Living

Techie wonders

Here are several red hot stocking stuffers that’ll have you surfing, texting and gaming in new, fun ways

Editor’s note: part two (of five) of our gift guide. Next week — gifts for kids. Last week’s on books, movies and CDs is here.

As Black Friday and Cyber Monday come up again, a lot of retailers will be offering big sales. Here are some electronics to look for that will likely be offered at some great prices.

eReaders

Amazon’s Kindle with WiFi now comes in a different color, graphite. The new reader is smaller, but has the same 6-inch screen. It’s 17 percent lighter and has double the storage. Out-of-copyright books are free as well as samples and all other books are $9.99 or less. The Kindle is $139 and can be bought at amazon.com or Staples.

Barnes & Noble’s NOOK now comes with a 7-inch color touchscreen. The NOOKcolor includes a new feature, NOOKkids, which brings picture books to life for children and will even read the books out loud. Books are $9.99 or less. NOOKcolor with wifi is $249 and can be purchased from b&n.com or other stores including Best Buy.

Sony’s Reader Touch Edition features a 6-inch clear touch screen that “reads like a real book.” Coming in two colors, red or black, the Reader can hold up to 50,000 books, allows for freehand highlight and note taking, and can play MP3 audio files. The Reader costs $229.99 and can be purchased as sony.com or many other stores including Wal-Mart.

Video Games

Playstation 3 has come out with new hardware giving games a more interactive feel with Move. Amazon.com is offering a bundle with a 320 GB console and a Move starter pack which includes the EyeCam, Move controller and Sports Champions game for $399.

Playstation 3 has come out with new hardware giving games a more interactive feel with Move. Amazon.com is offering a bundle with a 320 GB console and a Move starter pack which includes the EyeCam, Move controller and Sports Champions game for $399.

PS3 game, “Heavy Rain” ($59.99), is an action-packed adventure with four playable characters with savable chapters. It has become Move compatible through a Playstation Network software update.

In celebration of the 25th anniversary of the “Super Mario Bros.” game, Ninetendo is releasing a special limited edition red Wii bundle this holiday season. The bundle includes red versions of the console, Wii remote, nunchuck and a copy of New Super Mario Bros. Wii and Wii Sports ($199.99).

In celebration of the 25th anniversary of the “Super Mario Bros.” game, Ninetendo is releasing a special limited edition red Wii bundle this holiday season. The bundle includes red versions of the console, Wii remote, nunchuck and a copy of New Super Mario Bros. Wii and Wii Sports ($199.99).

“Donkey Kong Country Returns” ($49.99) is on Wii and is the first time in the franchise history that two people can play together at the same time, one as Donkey Kong and one as Diddy Kong.

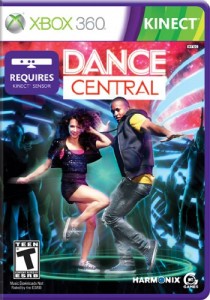

Xbox 360 also has new hardware to make its games more interactive with Kinect, which makes the player the controller. Microsoft is offering a bundle with a 250 GB console, the Kinect censor, “Kinect Adventures” game and a choice of a second game, including “Kinect Sports,” all for $449.98.

Xbox 360 also has new hardware to make its games more interactive with Kinect, which makes the player the controller. Microsoft is offering a bundle with a 250 GB console, the Kinect censor, “Kinect Adventures” game and a choice of a second game, including “Kinect Sports,” all for $449.98.

“Dance Central” is a new game with a soundtrack that spans today’s current pop, hip-hop and R&B artists with dance routines that incorporate authentic choreography without the use of any controller.

“Dance Central” is a new game with a soundtrack that spans today’s current pop, hip-hop and R&B artists with dance routines that incorporate authentic choreography without the use of any controller.

Apple

Apple has redesigned its iPod Nano. Now just big enough to fit a small touchscreen, the Nano no longer has the click wheel like the Classic and you can shuffle through songs with a quick shake. You can even listen to FM radio. Also has a built-in clip to listen hands free. An 8GB nano is $149 and a 16GB is $179.

Apple has redesigned its iPod Nano. Now just big enough to fit a small touchscreen, the Nano no longer has the click wheel like the Classic and you can shuffle through songs with a quick shake. You can even listen to FM radio. Also has a built-in clip to listen hands free. An 8GB nano is $149 and a 16GB is $179.

iPod Touch has received an update as well. It now features FaceTime, HD video recording and a dual camera for taking pictures on either side of the iPod. An 8GB Touch is $229, a 32GB is $299 and a 64GB is $399.

iPod Touch has received an update as well. It now features FaceTime, HD video recording and a dual camera for taking pictures on either side of the iPod. An 8GB Touch is $229, a 32GB is $299 and a 64GB is $399.

