National

McDermott introduces pro-gay tax equity bill

Legislation would eliminate tax on employer-provided coverage

The sponsor of legislation that would ensure tax equity for same-sex couples receiving employer-provided health benefits envisions upcoming tax reform legislation as a potential vehicle for passage.

Rep. Jim McDermott (D-Wash.), the sponsor of the Tax Parity for Health Plan Beneficiaries Act, said in an interview with the Washington Blade that he sees an opportunity to move his legislation forward when Congress takes up planned legislation for tax reform.

“It will be easy to put it in some tax bill along the way,” McDermott said. “It won’t be a standalone bill.”

Rep. Dave Camp (R-Mich.), chair of the House Ways & Means Committee, has said he wants to address tax reform during this Congress and has held hearings on the issue, although the time for when the panel will take up the larger bill is still unknown.

A McDermott staffer, who spoke on condition of anonymity, said his boss could amend the larger tax reform legislation with the Tax Parity for Health Plan Beneficiaries Act when it comes before the committee, but said it “depends on the process the Republicans take.”

McDermott’s legislation rectifies an inequity faced by LGBT couples under current law, which exempts employer-provided health coverage for opposite-sex spouses from an employee’s gross income, but makes domestic partner benefits and coverage for same-sex spouses subject to taxation.

Consequently, employees seeking to cover their same-sex partners or spouses pay more income and payroll tax than a straight employee with an opposite-sex spouse.

This inequity also burdens employers who want to extend their health benefits to the partners of their gay employees. Companies that offer such benefits have the administrative burden of calculating taxes separately and have to pay additional payroll taxes.

McDermott said he introduced the legislation, which has been languishing in Congress since 2001, as a “matter of basic fairness” for same-sex couples who are receiving employer-provided health benefits.

“If there is a couple who are in some kind of union, recognized in one way or another, they have to pay taxes on it,” McDermott said. “That’s not fair. Why should a gay couple, or any kind of couples that are living together, using one health insurance plan have to pay taxes whereas if you’re married and not a same-sex couple, you don’t have to pay taxes.”

Joe Solmonese, president of the Human Rights Campaign, said in a statement that the legislation will eliminate an additional barrier that same-sex couples face in securing health insurance coverage.

“This legislation would remove that added tax burden, which can be as much as $2,200 per year, as well as the penalty imposed on fair-minded employers who provide equal benefits to their LGBT employees,” Solmonese said.

In the last Congress, the legislation was included as a provision in a House version of health care reform legislation. However, the language never made it as part of the final bill because the Senate version of health care reform was the bill that made its way to President Obama’s desk.

Despite the failure last week, McDermott said the prospects of passing tax reform legislation this Congress are even greater than last year — even with Republicans in control of the House — because of the plan for Congress to address tax reform legislation by the end of next year.

“We’ve got some Republican sponsors this time,” McDermott said. “As a matter of fact, there are a lot more Republicans who have heard from people in their district who are saying, ‘Just change the tax code and make it easier for us.'”

As of this week, McDermott’s legislation has three co-sponsors: Reps. Richard Hanna (R-N.Y.) , Earl Blumenauer (D-Ore.) and Nan Hayworth (R-N.Y.). In the Senate, Chuck Schumer (D-N.Y.) is set to introduce companion legislation either this week or the next. Sen. Susan Collins (R-Maine) will be an original co-sponsor.

R. Clarke Cooper, executive director of the Log Cabin Republicans, praised the Republican co-sponsors for joining on in early support of the legislation.

“We need common sense, pro-growth policies to give businesses and entrepreneurs renewed confidence in our economy and to remove Washington as the roadblock to job creation,” Cooper said. “Under current policy, the federal tax code is punishing the business community for providing their gay and lesbian employees with benefits. Congress can help private sector growth by eliminating the punitive domestic partner tax.”

An estimated 60 percent of Fortune 500 companies offer health insurance benefits to the same-sex partners of the employees. On May 31, 77 major American businesses — including Alaska Airlines, Microsoft and Boeing — sent a letter to McDermott in support of the legislation.

“Companies like ours in increasing numbers have made the business decision to provide health benefits to such beneficiaries, such as the domestic partners, adult children, certain grandchildren, etc. of our employees,” the letter states. “This coverage and coverage of non-spouse, non-dependent beneficiaries helps corporations attract and retain qualified employees and provides employees with health security on an equitable basis.”

The legislation falls under the jurisdiction of the Republican-controlled House Ways & Means Committee, which most observers expect to be unfriendly to pro-LGBT legislation. Camp’s office didn’t immediately respond to a request for comment on the bill.

