Living

Smart strategies for managing back-to-school costs

Be strategic and budget conscious when shopping

As summer winds down and back-to-school season approaches, families are gearing up for the annual shopping spree that brings fresh notebooks and sharpened pencils. However, this excitement can be overshadowed by realities of our current economy, including rising costs and inflation, impacting budgets that make essential items more difficult to afford.

According to the National Retail Federation, families with children in elementary through high school plan to spend an average of $874.68 on clothing, shoes, school supplies and electronics, the second-highest amount in the survey’s history. For Washington D.C. families, specifically, tighter budgets and cuts among school systems may equate to fewer school-supplied tools and further add to the back-to-school shopping list, putting a significant strain on family budgets.

Here are some tips to help families manage back-to-school costs effectively:

Create a budget and stick to it. Whether your child is headed to elementary or high school, having a plan and prioritizing the essential items is a crucial first step in the back-to-school process. Determine how much you have to spend and then categorize the items on your list. For instance, focus on the necessary academic supplies such as notebooks, pens, pencils and backpacks, then consider secondary items like clothes, shoes and technology. If there is excess money, you can add fun items like stickers, fancy colored pens, or the latest and greatest electronics. For high school students, look into the school’s laptop or technology program. Working with a financial adviser can help you create a comprehensive budget that covers not only back-to-school necessities but also supports effective financial planning throughout the year. They can provide insights on cost-cutting, how to make the most of your resources and identify areas where you can save, leading to a more efficient and stress-free shopping experience. It’s important to create strategies that last all year long, as there are always going to be surprises out of our control, including rising prices.

Include your children in the planning. It’s never too early to discuss finances with your children. Involving them in the budgeting process can be a valuable, educational experience, as it not only teaches them about financial planning but also helps them understand the value of money. This is also a great opportunity to discuss needs versus wants and encourage them to prioritize their needs and to understand the concept of trade-offs. For example, they might have to choose between getting a new backpack or lunchbox and reuse the one they already have from last year. These small decisions can add up and have a big impact on the overall family budget.

Take an inventory check. Before heading to the store, take stock of what you already have. Go through last year’s supplies to see what can be reused – any leftover pencils, folders, etc. Items like backpacks, binders and even clothing may still be in good condition. This simple step can significantly reduce the number of new items you need to purchase, saving money and reducing waste.

Shop strategically. Look for discounts and sales that can help stretch your budget further, such as:

Cast a broad net when you’re seeking discounts. Utilize websites, apps and browser extensions that offer coupons or cash back.

Take advantage of back-to-school sales. Plan your shopping around these dates to maximize your budget. Waiting until the last minute typically means you pay full price.

Look for generic or less expensive brands of supplies.

Buy school supplies in bulk with items used frequently like notebooks and pens.

Search for local community organizations and libraries for back-to-school supply drives.

Prepare for unexpected expenses. It’s crucial to plan for unexpected expenses that can arise throughout the school year. These might include costs for school trips, extracurricular activities or last-minute supplies, such as project materials or replacement items. Setting aside a small emergency fund dedicated to these unforeseen expenses can go a long way and teaches your children a valuable lesson in financial preparedness.

Thinking Beyond the School Year: Allocating Funds for Future Education

Saving money allows you to ultimately invest that money into your future objectives or long-term strategies. While the goal here is to manage costs of supplies that will last the duration of your student’s calendar school year, by employing strategies to save money on that shopping, you can allocate more funds toward long-term education savings plans, such as a 529 account. These savings can significantly impact your child’s future educational opportunities. Working with a financial adviser can help you create and manage these savings plans effectively.

(Nikki Macdonald, CFP, is a financial adviser at Northwestern Mutual.)

Real Estate

Pride, patriotism, and prosperity

Real estate plays role in honoring servicemembers’ legacy

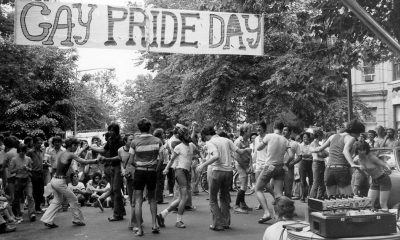

As the calendar turns to late May and early June, several powerful movements and celebrations converge in a profound and colorful tapestry of remembrance, Pride, and progress.

