Local

From the ashes, a new Blade

1 year later, details emerge in former parent company’s collapse

Blade publisher Lynne Brown, with mic, speaks at a Blade re-launch party in April. Co-owner and editor Kevin Naff is at left. The paper had continued publishing since it was shuttered last November but used the name DC Agenda for a few months. (Blade file photo)

The U.S. Small Business Administration filed a court motion last December giving its approval of a bankruptcy filing by Window Media, the company that owned the Washington Blade, resulting in the shutdown of the Blade after a 40-year run as an LGBT newspaper, according to court documents.

But in an unexpected turn of events, the dissolution of Window Media through its Chapter 7 bankruptcy wiped out its enormous debt to creditors, clearing the way for Blade employees to form a new company that purchased the Blade’s name and remaining assets from the bankruptcy court debt-free and at a bargain price.

One year after the Blade shutdown on Nov. 16, 2009, and six months after its resurrection, court documents and new information disclosed by sources familiar with Window and its parent company, Avalon Equity Fund, provide a dramatic glimpse into the final days of a collapsing gay media conglomerate.

Among the revelations was the dismaying discovery by the Blade’s new owners that the paper’s electronic archives — which made all of its content going back to about 2001 accessible online — were erased after Window stopped paying its bills to a company that stored the data on rented servers.

“Like any customer, they were delinquent in their payment,” said Kevin Soendker, chief operating officer of the Natick, Mass., based Inet Services. “The service was cancelled and the servers were repurposed,” he said, acknowledging that the data was erased.

The Blade’s new owner, Brown Naff Pitts Omnimedia, Inc., announced this week that it is launching non-profit foundation to raise money to pay for digitizing all back issues of the Blade and to make them accessible to the public.

Although the electronic archives were erased, all printed copies of the Blade going back to its first issue in October 1969 have been preserved and are in the Blade’s possession.

Also emerging within the past week are separate accounts by a top SBA official and Window’s former co-president and chief operating officer, Mike Kitchens, of frantic, behind-the-scenes discussions last summer and fall over whether the Blade and other newspapers owned by Window should be sold to bidders — including a group of former Blade employees — or whether the company should be dissolved in bankruptcy.

Thomas Morris, director of the SBA’s Office of Liquidation, said the SBA played no role in Window’s ultimate decision to declare bankruptcy. But he said the SBA joined Window in filing a Dec. 10, 2009 stipulated motion before a federal court in New York asking the court to retroactively agree to the bankruptcy that Window filed 20 days earlier in Atlanta.

The SBA’s involvement with Avalon and Window stems from its decision in 2008 to obtain a court order forcing Avalon Equity Fund into receivership after Avalon defaulted on $38 million in loans from the SBA. With the SBA placed in full control of Avalon through the receivership ordered by the U.S. District Court for the Northern District of New York, SBA also played a key role in Window’s affairs. Avalon, then under the control of the SBA, owned 75 percent of total equity in Window Media.

U.S. District Court Judge Peter K. Leisure included in his original Avalon receivership order, which he handed down Aug. 21, 2008, a directive that neither Avalon nor any of its assets, including companies it controlled, could declare bankruptcy without the court’s advance approval. Leisure approved the Dec. 10, 2009 motion backed by the SBA, clearing the way for the Window bankruptcy to move forward.

The bankruptcy and sudden shutdown of the Blade and several other publications owned by Window Media stunned the Blade staff and the D.C. gay community. Blade publisher Lynne Brown, who is part of the group that bought the Blade’s assets from the bankruptcy court, said she and the Blade’s managers and staff learned of the Avalon receivership in August 2008.

She said SBA officials working on the Avalon receivership told her in early 2009 the SBA was taking steps to sell Avalon’s and Window’s assets and publications, including the Blade. A short time later, Brown joined the Blade’s editor, Kevin Naff and senior sales executive Brian Pitts to form a group that submitted a bid to buy the Blade out of receivership.

The SBA organized the bidding process on Window’s behalf and encouraged others to submit bids. Among those who submitted a competing bid was gay rights advocate Nicholas Benton, publisher of the Falls Church, Va., News Press.

Benton, like Brown and Naff, expressed shock and anger when Window announced on Nov. 16, 2009 that it was declaring bankruptcy and shutting down all of its operations rather than sell its papers through the SBA bidding process.