However, one of the signers of the legislation is the Dow Chemical Co., which is headquartered in Midland, Mich., and in Camp’s district. Supporters of the legislation are hoping Dow’s endorsement will prompt Camp to support it.

McDermott said he hasn’t had discussions with Camp about his bill yet, but plans to do so when the congressional recess ends at the start of next week.

The administration has also yet to voice support one way or the other for the legislation. Shin Inouye, a White House spokesperson, told the Blade the administration hasn’t yet reviewed the measure.

“While we have not reviewed this specific legislation, the president generally supports efforts to give parity and equal protection to same-sex couples,” Inouye said.

McDermott said he doesn’t see any interim action that President Obama could take to address the situation and said passing legislation is the only to end the tax inequity faced by LGBT couples.

“I think it’s going to require a law change,” McDermott said. “If you keep after something that’s right, then ultimately the stars line up and it passes. That’s what’s going to happen here.”

Pennsylvania

Malcolm Kenyatta could become the first LGBTQ statewide elected official in Pa.

State lawmaker a prominent Biden-Harris 2024 reelection campaign surrogate

Following his win in the Democratic primary contest on Wednesday, Pennsylvania state Rep. Malcolm Kenyatta, who is running for auditor general, is positioned to potentially become the first openly LGBTQ elected official serving the commonwealth.

In a statement celebrating his victory, LGBTQ+ Victory Fund President Annise Parker said, “Pennsylvanians trust Malcolm Kenyatta to be their watchdog as auditor general because that’s exactly what he’s been as a legislator.”

“LGBTQ+ Victory Fund is all in for Malcolm, because we know he has the experience to win this race and carry on his fight for students, seniors and workers as Pennsylvania’s auditor general,” she said.

Parker added, “LGBTQ+ Americans are severely underrepresented in public office and the numbers are even worse for Black LGBTQ+ representation. I look forward to doing everything I can to mobilize LGBTQ+ Pennsylvanians and our allies to get out and vote for Malcolm this November so we can make history.”

In April 2023, Kenyatta was appointed by the White House to serve as director of the Presidential Advisory Commission on Advancing Educational Equity, Excellence and Economic Opportunity for Black Americans.

He has been an active surrogate in the Biden-Harris 2024 reelection campaign.

The White House

White House debuts action plan targeting pollutants in drinking water

Same-sex couples face higher risk from environmental hazards

Headlining an Earth Day event in Northern Virginia’s Prince William Forest on Monday, President Joe Biden announced the disbursement of $7 billion in new grants for solar projects and warned of his Republican opponent’s plans to roll back the progress his administration has made toward addressing the harms of climate change.

The administration has led more than 500 programs geared toward communities most impacted by health and safety hazards like pollution and extreme weather events.

In a statement to the Washington Blade on Wednesday, Brenda Mallory, chair of the White House Council on Environmental Quality, said, “President Biden is leading the most ambitious climate, conservation, and environmental justice agenda in history — and that means working toward a future where all people can breathe clean air, drink clean water, and live in a healthy community.”

“This Earth Week, the Biden-Harris Administration announced $7 billion in solar energy projects for over 900,000 households in disadvantaged communities while creating hundreds of thousands of clean energy jobs, which are being made more accessible by the American Climate Corps,” she said. “President Biden is delivering on his promise to help protect all communities from the impacts of climate change — including the LGBTQI+ community — and that we leave no community behind as we build an equitable and inclusive clean energy economy for all.”

Recent milestones in the administration’s climate policies include the U.S. Environmental Protection Agency’s issuance on April 10 of legally enforceable standard for detecting and treating drinking water contaminated with polyfluoroalkyl substances.

“This rule sets health safeguards and will require public water systems to monitor and reduce the levels of PFAS in our nation’s drinking water, and notify the public of any exceedances of those levels,” according to a White House fact sheet. “The rule sets drinking water limits for five individual PFAS, including the most frequently found PFOA and PFOS.”

The move is expected to protect 100 million Americans from exposure to the “forever chemicals,” which have been linked to severe health problems including cancers, liver and heart damage, and developmental impacts in children.

An interactive dashboard from the United States Geological Survey shows the concentrations of polyfluoroalkyl substances in tapwater are highest in urban areas with dense populations, including cities like New York and Los Angeles.

During Biden’s tenure, the federal government has launched more than 500 programs that are geared toward investing in the communities most impacted by climate change, whether the harms may arise from chemical pollutants, extreme weather events, or other causes.

