I did,” he said.

But by early 2010, Bank of America began foreclosure proceedings and refused to discuss any mortgage adjustment options that had been widely publicized in the media and by the Obama administration.

“I received something from the law office that was representing the bank that they were foreclosing,” he said. “At the same time I received a notice from the Landlord-Tenant Court from the bank’s lawyer about an eviction.”

Added Vanzant, “That’s when she [the bank’s lawyer] told me, ‘They don’t want to talk to you. They won’t have anything to do with you. They don’t have anything to say to you.’”

Mike Haack, an organizer for Occupy Our Homes and one of the leaders of the protest demonstration last week, said the group plans further protests if Bank of America doesn’t demonstrate a good faith effort to work out a way for Vanzant to save his home.

“We feel the bank can take steps to allow him to keep his house,” Haack said. “The Reverend is an asset to the community.”

Vanzant, who was being treated at Howard University Hospital at the time of the Sept. 6 protest, said a representative of the bank called him at the hospital that same day, leading him to believe that the protest may have “alerted” the bank to his plight.

“I told them I couldn’t talk to them at that time because I was under medical treatment,” he told the Blade. “I said I would like to talk to them the next week.”

He said the bank’s representative called again last Friday and he arranged to speak with the representative this week.

“I’m trying to arrange for some legal representation before I talk to them,” he said. “I’ve made mistakes in the past and have had what my friends say was some bad advice” by organizations he paid to help during the past two years.

Brian Sullivan, a spokesperson for the U.S. Department of Housing and Urban Development, which administers the federal government’s mortgage assistance programs, said HUD strongly urges consumers not to pay anyone for so-called mortgage assistance services. He said HUD has a long list of HUD-approved mortgage counseling organizations and all of them offer their services for free.

He said Vanzant would likely qualify for a mortgage modification program, but a final determination on his qualifications would depend on the specific status of his mortgage, such as whether it is associated with federally linked agencies like Fannie Mae and Freddie Mac or the Federal Housing Administration (FHA).

“He has to provide all of this information to whoever he selects to help him get through this process,” Sullivan said.

Maryland

Md. Commission on LGBTQIA+ Affairs released updated student recommendations

LGBTQ students report higher rates of bullying, suicide

The Maryland Commission on LGBTQIA+ Affairs has released updated recommendations on how the state’s schools can support LGBTQ students.

The updated 16-page document outlines eight “actionable recommendations” for Maryland schools, supplemented with data and links to additional resources. The recommendations are:

- Developing and passing a uniform statewide and comprehensive policy aimed at protecting “transgender, nonbinary, and gender expansive students” against discrimination. The recommendation lists minimum requirements for the policy to address: name, pronoun usage, and restroom access.

- Requiring all educators to receive training about the specific needs of LGBTQ students, by trained facilitators. The training’s “core competencies” include instruction on terminology, data, and support for students.

- Implementing LGBTQ-inclusive curricula and preventing book bans. The report highlights a “comprehensive sexual education curriculum” as specifically important in the overall education curriculum. It also states the curriculum will “provide all students with life-saving information about how to protect themselves and others in sexual and romantic situations.”

- Establishing Gender Sexuality Alliances “at all schools and in all grade levels.” This recommendation includes measures on how to adequately establish effective GSAs, such as campaign advertising, and official state resources that outline how to establish and maintain a GSA.

- Providing resources to students’ family members and supporters. This recommendation proposes partnering with local education agencies to provide “culturally responsive, LGBTQIA+ affirming family engagement initiatives.”

- Collecting statewide data on LGBTQ youth. The data on Maryland’s LGBTQ youth population is sparse and non-exhaustive, and this recommendation seeks to collect information to inform policy and programming across the state for LGBTQ youth.

- Hiring a full-time team at the Maryland Department of Education that focuses on LGBTQ student achievement. These employees would have specific duties that include “advising on local and state, and federal policy” as well as developing the LGBTQ curriculum, and organizing the data and family resources.

