Living

Service chiefs: ‘Don’t Ask’ repeal proceeding smoothly

Military leaders testify before House committee Thursday

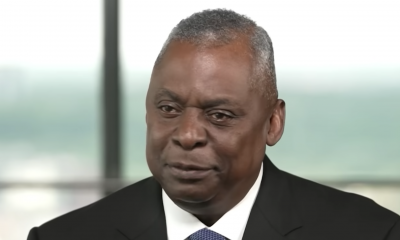

Gen. Norton Schwartz, chief of staff of the U.S. Air Force, at Thursday's hearing. (Blade photo by Joey DiGuglielmo)

The military service chiefs testified on Thursday that “Don’t Ask, Don’t Tell” repeal implementation was proceeding smoothly and that they don’t anticipate major problems with moving toward open service in the long term.

In a hearing before the Republican-controlled House Armed Services Committee, uniform leaders of the military services said “Don’t Ask, Don’t Tell” repeal implementation was proceeding in a way that they felt was favorable.

The chiefs of the Navy, Marine Corps and Air Force — Chief of Naval Operations Adm. Gary Roughead, Marine Corps Commandant Gen. James Amos and Air Force Chief of Staff Gen. Norton Schwartz — spoke on behalf of their services while Army Vice Chief of Staff Gen. Peter Chiarelli represented his service.

Many of the service chiefs — especially Amos, who said he feared open service could be a distraction that could cost Marines’ lives on the battlefield — voiced opposition to legislative action to end the anti-gay before law last year before Congress took action to pass allowing for repeal.

However, following the passage of repeal legislation, each of the chiefs committed to working toward repeal and issued guidance on implementing open service to their subordinates — a sentiment they voiced in testimony before the committee.

Roughead, who was among the chiefs to favor “Don’t Ask, Don’t Tell” repeal last year, said he doesn’t think repeal would have a measurable impact on the Navy.

“The United States Navy can successfully implement a repeal of the law,” Roughead said. “Combat effectiveness is what we provide the nation and repeal will not change who we are or what we do.”

Roughead said he’s established July 1 as time for when the Navy will be complete training for open service and said the service is on track to achieve that goal.

Amos noted that despite his earlier opposition to repeal, he issued guidance to the Marine Corps on the path toward open service and created a video to prepare Marines for “Don’t Ask, Don’t Tell” repeal.

“I’m looking for issues that might arise specifically coming out of the … training, and to be honest with you, chairman, we’ve not seen it,” Amos said. “There’s questions about billeting for Marines — I mean, the kinds of questions you would expect — but there hasn’t been the recalcitrant pushback, there’s not been the anxiety over it from the forces in the field.”

Amos said the Marine Corps has completed 100 percent of Tier 1 and Tier 2 training — which includes training of service leadership — and said Tier 3 training, training of the total force, is 41 percent finished and would be complete June 1.

Echoing the notion that repeal implementation is proceeding smoothly, Chiarelli, who’s superior Army Chief of Staff Gen. George Casey opposed repeal in testimony last year, said the training to prepare soldiers for open service is effective.

Chiarelli maintaining training “is not disruptive” to the Army, but said the “Don’t Ask, Don’t Tell” repeal implementation process for the service “will take time.”

“The chain teaching program facilitates thoughtful, constructive dialogue between leaders and subordinates,” Chiarelli said. “This dialogue is hugely important, especially at the lowest levels, where ownership and consensus are most critical.”

Chiarelli said he participated in the first session along with Casey and other four-star generals” and “can attest the process works.”

Schwartz, who testified last year that he didn’t want “Don’t Ask, Don’t Tell” implementation until 2012, said the Air Force is also moving toward open service in a deliberate but expeditious manner.

“We will rely on steady leadership at all levels to implement this change in a manner that is consistent with standards of military readiness and effectiveness, with minimal adverse effect on unit cohesion, recruiting and retention in the Air Force,” Schwartz said.

Schwartz added his service has trained about 15 percent of all airmen — some 117,000 of the force — is on track “to train the remainder within the project training window.”

Despite their generally favorable view of moving toward open service, both Chiarelli and Schwartz identified “moderate risk” with implementing “Don’t Ask, Don’t Tell” repeal, although they said they were mitigating the risk through educating service members.

LGBT advocates following the hearing that “Don’t Ask, Don’t Tell” repeal said the testimony demonstrates training is on track and further congressional hearings are unnecessary.

Alex Nicholson, executive director of Servicemembers United, said the testimony demonstrates the service chiefs are “comfortable with this policy change.”