New research by the Williams Institute at the UCLA School of Law found that because LGBTQ Americans are likelier to live in coastal areas and densely populated cities, households with same-sex couples are likelier to experience the adverse effects of climate change.

The report notes that previous research, including a study that used “national Census data on same-sex households by census tract combined with data on hazardous air pollutants (HAPs) from the National Air Toxics Assessment” to model “the relationship between same-sex households and risk of cancer and respiratory illness” found “that higher prevalence of same-sex households is associated with higher risks for these diseases.”

“Climate change action plans at federal, state, and local levels, including disaster preparedness, response, and recovery plans, must be inclusive and address the specific needs and vulnerabilities facing LGBT people,” the Williams Institute wrote.

With respect to polyfluoroalkyl substances, the EPA’s adoption of new standards follows other federal actions undertaken during the Biden-Harris administration to protect firefighters and healthcare workers, test for and clean up pollution, and phase out or reduce use of the chemicals in fire suppressants, food packaging, and federal procurement.

Maine

Maine governor signs transgender, abortion sanctuary bill into law

Bomb threats made against lawmakers before measure’s passage

BY ERIN REED | On Tuesday, Maine Gov. Janet Mills signed LD 227, a sanctuary bill that protects transgender and abortion providers and patients from out-of-state prosecution, into law.

With this action, Maine becomes the 16th state to explicitly protect trans and abortion care in state law from prosecution. This follows several bomb threats targeting state legislators after social media attacks from far-right anti-trans influencers such as Riley Gaines and Chaya Raichik of Libs of TikTok.

An earlier version of the bill failed in committee after similar attacks in January. Undeterred, Democrats reconvened and added additional protections to the bill before it was passed into law.

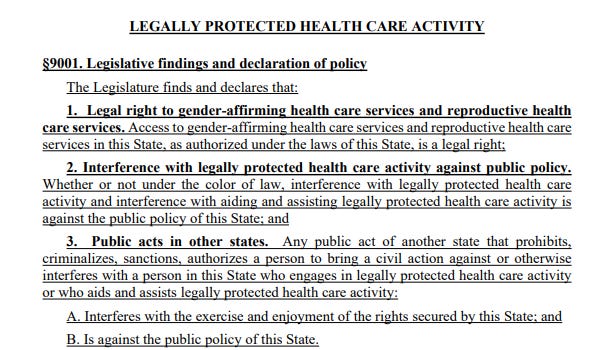

The law is extensive. It asserts that gender-affirming care and reproductive health care are “legal rights” in Maine. It states that criminal and civil actions against providers and patients are not enforceable if the provision or access to that care occurred within Maine’s borders, asserting jurisdiction over those matters.

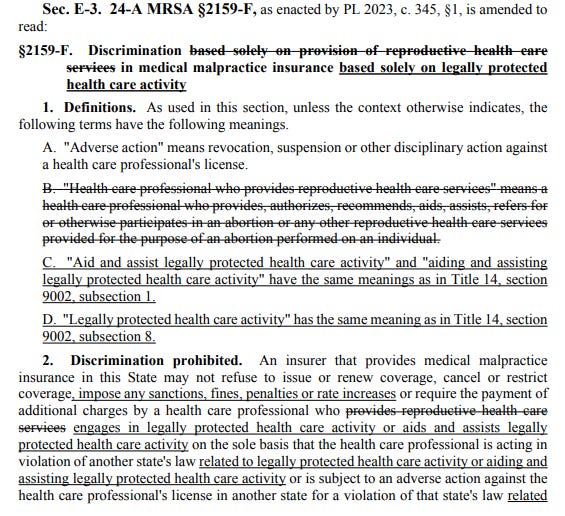

It bars cooperation with out-of-state subpoenas and arrest warrants for gender-affirming care and abortion that happen within the state. It even protects doctors who provide gender-affirming care and abortion from certain adverse actions by medical boards, malpractice insurance, and other regulating entities, shielding those providers from attempts to economically harm them through out-of-state legislation designed to dissuade them from providing care.

You can see the findings section of the bill here:

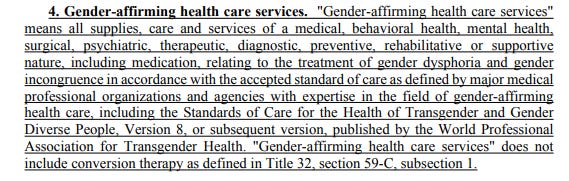

The bill also explicitly enshrines the World Professional Association of Transgender Health’s Standards of Care, which have been the target of right-wing disinformation campaigns, into state law for the coverage of trans healthcare:

The bill is said to be necessary due to attempts to prosecute doctors and seek information from patients across state lines. In recent months, attorneys general in other states have attempted to obtain health care data on trans patients who traveled to obtain care. According to the U.S. Senate Finance Committee, attorneys general in Tennessee, Indiana, Missouri, and Texas attempted to obtain detailed medical records “to terrorize transgender teens in their states … opening the door to criminalizing women’s private reproductive health care choices.”