- Promoting and ensuring awareness of the 2024 guidelines to support LGBTQ students.

The commission has 21 members, with elections every year, and open volunteer positions. It was created in 2021 and amended in 2023 to add more members.

The Governor’s Office of Communication says the commission’s goal is “to serve LGBTQIA+ Marylanders by galvanizing community voices, researching and addressing challenges, and advocating for policies to advance equity and inclusion.”

The commission is tasked with coming up with yearly recommendations. This year’s aim “to ensure that every child can learn in a safe, inclusive, and supportive environment.”

The Human Rights Campaign’s most recent report on LGBTQ youth revealed that 46.1 percent of LGBTQ youth felt unsafe in some school settings. Those numbers are higher for transgender students, with 54.9 percent of them saying they feel unsafe in school.

Maryland’s High School Youth Risk Behavior Survey reveals a disparity in mental health issues and concerns among students who identify as LGBTQ, compared to those who are heterosexual. LGBTQ students report higher rates of bullying, feelings of hopelessness, and suicidal thoughts. Nearly 36 percent of LGBTQ students report they have a suicide plan, and 26.7 percent of respondents say they have attempted to die by suicide.

The commission’s recommendations seek to combat the mental health crisis among the state’s LGBTQ students. They are also a call for local and state governments to work towards implementing them.

Virginia

Va. lawmakers consider partial restoration of Ryan White funds

State Department of Health in 2025 cut $20 million from Part B program

The Virginia General Assembly is considering the partial restoration of HIV funding that the state’s Department of Health cut last year.

The Department of Health in 2025 cut $20 million — or 67 percent of total funding — from the Ryan White Part B program.

The funding cuts started with the Trump-Vance administration passing budget cuts to federal HIV screening and protection programs. Rebate issues between the Virginia Department of Health and the company that provides HIV medications began.

Advocates say the funding cuts have disproportionately impacted lower-income people.

The Ryan White HIV/AIDS Program, a federal program started in 1990, provides medical services, public education, and essential services. Part B offers 21 services, seven of which remained funded after the budget cuts.

Equality Virginia notes “in 2025, a 67 percent reduction severely destabilized HIV services across the commonwealth.”

Virginia lawmakers have approved two bills — House Bill 30 and Senate Bill 30 — that would partially restore the funding. The Ryan White cuts remain a concern among community members.

Both chambers of the General Assembly must review their proposed changes before lawmakers can adopt the bills.

“While these amendments aren’t a full restoration of what community-based organizations lost, this marks a critical step toward stabilizing care for thousands of Virginians living with HIV,” said Equality Virginia Executive Director Narissa Rahaman. “Equality Virginia plans to continue their contact with lawmakers and delegates through the conference and up until the passing of the budget.”

“We appreciate lawmakers from both sides of the aisle who recognized the urgency of this moment and will work to ensure funding remains in the final version signed by the governor,” added Rahaman.

District of Columbia

D.C. Black Pride theme, performers announced at ‘Speakeasy’

Durand Bernarr to headline 2026 programming

The Center for Black Equity held its 2026 DC Black Pride Theme Reveal event at Union Stage on Monday. The evening, a “Speakeasy Happy Hour,” was hosted by Anthony Oakes and featured performances by Lolita Leopard and Keith Angelo. The Center for Black Equity organizes DC Black Pride.

Kenya Hutton, Center for Black Equity president and CEO, spoke following the performances by Leopard and Angelo. Hutton announced this year’s theme for DC Black Pride: “New Black Renaissance.”

Performers for 2026 DC Black Pride were announced to be Bang Garcon, Be Steadwell, Jay Columbus, Bennu Byrd, Rue Pratt and Akeem Woods.

Singer-songwriter Durand Bernarr was announced as the headliner for the 2026 festivities. Bernerr gave brief remarks through a video played on the screen at the stage.

DC Black Pride is scheduled for May 22-25. For more information on DC Black Pride, visit dcblackpride.org.