Apple iPad, starting from $499, has a 9.7-inch Multi-Touch display and features many of the same apps as an iPhone, with some apps only compatible on the iPad. Makes for a great photo album or screen to watch movies. The iPad comes in 16GB, 32GB and 64GB models.

Apple iPad, starting from $499, has a 9.7-inch Multi-Touch display and features many of the same apps as an iPhone, with some apps only compatible on the iPad. Makes for a great photo album or screen to watch movies. The iPad comes in 16GB, 32GB and 64GB models.

Apple TV ($99) hooks up to your television at home giving you instant access to HD movies on iTunes as well as Netflix, YouTube and more. Have an iPod, iPhone or iPad? Download the remote app and control Apple TV with one touch.

Apple TV ($99) hooks up to your television at home giving you instant access to HD movies on iTunes as well as Netflix, YouTube and more. Have an iPod, iPhone or iPad? Download the remote app and control Apple TV with one touch.

10 Interesting Apps on iTunes

Robot Unicorn Attack by Adult Swim features a robot unicorn that runs and jumps through the sky collecting fairies and rainbow-attacking giant stars all to the tune of “Always” by Erasure ($1.99). A Heavy Metal edition featuring “Battlefield” by Blind Guardian can also be purchased.

Scene It? Happy Potter is the perfect app for any Harry Potter fan. Includes 30 distinct quiz sets with 16 puzzle types. This app features questions based on movie clips, images and more ($1.99). There is an HD version of this game for the iPad that costs $4.99.

Angry Birds has been on iTunes top paid apps for a long time now and is in the essentials group, Hall of Famers. Angry Birds has 195 levels that require logic, skill and brute force (99 cents).

Trivia Master! features more than 3,000 questions falling into one of eight categories, general knowledge, entertainment, arts and literature, sports, science and nature, geography, history and politics and food and drink ($1.99).

Tetris is now on iPhone with this app that features classic marathon mode and new magic mode with includes five new versions. You can even listen and control your music while playing ($2.99). There’s an iPad version for $7.99

Food Network: In the Kitchen features recipes from Food Network stars like Paula Deen, Bobby Flay and Guy Fieri. Not only do you get the recipes, the app lets you click and save ingredients to your phone for shopping trips and cool tools such as a unti converter, cooking timer and more ($1.99).

Lady Gaga Revenge 2, from the developers of Tap Tap Revenge, this game includes “Bad Romance,” “Alejandro” and eight other tracks never before put on a Tap Tap game plus four boss tracks ($4.99).

Grindr X(tra), compatible with iPhone, iPod touch and iPad, this is a premium version of Grindr with extras like push notification, swiping through profiles, no ad banner and 11 more guys in your area ($2.99).

Instapaper allows you to save web pages for offline reading. This paid edition allows for sharing via email, Tumblr or Twitter, download up to 500 articles and store unlimited on the website and rotation lock ($4.99).

Nike + GPS, compatible with iPhone and iPod touch, tracks indoor and outdoor workouts without a sensor. This app will record pace, distance and run route using the GPS and accelerometer technology ($1.99).

Kitchen Appliances

Nostalgia Electrics has brought a little piece of the movie theater to home with its Hollywood Kettle Popcorn Maker ($99.99) which makes eight popped cups of popcorn and features a light-up marquee. Add your name or a fun message with 150 vinyl letters included. Available at bedbathandbeyond.com.

Nostalgia Electrics has brought a little piece of the movie theater to home with its Hollywood Kettle Popcorn Maker ($99.99) which makes eight popped cups of popcorn and features a light-up marquee. Add your name or a fun message with 150 vinyl letters included. Available at bedbathandbeyond.com.

Crock-Pot’s Cook and Carry Slow Cooker is a six quart cooler with removable oval stoneware, lid-mounted locking system, convenient warm setting and has a dishwasher safe stoneware and lid. Don’t forget to down load the free Recipe Finder app from iTunes.

Crock-Pot’s Cook and Carry Slow Cooker is a six quart cooler with removable oval stoneware, lid-mounted locking system, convenient warm setting and has a dishwasher safe stoneware and lid. Don’t forget to down load the free Recipe Finder app from iTunes.

Gadgets and Accessories

Heartbeats are high performance in-ear headphones designed by Lady Gaga. These give pitch-perfect highs and club caliber bass. Available in Black Chrome, Bright Chrome and Rose Red with or without ControlTalk, a built-in mic that enables hands-free calls and chat ($119.95 or $149.95).

