Financial

Local news in brief

Home intruder gets 26 years for targeting male students & more

Home intruder gets 26 years for targeting male students

A 24-year-old Virginia man has been sentenced to 26 years in prison for a series of burglaries and assaults against male students living in Georgetown University’s off-campus residences.

The sentence, handed down March 12, came after a D.C. Superior Court jury found Todd Thomas guilty of 11 offenses, including one count of fourth-degree sexual abuse under aggravating circumstances and two counts of simple assault.

The simple assault charges involved separate incidents in which police and prosecutors said one male student awoke to find Thomas massaging his shoulders and another awoke while Thomas was massaging his ankles. Police said the incidents occurred when the two male students were asleep in their living room in the same house on different days.

In another incident, Thomas allegedly entered a residence on the 1200 block of 33rd Street, N.W., and “sexually assaulted a victim who was sleeping in a bed in his second-floor bedroom,” the U.S. Attorney’s office said in a statement announcing the sentencing.

The U.S. Attorney’s office said all of the offenses occurred between July 2007 and August 2008.

LOU CHIBBARO JR.

Lesbian & Gay Chorus to cease operations

The Lesbian & Gay Chorus of Washington is indefinitely suspending its performances and operations following a final concert on June 20.

“After 26 years as a grass-roots community chorus, [we] will be taking an indefinite break from rehearsing and performing,” says a statement from the organization. “LGCW’s concert on June 20, 2010, will be the chorus’s last performance for the foreseeable future.

“Facing challenges from decreasing membership, revenue and resources, current members made the difficult decision to cease LGCW’s traditional choral operations following the June concert.

“As a non-auditioned, consensus-based chorus, LGCW has changed the lives of countless people in the D.C. area and beyond,” says the statement. “The chorus has been a reliable presence at social justice events around the metro area, including Capitol Pride, the March for Women’s Lives, and the D.C. Vote Rally; raised thousands of dollars for a number of local and national charities; and was the first lesbian and gay chorus to produce a CD.”

Paul Heins, the organization’s music director, said the group will retain its structure, including its tax exempt status, in the event a new group of participants chooses to resume its activities.

“I think there will be a way to bring it back, but it will be different,” he said. “I think some will say, ‘OK, now that it’s 2010, how can we rebrand it to meet today’s needs and funding goals and membership’ and all that.”

The chorus’s remaining three performances include the April 23-24 performances of “Just Married: The Musical” at Capitol Hill Arts Workshops; a June 12 preview performance Hillwood Museum & Gardens of the final concert; and the final concert, “The LGCW Farewell Concert: Our Love Song to You,” on June 20 at Capitol Hill Presbyterian Church.

LOU CHIBBARO JR.

Gay chamber celebrates 20th year

The Capitol Area Gay & Lesbian Chamber of Commerce will recognize a “diverse group of local business and community leaders” as it celebrates its 20th anniversary April 9 at the Mandarin Oriental Hotel.

Among those to be honored is gay businessman David von Storch, who will receive the group’s business excellence award. Von Storch opened the Capital City Brewing Company restaurant and Vida Fitness health spas.

Also receiving honors is Cathy Renna, who’s set to receive the group’s business leadership award for her role as managing partner of Renna Communications, a public relations firm. Thomas Sanchez will receive the emerging entrepreneur award for his work as a web strategist and founder of the web development and strategy firm Wamwaw LLC.

Jonathan Blumenthal, co-founder and president of Burgundy Crescent Volunteers, a 4,000-member local volunteer organization for LGBT-related causes, will received the volunteer of the year award.

Bob Summersgill, a longtime local LGBT rights and Democratic Party activist, will receive the community advocacy award. Also honored will be Wachovia, which will be recognized as corporate partner of the year for serving as a “longtime champion of the local LGBT community.”

LOU CHIBBARO JR.

Real Estate

What property should I purchase if I’m not sure how long I’ll be in D.C.?

Row homes, English basements and more options abound

Great question! If you are looking at real estate as an investment – two great property types to look at would be a smaller row home and also a row home that has an English basement. Some property types that you might want to stay away from would be a condo or a co-op unit. Let’s take a look at why these properties would be good and bad:

Smaller Row Home

Row homes are a great investment for many reasons. You can often find smaller two-bedroom row homes in the same price point as those of a two-bedroom condo, which might be seen as a “condo alternative” and afford you much more freedom. There are no condo associations or home owner associations that you must belong to so this keeps your monthly carrying costs on the lower end and you are allowed to make more independent decisions. For example, if you wanted to paint the house purple – in most cases you would be allowed to. If you wanted to change the color of the front door or put shutters on the windows – you would be allowed to. This is usually not the case with condo or co-ops.

When it comes to the rental market – similarly renters like the independence of privacy in a home and not being among many other people. The luxury of perhaps direct off-street parking, outdoor space or even just more space at the same rental amount that a two bedroom condo rent would be – this is more appealing for a renter and would likely rent faster than that of a condo or co-op. For this model – you would obviously need to move out before you could take advantage of the investment of this type of real estate.