Memorial Day in the United States honors the sacrifices of military personnel who gave their lives in service. Simultaneously, WorldPride and Black Pride commemorate both the historical struggles and enduring strength of LGBTQ+ communities worldwide.

Though these observances may seem distinct, they share powerful commonalities — solemnity, resilience, and the pursuit of equity. When viewed through the lens of real estate and community development, their intersection reveals the critical importance of space, ownership, and inclusion.

Memorial Day is more than a barbecue, a long weekend, or the unofficial start of summer. It is a solemn remembrance of those who laid down their lives for the ideals of freedom and democracy. Many of these fallen heroes came from marginalized backgrounds, including a rainbow of LGBTQ+ Americans who served valiantly, often without recognition or equal rights at home.

LGBTQ+ service members have fought in silence for decades, only gaining the right to serve openly in recent years and then having that opportunity for some individuals snatched back simply because of who they are. Memorial Day is a chance not only to honor their service but also as a reminder of the injustices they endured.

Real estate plays a role in their legacy. For decades, returning veterans used the GI Bill to buy homes and build generational wealth; however, discriminatory practices like redlining and restrictive covenants denied Black veterans the same opportunities, contributing to the racial wealth gap that persists today. Similarly, LGBTQ+ veterans and their partners often faced housing discrimination with little legal recourse. These systemic barriers underscore how access to safe and equitable housing is part of the fight for justice.

Black Pride events emerged in response to racism within the broader LGBTQ+ movement, asserting that Black queer lives matter and deserve visibility. Held in cities across the globe, Black Pride is not just a festival — it is a political and cultural declaration. It amplifies voices at the intersection of race and sexuality, advocating for people who are disproportionately impacted by housing insecurity and gentrification.

Many urban neighborhoods that were once cultural havens for queer communities are being transformed by rising rents and redevelopment. While revitalization can bring economic opportunity, it must be done equitably, with safeguards in place to ensure that long-standing residents are not displaced. Real estate, in this context, becomes a tool for resistance and renewal.

WorldPride, a global event celebrating LGBTQ+ rights and visibility, is hosted by a different city every few years. It draws millions of participants, shines an international spotlight on LGBTQ+ issues, and highlights disparities in rights and protections worldwide. In countries where queer identities are criminalized, safe housing can be a matter of life and death.

Even in more progressive regions, LGBTQ+ individuals often face subtle yet persistent discrimination from landlords, real estate agents, and lending institutions. In the real estate industry, advocacy groups are working to increase representation, offer training, define ethical responsibilities, and advocate for inclusive policies to ensure housing is truly accessible to all.

The convergence of WorldPride with Memorial Day and Black Pride invites deeper reflection: What kind of world are we building in memory of those who came before? How can we ensure that freedom, the very principle so many fought and died for, includes the right to live openly and securely, regardless of race, gender, or sexuality?

The real estate industry has a unique role in shaping the future. From urban planning to homeownership policy, to income-based downpayment grants, it directly influences who has access to stability and opportunity.

Developers, policymakers, and community leaders must work together to address housing disparities. This includes funding affordable housing, protecting tenants from discrimination, and investing in communities that have been historically excluded. It also means respecting cultural legacies and ensuring that neighborhoods reflect the diversity of the people who live in them.

Memorial Day reminds us of the cost of freedom. International Pride events remind us that the fight for freedom is ongoing. As we honor the fallen, let us also honor the living – those who continue to fight for their right to exist, to love, and to call a place home. Whether waving a flag at a Pride parade, laying a wreath at a soldier’s grave, or signing a first-time homebuyer agreement, these moments are connected by the enduring belief that everyone deserves dignity, safety, and a place to belong.