Heartbeats are high performance in-ear headphones designed by Lady Gaga. These give pitch-perfect highs and club caliber bass. Available in Black Chrome, Bright Chrome and Rose Red with or without ControlTalk, a built-in mic that enables hands-free calls and chat ($119.95 or $149.95).

C.H.I.M.P Rearview Monitor Mirror, available at thinkgeek.com, is a mirror that fits easily on either corner of a monitor with velcro to see who is coming up from behind ($7.99).

C.H.I.M.P Rearview Monitor Mirror, available at thinkgeek.com, is a mirror that fits easily on either corner of a monitor with velcro to see who is coming up from behind ($7.99).

Mimobot offers a variety of designer USB Flash Drives including characters from Hello Kitty, Star Wars, Halo and Happy Tree Friends as well as original characters like Fairybit (seen here). Prices range from $24.95 for a 2GB drive to $79.95 for 16GB. Visit mimoco.com to purchase.

Mimobot offers a variety of designer USB Flash Drives including characters from Hello Kitty, Star Wars, Halo and Happy Tree Friends as well as original characters like Fairybit (seen here). Prices range from $24.95 for a 2GB drive to $79.95 for 16GB. Visit mimoco.com to purchase.

KIWI U-Powered ($59.99) can be charged by USP port, car charger, solar energy and a wall charger then will hold its power for at least six months. Compatible with phones, iPods, iPad, GPS and more, the charger comes with a pack of 11 different tips to charge all your electronic gadgets. Find at kiwichoice.com.

KIWI U-Powered ($59.99) can be charged by USP port, car charger, solar energy and a wall charger then will hold its power for at least six months. Compatible with phones, iPods, iPad, GPS and more, the charger comes with a pack of 11 different tips to charge all your electronic gadgets. Find at kiwichoice.com.

The Harmony One Advanced Universal Remote ($249.99) from Logitech features a backlit, full-color touch screen, can control up to 15 devices and recharges with included base, getting rid of the need for batteries. Available at logitech.com.

The Harmony One Advanced Universal Remote ($249.99) from Logitech features a backlit, full-color touch screen, can control up to 15 devices and recharges with included base, getting rid of the need for batteries. Available at logitech.com.

Thinkgeek.com’s Retro Phone Handset ($29.99) connects to most cell phones via a 2.5mm jack, but not some newer Blackberry models, RAZR or Nokia phones and no batteries required. You can also get the Bluetooth Retro Handset which works with Bluetooth V1.0, 1.1 and 1.2 with a USB charged battery ($29.99).

Thinkgeek.com’s Retro Phone Handset ($29.99) connects to most cell phones via a 2.5mm jack, but not some newer Blackberry models, RAZR or Nokia phones and no batteries required. You can also get the Bluetooth Retro Handset which works with Bluetooth V1.0, 1.1 and 1.2 with a USB charged battery ($29.99).

Real Estate

The rise of virtual home tours

Adapting to changing consumer preferences in spring real estate

In today’s dynamic real estate market, the spring season brings not only blooming flowers but also a surge of activity as buyers and sellers alike prepare to make their moves. However, in recent years, there’s been a notable shift in how consumers prefer to explore potential homes: the rise of virtual tours.

For the LGBTQ community, these virtual experiences offer more than just convenience; they provide accessibility, safety, and inclusivity in the home buying process.

Gone are the days of spending weekends driving from one open house to another – unless that’s your thing of course, only to find that the property doesn’t quite match expectations. With virtual tours, you can explore every corner of a home from the comfort of your own space – find something interesting? Schedule a showing with any LGBTQ Realtor at GayRealEstate.com.

This is particularly significant for LGBTQ individuals, who may face unique challenges or concerns when attending in-person showings. Whether it’s the ability to discreetly view properties without fear of discrimination or the convenience of touring homes located in LGBTQ-friendly neighborhoods across the country, virtual tours offer a sense of empowerment and control in the home buying process.

Moreover, virtual tours cater to the diverse needs of the LGBTQ community. For couples or families with busy schedules or those living in different cities or states, these digital walkthroughs provide a convenient way to view properties together without the need for extensive travel. Additionally, for individuals who may be exploring their gender identity or transitioning, virtual tours offer a low-pressure environment to explore potential living spaces without the added stress of in-person interactions.

At GayRealEstate.com, we understand the importance of adapting to changing consumer preferences and leveraging technology to better serve our community. That’s why our agents offer an extensive selection of virtual tours for LGBTQ individuals and allies alike – visit our website, choose an agent and within minutes you’ll have access to the Multiple Listing Service (MLS) via their website.