A row home with an English basement

With this type of real estate you can immediately begin receiving income after your purchase. You can occupy the upstairs of the row home, which is usually the larger portion of the home, or you could even occupy the basement, which is usually the 1-2 bedroom smaller portion of the home and receive rental income for the other half of the home. This can be in the way of a yearly traditional tenant or in the manner of short-term rentals (check with the most recent STR policies within the District). With this model, you stand to make even more of a return on your investment upon your move out of the home as you can rent the entire home or you can rent the top unit and basement unit independently to gross a larger amount of income. It is important to note that it is never advised to purchase a row home unless you can fully afford it WITHOUT the idea of accepting additional rental income to offset the mortgage cost.

These two options listed above are the most typical found within the District because they are fee simple, standalone pieces of real estate and are not within a condo association, HOA, or a co-op with governing documents that tell you what you can and cannot do which makes row homes an attractive type of real estate for a long-term hold.

When looking at types of properties that you might want to stay away from – condos and co-ops come to mind and I say this with a caveat. You can surely purchase these types of real estate but must first understand the in’s and out’s of their governing documents. Condos are bound by the governing condominium documents which will tell you for how long your lease must be, a minimum of lease days, you can only rent after you have lived in the residence for a number of years, likely will stipulate no transient housing – which means no short term rentals. It could also quite possibly say that you can only rent for a specific amount of time and lastly it will also stipulate that only a specific amount of people can rent at one time in order to stay below the regulated lending requirements set forth by Fannie and Freddie Mac. Similarly, Co-ops are even more strict – they can tell you that you are just not able to rent at all or if you can you can only do so for a specific number of years and then you are required to sell or return back to the unit as your primary residence.

As you can see, when it comes to condos and co-ops there are more specific and stringent bylaws that owners must agree to and follow that limit or even outlaw your ability to rent your piece of real estate. When you purchase a row home – there are no regulations on what you can and cannot do regarding rentals (outside of the short-term regulations within the District).

When looking for a piece of real estate in the District it is important to think through how long you could possibly wish to hold onto this property and what the future holds. If you think this is a long-term hold then you might consider a row home option – again, you can find a smaller two-bedroom row home that amounts to that price similar to a two-bedroom condo and would afford you a more flexible lifestyle. It’s important to work with a real estate agent to ensure that they guide you in this process and help answer any questions you might have. It’s also always advised to speak directly to a short-term rental specialist should you wish to go down that route as they will truly understand the in’s and out’s of that marketplace.

All in all, there are specific property types that work for everyone and within the District we have a plethora of options for everyone.

Justin Noble is a Realtor with Sotheby’s International Realty licensed in D.C., Maryland, and Delaware for your DMV and Delaware beach needs. Specializing in first-time homebuyers, development and new construction as well as estate sales, Justin provides white glove service at every price point. Reach him at 202-503-4243, [email protected] or BurnsandNoble.com.

Real Estate

The rise of virtual home tours

Adapting to changing consumer preferences in spring real estate

In today’s dynamic real estate market, the spring season brings not only blooming flowers but also a surge of activity as buyers and sellers alike prepare to make their moves. However, in recent years, there’s been a notable shift in how consumers prefer to explore potential homes: the rise of virtual tours.

For the LGBTQ community, these virtual experiences offer more than just convenience; they provide accessibility, safety, and inclusivity in the home buying process.

Gone are the days of spending weekends driving from one open house to another – unless that’s your thing of course, only to find that the property doesn’t quite match expectations. With virtual tours, you can explore every corner of a home from the comfort of your own space – find something interesting? Schedule a showing with any LGBTQ Realtor at GayRealEstate.com.

This is particularly significant for LGBTQ individuals, who may face unique challenges or concerns when attending in-person showings. Whether it’s the ability to discreetly view properties without fear of discrimination or the convenience of touring homes located in LGBTQ-friendly neighborhoods across the country, virtual tours offer a sense of empowerment and control in the home buying process.

Moreover, virtual tours cater to the diverse needs of the LGBTQ community. For couples or families with busy schedules or those living in different cities or states, these digital walkthroughs provide a convenient way to view properties together without the need for extensive travel. Additionally, for individuals who may be exploring their gender identity or transitioning, virtual tours offer a low-pressure environment to explore potential living spaces without the added stress of in-person interactions.

At GayRealEstate.com, we understand the importance of adapting to changing consumer preferences and leveraging technology to better serve our community. That’s why our agents offer an extensive selection of virtual tours for LGBTQ individuals and allies alike – visit our website, choose an agent and within minutes you’ll have access to the Multiple Listing Service (MLS) via their website.

From cozy condominiums in bustling urban centers to sprawling estates in picturesque suburbs, virtual tours showcase a wide range of properties tailored to diverse tastes and lifestyles.