Valerie M. Blake is a licensed Associate Broker in DC, MD & VA with RLAH @properties. Call or text her at (202) 246-8602, email her at DCHomeQuest.com, or follow her on Facebook at TheRealst8ofAffairs.

Real Estate

Tips for buying a house in Rehoboth Beach

And why it’s a great fit for the LGBTQ community

If you’ve ever dreamed of owning a charming beach house where flip-flops are considered formalwear and sunsets are your daily entertainment, Rehoboth Beach, Del., might just be your dream come true. It’s not just a beautiful coastal town—it’s also a long celebrated safe haven and vibrant hub for the LGBTQ community. Let’s dive into why Rehoboth Beach is a fabulous choice and how to make a savvy beach house purchase.

Why Rehoboth Is a Vibe (especially for the LGBTQ community)

1. A Welcoming, Inclusive Community

Rehoboth Beach has been lovingly nicknamed the “Nation’s Summer Capital,” and it’s not just because of its proximity to D.C. For decades, Rehoboth has built a reputation as a warm, inclusive, and LGBTQ-friendly destination. From gay-owned businesses to LGBTQ events and nightlife, this is a town where you can truly be yourself.

2. Packed Social Calendar

Poodle Beach, the LGBTQ beach hangout just south of the boardwalk, is always buzzing in the summer. Events like Rehoboth Beach Bear Weekend, Women’s FEST, and CAMP Rehoboth’s myriad of social and wellness events bring people together all year round. That’s right—you’ll never be bored here unless you want to be.

3. Small Town Charm Meets Big City Culture

You get art galleries, drag brunches, live theater, eclectic cuisine, and adorable boutiques—basically everything your soul craves—without the chaos and crowds of major cities. It’s quaint but never boring. Think: Key West vibes with a Delaware zip code.

Tips for Buying Your Dream Beach House

1. Know Your Budget and Think Long Term. Beachfront and near-beach properties come at a premium. Expect to pay a bit more for proximity to the sand and ocean views.

2. Choose Your Neighborhood Wisely. Do you want to be walking distance from the action on the boardwalk? Or do you prefer something more secluded in areas like North Shores or Henlopen Acres?

3. Rental Potential. If you’re not living there full time, your beach house could work overtime as a vacation rental. Rehoboth Beach has a healthy short-term rental market, especially in peak summer. Often times LGBTQ travelers actively seek inclusive, affirming places to stay.

4. Weather the Weather. Like all coastal areas, Rehoboth comes with a side of salt air and occasional storms. Invest in a good home inspection, especially for older homes, and be prepared for the maintenance that comes with beachfront living (yes, that includes sand everywhere).

5. Work With a Local Real Estate Agent. Look for an agent who knows Rehoboth inside and out and understands the unique needs of LGBTQ buyers. This isn’t just a house — it’s your happy place. You want someone who sees that and says, “Let’s find your sanctuary.”

Buying a beach house in Rehoboth Beach isn’t just about real estate — it’s about finding a space that reflects your lifestyle, values, and need for both community and calm. Whether it becomes your full-time home, your weekend escape, or your Airbnb side hustle, Rehoboth welcomes you with open arms (and maybe a mimosa).

Want personalized tips on navigating the Rehoboth Beach real estate market? Let’s chat! I’ll bring the listings if you bring the sunscreen.

Justin Noble is a Realtor with The Burns & Noble Group with Sotheby’s International Realty, licensed in D.C., Maryland, and Delaware. Reach him at [email protected] or 202-234-3344.

Real Estate

Impact of federal gov’t RIF on D.C.’s rental market

A seismic economic change for local property owners

In a move that could redefine the federal government workforce and reshape the economic fabric of Washington, D.C., President Donald Trump has announced his intentions to significantly reduce federal government spending as well as the number of people the federal government employs.

Calling the federal bureaucracy “bloated” and “out of control,” Trump has repeatedly expressed his desire to cut thousands of federal jobs. While these cuts align with his long-standing push to “drain the swamp,” they come with potential and real collateral damage, especially for landlords in the D.C. area who have relied on government employees as some of their most reliable and long-term tenants.