The most blatant of these attempts was from the attorney general of Texas, who, according to the Senate Finance Committee, “sent demands to at least two non-Texas entities.” One of these entities was Seattle Children’s Hospital, which received a letter threatening administrators with arrest unless they sent data on Texas patients traveling to Seattle to obtain gender-affirming care.

Seattle Children’s Hospital settled that case out of court this week, agreeing to withdraw its Texas business registration in return for Texas dropping its investigation. This likely will have no impact on Seattle Children’s Hospital, which has stated it did not treat any youth via telemedicine or in person in Texas; the hospital will be able to continue treating Texas youth who travel outside of Texas to obtain their care. That settlement was likely compelling due to a nearly identical law in Washington that barred out-of-state investigations on trans care obtained solely in the state of Washington.

The bill has faced a rocky road to passage. A similar bill was debated in January, but after coming under intense attack from anti-trans activists who misleadingly called it a “transgender trafficking bill,” the bill was voluntarily withdrawn by its sponsor.

When LD 227 was introduced, it faced even more attacks from Gaines and Libs of TikTok. These attacks were followed by bomb threats that forced the evacuation of the legislature, promising “death to pedophiles” and stating that a bomb would detonate within a few hours in the capitol building.

Despite these threats, legislators strengthened both the abortion and gender-affirming care provisions and pressed forward, passing the bill into law. Provisions found in the new bill include protecting people who “aid and assist” gender-affirming care and abortion, protections against court orders from other states for care obtained in Maine, and even protections against adverse actions by health insurance and malpractice insurance providers, which have been recent targets of out-of-state legislation aimed at financially discouraging doctors from providing gender-affirming care and abortion care even in states where it is legal.

See a few of the extensive health insurance and malpractice provisions here:

Speaking about the bill, Gia Drew, executive director of Equality Maine, said in a statement, “We are thrilled to see LD 227, the shield bill, be signed into law by Gov. Mills. Thanks to our pro equality and pro reproductive choice elected officials who refused to back down in the face of disinformation. This bill couldn’t come into effect at a better time, as more than 40 percent of states across the country have either banned or attempted to block access to reproductive care, which includes abortions, as well as transgender healthcare for minors. Thanks to our coalition partners who worked tirelessly to phone bank, lobby, and get this bill over the finish line to protect community health.”

Destie Hohman Sprague of the Maine Women’s Lobby celebrated the passage of the bill despite threats of violence, saying in a statement, “A gender-just Maine ensures that all Mainers have access to quality health care that supports their mental and physical wellbeing and bodily autonomy, including comprehensive reproductive and gender-affirming care. We celebrate the passage of LD 227, which helps us meet that goal. Still, the patterns of violence and disinformation ahead of the vote reflected the growing connections between misogyny, extremism, and anti-democratic threats and actions. We must continue to advocate for policies that protect bodily autonomy, and push back against extremist rhetoric that threatens our states’ rights and our citizens’ freedoms.”

The decision to pass the legislation comes as the Biden administration released updated HIPAA protections that protect “reproductive health care” from out-of-state prosecutions and investigations.

Although the definition of “reproductive health care” is broad in the new HIPAA regulations, it is uncertain whether they will include gender-affirming care. For at least 16 states, though, gender-affirming care is now explicitly protected by state law and shielded from out-of-state legislation, providing trans people and those seeking abortions with protections as the fight increasingly crosses state lines.

****************************************************************************

Erin Reed is a transgender woman (she/her pronouns) and researcher who tracks anti-LGBTQ+ legislation around the world and helps people become better advocates for their queer family, friends, colleagues, and community. Reed also is a social media consultant and public speaker.

******************************************************************************************

The preceding article was first published at Erin In The Morning and is republished with permission.

-

State Department3 days ago

State Department3 days agoState Department releases annual human rights report

-

Maryland4 days ago

Maryland4 days agoJoe Vogel campaign holds ‘Big Gay Canvass Kickoff’

-

Politics4 days ago

Politics4 days agoSmithsonian staff concerned about future of LGBTQ programming amid GOP scrutiny

-

District of Columbia22 hours ago

District of Columbia22 hours agoCatching up with the asexuals and aromantics of D.C.