In addition to virtual tours, GayRealEstate.com provides comprehensive resources and support to guide LGBTQ buyers and sellers through every step of the real estate journey. Our network of LGBTQ-friendly agents is committed to providing personalized service, advocacy, and representation to ensure that all individuals feel respected, valued, and empowered throughout the process. Plus, we are happy to provide a free relocation kit to any city in the USA or Canada if you are a home buyer.

As we embrace the spring season and all the opportunities it brings in the real estate market, let’s also celebrate the power of virtual tours to revolutionize the way we find and experience our future homes. Whether you’re searching for your first apartment, forever home, or investment property, GayRealEstate.com is here to help you navigate the exciting world of real estate with confidence, pride, and inclusivity.

Jeff Hammerberg is founding CEO of Hammerberg & Associates, Inc. Reach him at [email protected].

Real Estate

Boosting your rental property’s curb appeal

Affordable upgrades to attract and keep tenants happy

In the District of Columbia, the rental market tends to open up significantly during the springtime for several reasons. First, spring brings about a sense of renewal and change, prompting many individuals and families to seek new living arrangements or embark on relocations. Additionally, the warmer weather and longer daylight hours make it more conducive for people to explore housing options, attend viewings, and make decisions about moving. Furthermore, spring often coincides with the end of academic terms, leading to an influx of students and young professionals entering the rental market.

Landlords and property managers also tend to schedule lease renewals or list new vacancies during this time, capitalizing on the increased demand and ensuring a steady turnover of tenants. In the competitive world of rental properties, attracting and retaining quality tenants can be challenging. However, with some strategic upgrades, property owners can significantly enhance their units’ appeal without breaking the bank. From enhancing curb appeal to interior upgrades, here are some practical and cost-effective ideas to make your rental property stand out in the market.

Curb appeal

First impressions matter, and curb appeal plays a crucial role in attracting potential tenants. Simple enhancements like freshening up the exterior paint, adding potted plants or flowers, and ensuring a well-maintained lawn can instantly elevate the property’s appearance. Installing outdoor lighting not only adds charm but also enhances safety and security.

Interior upgrades

Upgrade the kitchen and bathroom fixtures to modern, energy-efficient options. Consider replacing outdated appliances with newer models, which not only appeal to tenants but also contribute to energy savings. Fresh paint and updated flooring can transform the look of a space without a hefty investment. Additionally, replacing worn-out carpets with hardwood or laminate flooring can make the unit more attractive and easier to maintain.

Enhance storage

Maximize storage options by installing built-in shelves, cabinets, or closet organizers. Tenants appreciate ample storage space to keep their belongings organized, contributing to a clutter-free living environment.

Improve lighting

Brighten up the interiors by adding more lighting fixtures or replacing old bulbs with energy-efficient LED lights. Well-lit spaces appear more inviting and spacious, enhancing the overall ambiance of the rental unit.

Upgrade window treatments

Replace outdated curtains or blinds with modern window treatments that allow natural light to filter in while offering privacy. Opt for neutral colors and versatile styles that appeal to a wide range of tastes.

Focus on security

Invest in security features such as deadbolts, window locks, and a reliable alarm system to ensure the safety of your tenants. Feeling secure in their home is a top priority for renters, and these upgrades can provide meaningful, genuine peace of mind.

Enhance outdoor spaces

If your rental property includes outdoor areas like a patio or balcony, consider sprucing them up with comfortable seating, outdoor rugs, and potted plants. Creating inviting outdoor spaces expands the living area and adds value to the rental property.

As landlords, investing in the enhancement of your rental properties is not merely about improving aesthetics; it’s about investing in the satisfaction and well-being of your tenants, and ultimately, in the success of your investment. By implementing these practical and affordable upgrades, you’re not only increasing the desirability of your units but also demonstrating your commitment to providing a high-quality living experience.

These efforts translate into higher tenant retention rates, reduced vacancy periods, and ultimately, a healthier bottom line. Moreover, by prioritizing the comfort, safety, and happiness of your tenants, you’re fostering a sense of community and trust that can lead to long-term relationships and positive referrals. So, let’s embark on this journey of transformation together, turning rental properties into cherished homes and landlords into valued partners in creating exceptional living spaces.

Scott Bloom is owner and Senior Property Manager of Columbia Property Management. For more information and resources, visit ColumbiaPM.com.

-

The White House2 days ago

The White House2 days agoEXCLUSIVE: White House Press Secretary Karine Jean-Pierre on speaking out and showing up

-

Middle East2 days ago

Middle East2 days agoTel Aviv authorities cancel Pride parade

-

Maryland4 days ago

Maryland4 days agoTrone discusses transgender niece

-

The White House3 days ago

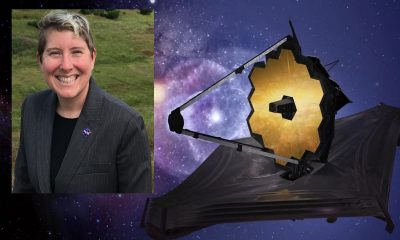

The White House3 days agoJane Rigby awarded Presidential Medal of Freedom