The potential reduction of thousands of jobs in a city built around government work is not just a political shift—it’s a seismic economic change for the city government as well as for local property owners who have invested in the predictability of a near-constant demand for workers in the federal government agencies, government contractors and the economic ecosystem they sustain.

For landlords, government workers have represented ideal tenants: strong income, long-term leases, and responsible rental histories. Now, that foundation is being shaken in a battle by the Administration against a workforce which is the backbone of the Washington area’s overall economy, and especially its rental market.

With uncertainty looming, landlords are left in a difficult position. If widespread layoffs come to fruition, rental vacancies could spike, rental prices would drop, and previously secure investment properties might become financial liabilities. The sudden shift forces landlords to consider their next moves: how to support tenants facing job losses, how to adapt to a changing market, and how to ensure their own financial stability amid the uncertainty.

For D.C. landlords, this isn’t just about policy shifts or budget cuts, it’s about economic livelihood. The challenge ahead isn’t about just reacting to change, but proactively preparing for it, ensuring they can weather the storm of political maneuvering.

Potential Consequences for D.C. Landlords

- 1. Increased Risk of Non-Payment of Rent

- Job losses may lead to late or missed rent payments

- As affected tenants struggle financially, they may ask to break their lease to live elsewhere or even move out of the region

- Eviction lawsuits may rise, leading to a long and expensive process for landlords, all while not being able to rent their property to paying tenants.

- 2. Higher Vacancy Rates

- If many government employees leave the D.C. region in search of work elsewhere, the rental demand could decline significantly

- Rental properties may sit empty longer, requiring landlords to lower rents to attract new tenants and creating even more financial loss

3. More Competition from Other Landlords

- As many more units are vacant on the market, all competing for the same pool of potential tenants, older and smaller rentals, and those located further out from the core of the city will all struggle to find quality renters.

- Landlords will need to offer other ways to attract and retain tenants, such as incentives, which could quickly overwhelm the finances of smaller landlords who cannot keep up.

Proactive Strategies for Landlords

To mitigate risks and ensure future rental success, landlords should consider these defensive measures:

1. Strengthen Tenant Relationships and Communication

- Encourage tenants to communicate if they anticipate financial hardship due to job loss.

- Work out temporary payment plans or partial payments to prevent full non-payment or eviction.

- Provide guidance on rental assistance programs available in D.C.

2. Offer Flexible Lease Terms

- Consider shorter-term leases than a full 12-month term to accommodate the needs of tenants who may be uncertain about their long-term employment status.

- Offer lease renewals at the same rent amount to keep stable tenants and avoid turnover

3. Diversify Tenant Base

- If a large portion of tenants are government workers, a landlord may want to market to a broader audience or professionals in private industries.

- Advertise on platforms that cater to diverse tenant pools, including students and international workers.

4. Adjust Screening Criteria Thoughtfully

- While it’s important to ensure financial stability, consider creditworthiness, assets, and rental history rather than just employment status.

- Consider alternative income sources, like family members assisting, part-time work or freelance gigs.

5. Protect Cash Flow with Rent Guarantee Options

- Explore rental insurance policies or rent guarantee services to cover losses in case of non-payment.

- Consider co-signers or guarantors on leases for new tenants in vulnerable industries, just in case.

6. Adjust Rental Pricing to Stay Competitive

- Monitor the D.C. rental market and adjust pricing accordingly to attract new tenants.

- Consider offering move-in incentives as a way to stand out. Be creative! Sometimes things you can offer are different and may catch someone’s eye

Long-Term Planning for Rental Success

- Build reserves to cover expenses during potential vacancies or rent shortfalls.

- Invest in property upgrades to make rentals more attractive to a broader audience, such as young professionals or remote workers.

- Consider diversifying property holdings to include areas that are less reliant on government employment.

By taking proactive steps, landlords can safeguard their investments while supporting tenants through economic uncertainty, ultimately leading to a more stable and resilient rental business.

Scott Bloom is owner and senior property manager at Columbia Property Management. For more information, visit ColumbiaPM.com.