“This should be the last waste of their time and taxpayers’ resources to try to undo the inevitable,” Nicholson said. “‘Don’t Ask, Don’t Tell’ is going away, and we will have a stronger military and a stronger nation as a result.”

No committee hearings specifically devoted to “Don’t Ask, Don’t Tell” repeal are planned in the Senate. Tara Andringa, a spokesperson for Senate Armed Services Committee Chair Carl Levin (D-Mich.), said his committee has asked the chiefs to inform panel members about the progress of repeal as part of the hearing on the fiscal year 2012 budget.

Despite the confidence that chiefs expressed in moving toward open service, Republicans on the committee voiced concerns about “Don’t Ask, Don’t Tell” or griped about the process that led to passage of legislation allowing for repeal of the anti-gay law.

House Armed Services Committee Chair Buck McKeon (R-Calif.) said he disapproved of the way the Democratic-controlled House last year proceeded with repeal legislation after the Pentagon published its study in November on “Don’t Ask, Don’t Tell.”

“As a result of the rush to judgment that bypassed this committee, Congress was denied the opportunity to ask questions and identify weaknesses in the repeal implementation plan,” McKeon said. “Now, we’re confronted by an implementation process that is moving quickly to completion of the education and training phase.”

McKeon maintained that the “one outcome that must be avoided” is a path for the U.S. armed forces that would “put the combat readiness of our military forces at risk.”

Following the hearing, McKeon told the Washington Blade that the chiefs’ testimony didn’t allay his concerns — but insisted they were based on the congressional repeal process as opposed to open service itself.

“My views of established from the way it was handled in the first place to get to this point,” McKeon said. “They’re just doing their job.”

Aubrey Sarvis, executive director of the Servicemembers Legal Defense Network, chided for McKeon for holding the hearings and for asserting that insufficient discussion led to repeal.

“It’s particularly unfortunate that the full committee chairman, Mr. McKeon, has decided to become a party to this ugly cabal to play politics with our men and women in uniform,” Sarvis said. “This has traditionally been a bi-partisan committee, but under the current leadership of McKeon and [House Armed Services Subcommitee Chair Joe] Wilson, that sane and sensible approach is at risk.”

While Republicans voiced concern about the passage of “Don’t Ask, Don’t Tell” repeal legislation or implementing open service in the U.S. military, Democrats on the panel indicated support for the repeal legislation Congress passed last year.

Rep. Adam Smith (D-Wash.), ranking Democrat on the committee, said the issue of “Don’t Ask, Don’t Tell” has been “hotly debated” since its inception in 1993 and disputed the argument that Congress didn’t undertake sufficient discussion before acting — adding lawmakers “made the only logical choice” last year by enacting repeal.

“I believe we have analyzed this at enormous length over an enormous period of time, and at some point you have to make a decision about what the best way to go forward is,” Smith said.

Smith added the longtime service of gays in the military is well known — although they’ve been serving in secret because of “Don’t Ask, Don’t Tell” — and said he’s “yet to meet a service member who wasn’t abundantly aware of somebody that they were serving with [who] was gay or lesbian, and yet we have the finest military in the world.”

Rep. Linda Sanchez (D-Calif.) said when Congress was going through the process of “Don’t Ask, Don’t Tell” repeal she had no doubts the U.S. military could handle open service.

“I did not believe that our military units were so fragile that finding out having somebody next to you that was openly gay would be disruptive to the mission of our units,” she said. “I am very proud so far, as you’ve discussed today, of all men and women in uniform, who not only go out and fight for us everyday but who are also working through this new policy that you’re trying to implement.”

Sanchez asked whether service members discharged would be able to re-enter the military if there was no other reason for their separation.

Schwartz replied that discharged service members would be able to re-enlist based on the needs of the services to which they apply and there is no guarantee for returning at the same grade.

Pressed by Sanchez on what options are available to gay service members if they feel they’re harassed upon seeking re-entry, Schwartz replied an appeal process is available both through an inspector general and the Board of Corrections.

Could legislation disrupt certification?

In December, President Obama signed legislation allowing for repeal of “Don’t Ask, Don’t Tell,” but the anti-gay law will only be off the books after 60 days pass following certification from the president, the defense secretary, and the chair of the Joint Chiefs of Staff. Defense officials have said certification is anticipated mid-summer.

But Rep. Duncan Hunter (R-Calif.) has introduced legislation in the House that could complicate or delay certification by expanding the certification requirement to include direct input from each the chiefs.

Following the hearing, Hunter told the Blade he still thinks legislation to expand the certification requirement is necessary despite the chiefs’ testimony because of “the same reason [he] put it up in the first place.”