From cozy condominiums in bustling urban centers to sprawling estates in picturesque suburbs, virtual tours showcase a wide range of properties tailored to diverse tastes and lifestyles.

In addition to virtual tours, GayRealEstate.com provides comprehensive resources and support to guide LGBTQ buyers and sellers through every step of the real estate journey. Our network of LGBTQ-friendly agents is committed to providing personalized service, advocacy, and representation to ensure that all individuals feel respected, valued, and empowered throughout the process. Plus, we are happy to provide a free relocation kit to any city in the USA or Canada if you are a home buyer.

As we embrace the spring season and all the opportunities it brings in the real estate market, let’s also celebrate the power of virtual tours to revolutionize the way we find and experience our future homes. Whether you’re searching for your first apartment, forever home, or investment property, GayRealEstate.com is here to help you navigate the exciting world of real estate with confidence, pride, and inclusivity.

Jeff Hammerberg is founding CEO of Hammerberg & Associates, Inc. Reach him at [email protected].

Advice

Should I divorce my husband for the hot new guy in our building?

Debating whether to leave or stay after the sex goes cold

Dear Michael,

I’ve been with my husband for 10 years and the sex is pretty much gone. It stopped being exciting a long time ago and pretty much the only time we ever do it is with the occasional third.

A really hot guy moved into our building about a year ago. We would see each other sometimes in the elevator or at our building’s gym and we started talking and really hit it off. Mark is 15 years younger than I but we seem to have a lot in common. We started hooking up and the sex is amazing.

I haven’t told my husband because it’s breaking our rule about no repeats. I have to say that the secrecy is hot. It’s kind of a thrill to take the elevator upstairs when I say I’m going on an errand. But it’s more than that. I have a connection with Mark that is far more amazing than what I have ever felt with my husband. Not just the sex. We just enjoy being together, talking about anything and everything.

My husband went to visit his family last weekend and I spent the whole time with Mark. Since then I can’t stop thinking that I want to leave my husband and be with Mark.

Part of me thinks this is a crazy mid-life crisis. I mean, this kid’s in a totally different place in life. But we have mind-blowing sex and a fantastic connection. I’d like your thoughts on how to proceed.

Michael replies:

You’ve got a lot to consider.

First: Sex with a long-term partner changes over time. It tends to be less about erotic heat and more about the connection with a person whom you love. In other words, it’s being with the person you’re with that makes the sex meaningful and even great. Having a good sexual relationship with a long-term partner comes far more from a heart connection than from a crotch attachment.

Second: You seem ready to throw your relationship under the bus pretty quickly, without addressing other problems in the relationship besides sex. When you are sneaking around, lying, and rule-breaking , I don’t see how you can look your husband in the eye; and if you can’t look him in the eye, you certainly can’t have even a half-way decent relationship.

Yet another point to consider: Affairs pretty much always seem more exciting than marriage. The partner is new, which almost automatically makes the sex hotter; the secrecy is a thrill; and you don’t have to deal with paying the rent, house chores, and all the petty annoyances of living up-close with someone day-in, day-out.

You are bringing lots of energy to your affair, and everything about it is exciting. You are bringing no energy — at least no positive energy — to your marriage. You get what you put into a relationship.

Divorce is not something that should be entered into lightly. Be aware that if you leave your husband for Mark, you will no doubt find over time that the sex becomes less exciting and that the connection is not always fantastic. No surprise, 75 percent of marriages that begin with affair partners end in divorce. While I don’t think statistics predict what will happen to any particular couple, believing that you will have a significantly better relationship with your affair partner than you did with your husband sets you up for likely disappointment.

Many gay men focus on “hot sex” as the big draw, pursuing a lot of sex with a lot of men, and/or pursuing an ongoing series of relationships that last until the sex cools. If that’s what you want, that’s fine. But it’s a different path from pursuing a close and loving long-term relationship, which involves knowing someone well and having him know you well; collaborating on getting through the hard stuff life throws at us; finding ways to make peace with disappointment; and consistently striving to be someone worth being married to.

How to proceed? While you are the only person who should make that decision, I would suggest that whatever your choice, keep in mind that marriage can be more than what you’ve made of it, so far.

Michael Radkowsky, Psy.D. is a licensed psychologist who works with couples and individuals in D.C. He can be found online at michaelradkowsky.com. All identifying information has been changed for reasons of confidentiality. Have a question? Send it to [email protected].

Autos

Sport haulers: Jeep Grand Cherokee, Mercedes GLE-Class

Updated cabins, adept handling, and more

Now that March Madness and the Masters are over, it’s time for, well, everything else. For my husband and me, this means water sports, as in kayaks and rowing sculls, which is why we trekked to the Potomac for the George Washington Invitational regatta last weekend.