The shutdown immediately eliminated the jobs of the Blade’s 24-member staff. In a development that drew extensive media coverage, Window co-presidents Kitchens and Steve Meyers appeared at the Blade’s offices in the National Press Building on Monday morning, Nov. 16, to announce the shutdown. The two directed all employees to retrieve their personal possessions, clear out their desks, and leave the premises by 3 p.m. that day when the office was to be shuttered.

Before leaving, however, most employees joined Brown, Naff and Pitts in vowing to band together to form a new publication — with the first fledgling edition to come that Friday, just four days later, when the Blade would have hit the streets had it not been shut down.

“We wanted to show the world we weren’t going away and that we could produce a paper without missing a beat,” Naff said.

Displaced Blade staff planning an early issue of DC Agenda at temporary office space above Results on U Street last December. From left are Lou Chibbaro, former news editor Joshua Lynsen and Kevin Naff. (Blade file photo)

Not knowing if they would ever be able to obtain the Blade’s name, the staff met the following morning at a café in the National Press Building lobby to plan a new paper, which they decided to name the DC Agenda.

While Naff and the now volunteer reporters and editors planned stories for the new paper, Brown and Pitts scrambled to line up advertisers and a printer. To the surprise and acclaim of many in the LGBT community, the first edition of the eight-page newsletter-style DC Agenda appeared at many of the Blade’s distribution locations on Friday, Nov. 20.

In subsequent weeks and months, the Agenda expanded its pages and evolved into a tabloid newspaper similar to the Blade.

Meanwhile, Brown Naff Pitts Omnimedia, Inc., the company formed by the Blade’s former publisher, editor and sales executive, responded to an offer by the Window bankruptcy court for bids on the Blade’s assets, which included the Blade’s name.

“We didn’t know who or what we were up against,” Brown said.

She noted that the new company was seeking investors and advertisers but didn’t have a huge amount of capital to compete with a large company or wealthy individual that might submit a competing bid.

As it turned out, no one else submitted a bid. Media observers said the economic recession and the longstanding decline in the print media industry may have discouraged investors from seeking to buy and restart the Blade. In addition, with the Blade’s former staff having started a new D.C. LGBT community newspaper, the Agenda, the value of buying the Blade’s assets — consisting only of used office equipment, the paper’s printed archives and its name — may not have been appealing to investors or other potential buyers, according to some media industry observers.

The lack of competing bids resulted in Brown Naff Pitts Omnimedia obtaining the Blade assets for $15,000.

Morris, the SBA’s liquidation office director, disclosed this week that the Buffalo, N.Y., based M&T Bank may have been responsible for scuttling the initial plans by the SBA and Window to sell its assets rather than go the route of bankruptcy.

When the financially troubled Window defaulted on a loan of close to $1.3 million from M&T, the bank became the No. 1 secured creditor or lien holder, Morris said. In that role, M&T would not agree to a proposal by the SBA that it initiate a foreclosure on Window Media, a legal status that would allow a potential buyer of any of Window’s assets like the Blade to be free from liability for Window’s debts.

An interested party would still be allowed to buy the Blade but they would most likely decline to do so if they had to assume Window’s debt, Morris said.

“Once that fell through, we had no viable alternative plan, and without one we would not have won a challenge to the bankruptcy filing,” Morris told the Blade in an e-mail.

The SBA could have asked the receivership judge to stop the bankruptcy and, as a federal district court judge, he likely had authority to do so, Morris said.

“But our conclusion at that time was that M&T was owed more than the company was worth,” Morris said.

He said that meant that no other creditors, including Avalon, which was Window’s largest creditor, would recoup any funds through the sale of Window’s assets. Window owed Avalon close to $5 million.

Thus he said the receivership judge would most likely have rejected an SBA motion to challenge the Window bankruptcy.

Kitchens said resignations of members of Window’s board of directors resulted in just he and Window co-president Steve Meyers as the only remaining board members during the months prior to the bankruptcy filing. According to Kitchens, the company’s operating rules required at least three board members for a quorum to make any important decisions such as the sale of assets.

He said the SBA could have named someone to the board, which may have allowed the board to vote to approve the sale of the Blade and other papers to those who had submitted bids before the bankruptcy filing.

“They should have taken places on the board, but they didn’t,” he said of the SBA.

Morris disputed that assertion, noting that Kitchens and Myers managed to approve the bankruptcy. He said he is not aware of any reason why they couldn’t have found a board member to approve a sale of the assets if they wanted to pursue that option.

As the SBA proceeded with receivership, it reached out to potential buyers, including Chris Crain and William Waybourn, who founded Window Media in 1996. The two left Window Media in 2006 in a shakeup of the company by Avalon’s founder and chief operating officer David Unger, who secured full control of Window in 2001.