Hunter said he’s been talking with McKeon’s staff about having a vote on his legislation in committee and is expecting a vote during the panel markup for the FY2012 budget.

McKeon seemed unaware of any plans to hold a vote on Hunter’s legislation or didn’t want to disclose his plans. Asked by the Blade whether he was expecting a vote, McKeon replied, “I don’t know. We’ll have to look at it and see.”

Nicholson said Hunter was probably referring to the FY-2012 defense authorization bill — legislation over which the House Armed Services Committee has jurisdiction.

Additionally, Nicholson said Hunter may have enough votes to attach the measure as part of the House version of the defense legislation, but won’t have a shot of passing it through the Senate or having Obama sign the legislation.

“Of course, the reason we’re not worried about it is because it’ll never pass the Senate,” Nicholson said. “So I wouldn’t necessarily be surprised and I wouldn’t necessarily be alarmed even if it passed as part of the House defense budget.”

Real Estate

Celebrate the power of homeownership this Fourth of July

Owning a home is powerful act of self-determination

This Fourth of July, celebrate more than independence: celebrate the power of LGBTQ+ homeownership. Explore resources, rights, and representation with GayRealEstate.com, the trusted leader in LGBTQ+ real estate for over 30 years.

Home is more than a house: it’s a symbol of freedom

As the fireworks light up the sky this Fourth of July, LGBTQ+ individuals and families across the country are not just celebrating the nation’s independence — they’re celebrating personal milestones of freedom, visibility, and the right to call a place their own.

For many in the LGBTQ+ community, owning a home represents more than stability — it’s a powerful act of self-determination. After generations of discrimination and exclusion from housing opportunities, more LGBTQ+ people are stepping into homeownership with pride and purpose.

Why homeownership matters to the LGBTQ+ community

While progress has been made, LGBTQ+ homebuyers still face unique challenges, including:

- Housing discrimination, even in states with legal protections

- Limited access to LGBTQ+ friendly realtors and resources

- Concerns about safety and acceptance in new neighborhoods

- Lack of representation in the real estate industry

That’s why the Fourth of July is a perfect time to reflect not just on freedom as a concept, but on how that freedom is expressed in the real world — through ownership, safety, and pride in where and how we live.

Finding LGBTQ+ Friendly Neighborhoods

One of the top concerns for LGBTQ+ buyers is whether they’ll feel safe, accepted, and welcome in their new neighborhood. Thanks to evolving attitudes and stronger community support, many cities across the U.S. now offer inclusive, affirming environments.

Some of the best cities for LGBTQ+ home buyers include:

- Wilton Manors, Fla. – A vibrant LGBTQ+ hub with strong community ties

- Palm Springs, Calif. – A longtime favorite for LGBTQ+ homeowners

- Asheville, N.C. – Progressive and artsy, with growing LGBTQ+ visibility

- Portland, Ore. – Inclusive, eco-conscious, and diverse

- Philadelphia, PA – Rich in history and LGBTQ+ community leadership

When you work with an LGBTQ+ friendly realtor, you get insight into more than property values — you get a real perspective on where you’ll feel most at home.

Navigating the real estate process with confidence

Whether you’re a first-time gay homebuyer or preparing to sell your home as an LGBTQ+ couple, it’s essential to understand your rights and options. Here are a few key tips:

1. Work with a trusted LGBTQ+ real estate agent

Representation matters. A gay realtor, lesbian real estate agent, or LGBTQ+ friendly agent understands the unique concerns you may face and advocates for you every step of the way.

Use GayRealEstate.com to connect with LGBTQ+ real estate agents near you. For over 30 years, we’ve helped LGBTQ+ buyers and sellers find their ideal home and a professional who respects their identity.

2. Know your legal protections

While federal law (via the Fair Housing Act and Supreme Court rulings) prohibits housing discrimination based on sexual orientation or gender identity, enforcement can vary by state. Make sure to research:

- State-level housing discrimination laws

- Local LGBTQ+ protections and resources

- What to do if you experience discrimination during a transaction

3. Secure inclusive financing

While most lenders follow fair lending rules, it’s smart to seek out banks or credit unions with LGBTQ+ inclusive policies and a history of non-discriminatory lending practices.

4. Plan for the future as a family

For same-sex couples, especially unmarried partners, it’s vital to review how you’ll hold the title, designate beneficiaries, and plan your estate.