Alas, high winds splashed cold water on the event, canceling much of it. But there was still plenty of spirited camaraderie to rival “The Boys in the Boat.”

And I was reminded of my time years ago as a rower with D.C. Strokes, ferrying teammates to races up and down the East Coast. Back then my ride was a dated, rather cramped four-door sedan.

If only we could have paddled around in a sporty SUV like the two reviewed here. Now that would have been some smooth sailing (wink-wink).

JEEP GRAND CHEROKEE

$40,000

MPG: 19 city/26 highway

0 to 60 mph: 7.5 seconds

Maximum cargo room: 37.7 cu. ft.

PROS: Updated cabin, adept handling, strong towing

CONS: So-so gas mileage, no third row, pricey trim levels

IN A NUTSHELL: Rough, tough and buff. It’s doesn’t get much more butch than a Jeep. This year’s Grand Cherokee is no exception, with rugged looks, expert off-road capability and better-than-average towing capacity of 6,200 pounds.

There are a dizzying number of trim levels—more than a dozen—starting with the barebones base-model Laredo at an affordable $40,000. The lineup tops out with the Summit Reserve 4xe PHEV, which is almost twice the price at $76,000 and one of various plug-in hybrid versions available. Those plug-in hybrids can drive up to 25 miles on all-electric power before the four-cylinder gas engine kicks in. Otherwise, you can choose from a standard V6 or V8. Gas mileage on all trim levels is basically the same as the competition.

Where the Grand Cherokee really shines is in the handling. More refined than a Wrangler but less lavish than a Land Rover, this Jeep maneuvers just as well on city streets and highways as it does on bumpier terrain.

I tested the mid-range and mid-priced Overland, which comes standard with four-wheel drive and large 20-inch wheels. It also boasts a slew of niceties, such as quilted upholstery, panoramic sunroof and high-tech digital displays. These include a 10.25-inch infotainment touchscreen and rear-seat entertainment system.

The nine-speaker Alpine stereo, designed specifically for the Grand Cherokee, is pleasing. But I really wanted to hear the boffo 19-speaker McIntosh surround-sound system that Jeep also offers. Sigh, it’s only available on the premium Summit trim level.

MERCEDES GLE-CLASS

$64,000

MPG: 20 city/25 highway

0 to 60 mph: 6.6 seconds

Maximum cargo room: 33.3 cu. ft.

PROS: Lush interior, silky-smooth suspension, speedy

CONS: Some confusing electronics, tight third row, many competitors

IN A NUTSHELL: For a more high-class hauler, there’s the Mercedes GLE-Class. This midsize SUV is similar in size to the Jeep Grand Cherokee. But instead of seating five passengers, the GLE can carry up to seven. Sure, legroom in the optional third row may be tight for taller travelers, but it’s perfect for a cocky cockswain or two.

Six trim levels, ranging from the base-model GLE 350 to two high-performance AMG models. For eco-conscious buyers, the GLE 450e plug-in hybrid arrived earlier this year and can run on battery power alone for almost 60 miles.

My test car was the top-of-the-line AMG 63 S 4Matic, a head-turner in every way. Priced at a whopping $127,000, this GLE looks best in glossy black with the Night Package, which includes tasteful jet-black exterior accents and matte-black wheels. To complete the Darth Vader effect, there’s a deep, menacing exhaust rumble that’s downright threatening.

You expect such a ride to be wicked fast, and it is: 0 to 60 mph in a blistering 3.7 seconds. Yet the carbon ceramic brakes with their devil-red calipers are equally impressive in slowing things down quickly.

Inside, each GLE comes with two large digital displays on the elegantly sculpted dashboard. My favorite feature is the “Hey Mercedes” digital assistant, which responds to voice commands such as opening or closing the sunroof, operating the infotainment system or activating the climate controls.

It’s hard to find sport seats that are more comfortable, especially with the heavenly massage function (though those massage controls could be a bit more user-friendly.) For AMG models, the seats come with red-contrasting stitching and red seatbelts—a nod to the devilish demeanor under the hood.

Considering all the SUVs available in showrooms, few make quite the splash of a GLE.

-

State Department3 days ago

State Department3 days agoState Department releases annual human rights report

-

South America1 day ago

South America1 day agoArgentina government dismisses transgender public sector employees

-

District of Columbia1 day ago

District of Columbia1 day agoCatching up with the asexuals and aromantics of D.C.

-

Politics4 days ago

Politics4 days agoSmithsonian staff concerned about future of LGBTQ programming amid GOP scrutiny