Crain said the SBA never responded to his and Waybourn’s request for financial information about the company; they declined to submit a bid.

Lynne Brown addresses Blade staffers in a coffee shop in downtown Washington the day after Window Media closed the paper last November. (Blade file photo by Joey DiGuglielmo)

Blade’s fate tied to Window’s rise and fall

Waybourn and Crain’s interest in returning as Blade owners would likely have created an uproar among some gay activists and media commentators, who blame the two for setting in motion the events that led to the Blade’s demise.

The two strongly dispute those claims, saying the fall of Window Media and the gay newspapers and glossy entertainment publications the company acquired over the years was due to circumstances beyond their control.

Crain, a lawyer in private practice, joined Waybourn, a gay activist and businessman, in founding Window Media in 1996. The two have said their intent was to create an LGBT newspaper chain that would strengthen LGBT publications through the economic benefit of consolidation of resources.

Critics, however, have said consolidation of LGBT publications under ownership of a single company hurt the community by eliminating a diversity of voices and independent regional news coverage.

The company’s first move was the 1997 acquisition of Southern Voice, an Atlanta gay paper. In the next few years, Window bought gay papers in Houston and New Orleans and acquired smaller gay entertainment magazines in other cities.

The Blade, which was founded as the Gay Blade in 1969 by local gay activists, evolved from a fledgling newsletter style publication put together in the homes of its volunteer editors, into what many have called the LGBT community’s newspaper of record.

Gay activist and businessman Don Michaels, who became publisher in the late 1970s, has been credited with transforming the Blade into a thriving business as well as a well-respected news publication.

Window Media bought the Washington Blade and the New York Blade, which Michaels founded in the 1990s, in 2001, when Michaels made plans to sell the papers and retire. All parties declined to disclose the sale price, but sources have said it exceeded $3 million.

Chris Crain, right, chats with Kevin Naff, left, and Lou Chibbaro in the Blade newsroom in 2009. Crain was no longer associated with the paper at the time but came to see the then-new offices at the National Press Club. (Blade file photo by Joey DiGuglielmo)

Crain said this week that although Window Media had been financed by many small investors, it hooked up with Avalon Equity Fund — a multimillion dollar investment company — to provide the main financing for the purchase of the Washington Blade and New York Blade. He said the financing arrangement made Avalon the majority shareholder in Window Media at the time of the closing of the sale of the two Blades in May 2001.

But he noted that while Avalon had legal control of Window at that time, it allowed Crain and Waybourn to run the company and make all key decisions up until January 2006, when Waybourn left the company. At that time, Avalon’s founder and managing partner, David Unger, named one of his top Avalon lieutenants, Peter Polimino, as Waybourn’s replacement as Window president.

In September 2006, Crain left the company, amid speculation that both he and Waybourn had been ousted by Unger over sharp disagreements on how the company and its newspapers should be run.

Waybourn stated at the time of his departure that he decided to retire after completing what he said was the creation and operation of a successful LGBT newspaper chain. Sources familiar with Window, however, said Waybourn left the company due to irreconcilable disagreements with Unger over Unger’s management style and plans for acquiring more publications at the risk of assuming greater debt.

Crain said it was his decision to leave the company over a dispute that arose over Avalon’s decision to abolish Crain’s position of editorial director of all the Window publications and to hire individual editors at each of the Window papers.

Waybourn, who declined to comment this week on Window’s finances, has said in the past that the company acquired more debt than it had planned for over circumstances beyond its control. He noted that the Sept. 11, 2001 terrorist attacks on the World Trade Center and Pentagon led to a sharp drop in advertising sales due to a slump in the economy.

He noted that a decision by Blade employees to attempt to form an employee union the week Window assumed ownership of the Blade forced Window to spend at least $100,000 to fight the union. The union effort failed after a tense campaign and employee election supervised by the National Labor Relations Board.

The union fight was followed by the start of the current economic recession that further cut into Window’s revenue from advertising sales, Waybourn said at the time.

All of this made it necessary for Window to obtain additional cash infusions from Avalon, which resulted in Avalon increasing its ownership share of Window until it reached a 75 percent equity level, company sources have said.

The sources say Waybourn insists Window remained profitable despite these developments as of the time Waybourn left the company in 2006.

Unger declined to comment for this story when contacted by the Blade.