Ask your agent or attorney about:

- Joint tenancy with right of survivorship

- Living trusts

- Powers of attorney and healthcare proxies

Selling a home as an LGBTQ+ homeowner

If you’re listing your home, working with a gay-friendly real estate agent ensures your identity and story are honored — not hidden — in the process.

Highlight:

- Your community connections

- Your home’s role in creating a safe space

- Local LGBTQ+ resources to attract like-minded buyers

Showcasing the full value of your home includes sharing what it meant to live there authentically and safely.

Your home, your freedom

The Fourth of July reminds us that freedom isn’t just an abstract idea — it’s lived every day in the spaces where we find comfort, love, and belonging. For the LGBTQ+ community, the right to own and thrive in a home is part of the larger journey toward full equality.

At GayRealEstate.com, we believe every LGBTQ+ person deserves:

- A safe place to live

- A community that welcomes them

- An advocate in the home buying or selling process

Ready to make a move?

Whether you’re dreaming of your first home, upgrading with your partner, or selling a space that helped shape your identity, GayRealEstate.com is your trusted partner. With our nationwide network of gay realtors, lesbian real estate agents, and LGBTQ+ friendly professionals, we make your journey smooth, respectful, and informed.

Visit GayRealEstate.com to:

- Search LGBTQ+ friendly homes

- Connect with inclusive real estate agents

- Access free guides for buyers and sellers

- Protect your rights and get expert advice

This Fourth of July, celebrate more than independence — celebrate your freedom to live, love, and own with pride.

Did you melt like the Wicked Witch of the West this week?

As summer temperatures rise, keeping your home or apartment cool during a heat wave can become both a comfort issue and a financial challenge. One of the most effective ways to keep a home cool is to prevent heat from entering in the first place. Sunlight streaming through windows can significantly raise indoor temperatures. Consider the following solutions:

• Close blinds or curtains during the hottest parts of the day. Blackout curtains or thermal drapes can reduce heat gain by up to 30%.

• Install reflective window films to block UV rays and reduce solar heat without sacrificing natural light.

• Use outdoor shading solutions such as awnings (yes, the ones you removed because they were “dated”) and shutters to limit direct sunlight.

Fans are a cost-effective way to circulate air and create a wind-chill effect that makes rooms feel cooler.

• Ceiling fans should rotate counterclockwise in the summer to push cool air down.

• Box fans or oscillating fans can be placed near windows to pull in cooler evening air or push hot air out.

• Create a cross-breeze by opening windows on opposite sides of your home and positioning fans to direct airflow through the space.

• For an extra cooling effect, place a bowl of ice or a frozen water bottle in front of a fan to circulate chilled air.

To optimize natural ventilation, open windows early in the morning or late in the evening when outdoor temperatures drop. This allows cooler air to flow in and helps ventilate heat that built up during the day.

Appliances and electronics generate a surprising amount of heat. To reduce indoor temperatures:

• Avoid using the oven or stove during the day; opt for no-cook meals, microwave cooking, or grilling outside.

• Run heat-producing appliances like dishwashers and clothes dryers in the early morning or late evening.

• Unplug electronics when not in use, as even standby power can add heat to your space.

• Switching to energy-efficient LED lightbulbs can also reduce ambient heat compared to incandescent lighting.

If you do use an air conditioner, maximize its effectiveness by:

• Setting it to a reasonable temperature—around 76–78°F when you’re home and higher when you’re away.

• Cleaning or replacing filters regularly to maintain airflow and efficiency.

• Sealing gaps around doors and windows to prevent cool air from escaping. (Didn’t we all have a parent who said, “Close the door. You’re letting all the cool out?”)

• Using a programmable thermostat to optimize cooling schedules and reduce energy use.

If it is not cost-prohibitive, adding insulation in attics and walls can greatly reduce heat transfer. Solar panels that reflect heat can also help, as well as offset the cost of their installation. Adding weatherstripping around doors and windows, sealing cracks, and using door sweeps can make a significant difference in keeping heat out and cool air in.

Natural and eco-conscious methods can also help cool your home.

• Snake plants, ferns, or rubber trees can improve air quality and slightly cool the air through transpiration.

• White or reflective roof paint can reduce roof temperatures significantly.

• Cooling mats or bedding can make sleeping more comfortable without cranking up the A/C.

For renters or those who can’t make permanent modifications, there are still plenty of ways to keep cool.

• Use portable fans and A/C units instead of built-in systems, making sure they are the correct size for your space.

• Removable window film or static cling tinting can reflect heat without violating your lease.

• Install tension rod curtains or temporary blackout panels instead of hardware-mounted window coverings.