The SBA receivership documents filed in federal court in New York, where Avalon was based, show that the multimillion dollar investment company went into financial decline due to the failure of many of the media and cable TV companies it helped to finance in the years leading to 2008, when it defaulted on a series of loans the SBA extended to it that exceeded $38 million.

Under receivership, the SBA is charged with liquidating all of Avalon’s remaining assets.

The SBA’s Morris said Unger was ousted from his position as Avalon’s CEO in August 2008, when the SBA assumed full control under the receivership. But Morris said the SBA retained Unger as a paid member of Window Media’s board of directors up until June 2009, when he resigned from that post.

Gay rights attorney Bill Dobbs of New York, a longtime observer of the LGBT press, said Window Media’s decision to file for bankruptcy and close the papers it owned had an impact on the broader LGBT community.

“Gay newspapers are not just businesses — they’re a circulatory system for news, information and political discussion,” he said. “Even in the Internet age they play a key role. Perfectly solid local newspapers were gobbled up by Window Media who claimed bigger was better. They were wrong as some of us warned,” Dobbs said. “Concentrated ownership of media in a minority community has special perils. Window/Avalon dragged all those papers down to failure — a community disaster.”

Waybourn, however, has said some of the papers Window sought to buy were faltering due to lack of resources by their community-based publishers. He said his objective — at the time he controlled Window — was to strengthen the local papers by pumping in resources.

District of Columbia

Billy Porter, Keke Palmer, Ava Max to perform at Capital Pride

Concert to be held at annual festival on June 9

The Capital Pride Alliance, the group that organizes D.C.’s annual LGBTQ Pride events, announced this week the lineup of performers for the Sunday, June 9, Capital Pride Concert to be held during the Capital Pride Festival on Pennsylvania Avenue, N.W. near the U.S. Capitol.

Among the performers will be nationally acclaimed singers and recording artists Billy Porter and Keke Palmer, who will also serve as grand marshals for the Capital Pride Parade set to take place one day earlier on Saturday, June 8.

The Capital Price announcement says the other lead performers will be Ava Max, Sapphira Cristal, and the pop female trio Exposé.

“The beloved pop icons will captivate audiences with upbeat performances coupled with their fierce advocacy for LGBTQ+ rights, echoing the vibrant spirit of this year’s theme, ‘Totally Radical,’” according to a statement released by Capital Pride Alliance.

“With Billy Porter and Keke Palmer leading the parade as Grand Marshals, we’re not only honoring their incredible contributions to the LGBTQ+ community but also amplifying their voices as fierce advocates for equality and acceptance,” Capital Pride Alliance Executive Director Ryan Bos said in the statement.

“The concert and festival serve as a platform to showcase the diverse array of LGBTQ+ talent, from the chart-topping hits of Ava Max to the iconic sounds of Exposé and the electrifying performances of Sapphira Cristal,” Bos said in the statement. “Capital Pride 2024 promises to be a celebration like no other.”

The concert will take place from 12-10 p.m. on the main stage and other stages across the four-block long festival site on Pennsylvania Avenue.

Arts & Entertainment

Washington Blade’s Pride on the Pier and fireworks show returning June 8

The annual Pride on the Pier Fireworks Show presented by the Leonard-Litz Foundation will take place on Saturday, June 8 at 9 p.m.

The Washington Blade, in partnership with LURe DC and The Wharf, is excited to announce the 5th annual Pride on the Pier and fireworks show during D.C. Pride weekend on Saturday, June 8, 2024, from 2-10 p.m.

The event will include the annual Pride on the Pier Fireworks Show presented by the Leonard-Litz Foundation at 9 p.m.

Pride on the Pier extends the city’s annual celebration of LGBTQ visibility to the bustling Southwest waterfront with an exciting array of activities and entertainment for all ages. The District Pier will offer DJs, dancing, drag, and other entertainment. Alcoholic beverages will be available for purchase for those 21 and older. Local DJ’s Heat, Eletrox and Honey will perform throughout the event.

3 p.m. – Capital Pride Parade on the Big Screen

3:30 p.m. – Drag Show hosted by Cake Pop!

9 p.m. – Fireworks Show Presented by Leonard-Litz Foundation

The event is free and open to the public. The Dockmasters Building will be home to a VIP experience. To learn more and to purchase tickets go to www.prideonthepier.com/vip. VIP tickets are limited.

Event sponsors include Absolut, Buying Time, Capital Pride, DC Brau, DC Fray, Burney Wealth Management, Infinate Legacy, Leonard-Litz Foundation, Mayor’s Office of LGBTQ Affairs, MISTR, NBC4, The Wharf. More information regarding activities will be released at www.PrideOnThePier.com

Maryland

Trone discusses transgender niece

Blade interviewed Md. congressman, Angela Alsobrooks last week

Editor’s note: The Washington Blade last week interviewed both U.S. Rep. David Trone (D-Md.) and Prince George’s County Executive Angela Alsobrooks. The full interviews with both Democratic candidates for retiring U.S. Sen. Ben Cardin (D-Md.)’s seat will be on the Blade’s website later this week.

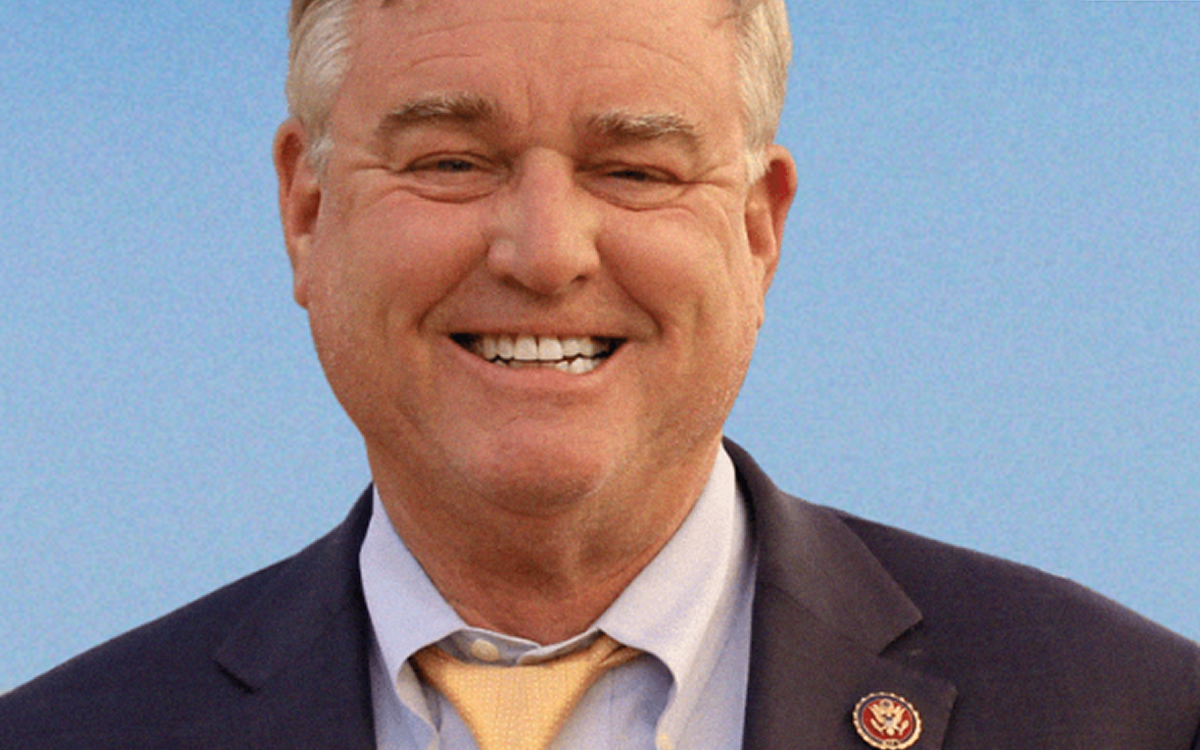

Maryland Congressman David Trone last week discussed his transgender niece during an interview with the Washington Blade about his U.S. Senate campaign.

Trone, who is running to succeed retiring U.S. Sen. Ben Cardin (D-Md.), on May 1 told the Blade during a telephone interview that his niece transitioned when she was in her early 20s. Trone also noted she attended Furman University, a small, liberal arts university in Greenville, S.C.

“I was concerned about how she would be able to transition there,” said Trone.

Trone, who founded Total Wine & More, attended Furman University as an undergrad and is on the school’s board of trustees. Trone told the Blade he donated $10 million to the university to “build out their mental health capacity, which I felt was a way that she could have the best mental health care possible when she worked her way through (her) transition.”

Trone’s niece graduated from the university after she spent five years there.

“She had a great relationship with Furman,” said Trone.

Trone and Prince George’s County Executive Angela Alsobrooks are the leading Democrats running to succeed Cardin. The winner of the May 14 Democratic primary will face former Maryland Gov. Larry Hogan in November.