• Add draft blockers and weatherstripping tape that can be applied and removed without damage.

• Cover floors with light-colored rugs to reflect heat rather than absorb it.

• If allowed, use temporary adhesive hooks to hang reflective materials or light-filtering fabrics over windows.

Even if your space is warm, you can still take steps to help your body stay cool.

• Wear light, breathable fabrics like cotton or linen.

• Stay hydrated and avoid caffeine or alcohol during peak heat hours.

• Take cool showers or use damp cloths on your neck and wrists to bring your body temperature down.

Keeping your home or apartment cool in the summer doesn’t have to be expensive or energy-intensive. With a few adjustments such as blocking sunlight, optimizing airflow, using fans effectively, and making renter-friendly upgrades, you can create a more comfortable indoor environment while keeping energy bills in check.

Valerie M. Blake is a licensed Associate Broker in D.C., Maryland, and Virginia with RLAH @properties. Call or text her at 202-246-8602, email her at DCHomeQuest.com, or follow her on Facebook at TheRealst8ofAffairs.

Real Estate

The world’s on fire and D.C. is on sale (sort of)

Prices are up, but then again, nothing makes sense anymore

ICE is disappearing people, revered government agencies are shuttering, and who knows if we’ll be in World War III next week? But can you believe prices in D.C. are actually still up 6.3% since last year? It doesn’t make sense, and perhaps that does make sense, because nothing seems to make any sense any more.

That said, there are some parts of our market that are truly suffering. The interest rates, which have been up, up, up for about four years now, are the ongoing rain on our market’s military parade. Combine that with 75,000 federal employees taking a buyout nationwide, and DOGE cuts eliminating around 40,000 federal jobs in the District (per estimates by the D.C. CFO), not to mention thousands of other job losses in non-governmental organizations due to funding and program cuts, and you’ve got a case of uncertainty, and downright unaffordability in the pool of otherwise would-be buyers.

This has had a marked impact on properties that starter-home buyers and low- to mid-level employees would otherwise buy, most notably condominium and cooperative apartment units. These properties have already slowed in our market thanks to the profound impact that higher interest rates have had on their monthly carrying costs—pair that with job insecurity, and a lot of condos are proving to be very difficult to sell indeed.

So how is the average sale price up in our market?

The increase is almost entirely due to the resounding strength of the single-family home market, especially in upper Northwest D.C., where it is still quite common to see bidding wars, even on properties pushing past the $3M mark. It seems that buyers in that echelon are less impacted by a few percentage points in the interest rate, and less concerned about their job security. Notably, those buyers are often married with children and have an absolute need for more space, must stay in the area due to one spouse’s job, or the kid’s friend group, regardless of whether the cost of owning is thousands of dollars more per month than it would have been in 2020 or 2021. The continued appreciation in these neighborhoods defies imagination.

So, what to do if you are not one of those lucky enough to be shopping for a $3M home? The short answer: wait. If you want more space, rent your current place out and learn the joys of being a landlord while someone else pays your mortgage. Need the equity from your current home to buy your next place? Get a home equity line of credit, or loan, and pull the equity out of your current place to buy the next one. Or—and I have never recommended this before in 21 years of being a Realtor—rent for a few years. Sure, I’d love to list and sell your condo so you can climb the real estate ladder, but it might just be a waste of time, money or both if you could just ride out this storm and sell in a DOGE-less future.

All this said, there are some condos that seem to be immune from this recent negative news. Anecdotally, it feels like it’s the truly special ones that do just fine no matter the market. Our recent listing in Capitol Hill had a view from every one of its 15 windows of the Supreme Court. Sold in five days with six offers. Another condo was on the top two floors of a townhouse and had the coolest black wood floors that gleamed like a grand piano. Sold in four days at full price.

So, all is not for naught if you have a condo or home in an area that people want to be in, with nice space, light, amenities and a certain je ne sais quois. And, as long as we have a democracy in a few years, my experience says our market will be back, stronger than ever, really soon.

David Bediz is a Realtor and mortgage loan broker for the Bediz Group LLC and Home Starts Here, LLC. Reach him at [email protected].

-

U.S. Supreme Court2 days ago

U.S. Supreme Court2 days agoSupreme Court to consider bans on trans athletes in school sports

-

Out & About2 days ago

Out & About2 days agoCelebrate the Fourth of July the gay way!

-

Virginia2 days ago

Virginia2 days agoVa. court allows conversion therapy despite law banning it

-

Maryland5 days ago

Maryland5 days agoLGBTQ suicide prevention hotline option is going away. Here’s where else to go in Md.