Real Estate

What the tax bill means for buyers, homeowners

There’s good news and there’s bad news

There’s good news and there’s bad news in the new tax bill.

In case you missed it, the hotly debated new tax bill has officially passed. Since real estate is one of the key areas of change in the bill, everyone is asking us, “What does the new tax bill mean for me? Is this good news or bad news for D.C.-area buyers and sellers?” The answer, as it so often is in real estate is, “it depends!”

The initial version of this new tax bill would have been troublesome for real estate values in our area. It slashed the mortgage deduction in half, had big changes for capital gains, and made it much more expensive to move. Several changes were made between the initial draft and the final form, which makes the final impact of the bill more of a mixed bag. There’s good news and there’s bad news.

So without further ado, here are the main changes and takeaways affecting homeowners in our area.

MORTGAGE INTEREST DEDUCTION

THE CHANGE: Through the end of 2025, new homebuyers will only be able to deduct interest on the first $750,000 of a mortgage (down from $1 million). In 2026, the deduction cap will revert to $1 million in loan value. Existing mortgages will be unaffected.

THE IMPACT: None for existing homeowners or new buyers with loan amounts under $750,000. While this reduction is bad news for upper price point buyers, the news is much better than the original proposal, which was a reduction to $500,000 and would have affected the majority of mortgages in our area. Remember, these are loan amounts – NOT sales prices. Thus, the only impact will be for buyers with loans above $750,000 – which most often is homes above $825,000 – depending on how much the buyer is financing. While it is possible the bill could cause a small slowdown for “move-up” buyers in our market, we don’t anticipate this causing a major change now. The impact of the new cap will probably make it less attractive to refinance in upper brackets. If your loan existed before December 14, 2017 up to $1,00,000 can still deduct the interest as long as the new loan does not exceed the amount refinanced.

Let’s look at Buyers A & B to see how this new cap comes into play.

Buyer A is putting 10% down on a sales price of $825,000, meaning he has a loan of $750,000, which is the deduction limit. Buyer A would be unaffected.

Buyer B is putting 10% down on $1,000,000, which is a loan amount of $900,000. The deduction can still be taken, but can only be taken on the first $750,000. Buyer B would not be able to deduct the interest paid on $150,000 of the loan (the difference between $750K-$900K).

HOME EQUITY LOAN INTEREST DEDUCTION

THE CHANGE: The new tax bill also suspends the deduction for interest on home equity loans until 2026. Currently, deductions are allowed for loans up to $100,000. Caveat: the interest on a home-equity loan can be deducted if the proceeds are used to substantially improve the home.

THE IMPACT: This change makes it less attractive for homeowners to take out equity lines on their homes in order to do minor renovations or use their home’s equity to pay for other things like kids’ college tuition or other big purchases. While this change is certainly frustrating for those planning to take advantage of these loans, it shouldn’t affect the housing market in a significant way since it is typically utilized by homeowners who have been in their properties for several years (and have equity) and are planning to stay longer to regain the equity over time.

MORTGAGE INTEREST ON A SECOND HOME DEDUCTION

THE CHANGE: The interest deduction on loans for a second home will still be allowed. However, homeowners can only deduct the first $750,000 of interest on the combined value of loans on their first and second homes.

THE IMPACT: Owners of multiple properties will feel this one. The bad news is there is likely to be a large impact on housing markets in resort or second home areas, as it will certainly be more expensive to own more than one property. While we are not a second home market, we have many clients buying properties in our area to be near their kids and grandkids. Similarly, we have many service members who take advantage of their housing allowance and low down payment opportunities with VA loans to keep their homes in other areas while buying a home when they are stationed here in the DC area. The impact of this change remains to be seen.

“SALT” DEDUCTION FOR STATE & LOCAL PROPERTY TAX

THE CHANGE: Individuals can only deduct up to $10,000 in state and local income and property taxes or state and local property and sales taxes. Previously, there was no cap on this deduction.

THE IMPACT: Homeowners living in high property tax states (like New Jersey with an average rate of 2.38%) will likely see an increased tax bill come April. Nationally, ATTOM Data Solutions estimates that 4.1 million Americans pay more than $10,000 in property taxes so it will affect many Americans. Locally, average property tax rates are more reasonable (Maryland is 1.1% which is #22 nationally, Virginia is .78% which ranks #37 nationally and D.C. is .57% bringing up the rear at #46 nationally), so it should have less of an impact here than it does in some of the higher-taxed states.

DEDUCTIONS FOR WORK-RELATED MOVING EXPENSES

THE CHANGE: Reasonable moving expenses for work-related relocations are no longer deductible – with the exception of those in the military.

THE IMPACT: While it is possible that fewer people will want to move due to this deduction, generally these types of moves come with increased salaries and opportunity, so we don’t anticipate big changes to the market because of this change.

CAPITAL GAINS

NO CHANGE. Despite some back and forth, the deduction for up to $500,000 in capital gains (or $250,000 for single filers) from selling a primary home remains (so as long as it has been the primary residence for two of the last five years). This is a big win, as previous versions of the bill sought to make the tenure requirements five of the last eight years as the primary residence.

SO, WHAT DOES THE NEW TAX BILL MEAN FOR HOMEOWNERS & HOUSE HUNTERS?

The good news is that many of the real estate changes in the new tax bill will have much less of an impact than previous versions of the bill suggested. On the plus side, it’s possible that the impact of the lowered deduction could be offset by lower income taxes for these high-end homebuyers, specifically business owners or those in “pass-through” businesses, which will see a big tax deduction on their income.

The bad news is we might see an impact in our “move up” market. We will carefully watch buyers’ reactions to the home mortgage deduction limit to $750,000, which could make “moving up” slightly more difficult in upper bracket price points. This change is likely to have the biggest impact in our market. Nationally, we may see a decrease in people buying vacation properties so resort areas will likely take a hit. We’ve read statistics that predict the changes could lower home values by 4%.

The bottom line? While there might be some slow down and a temporary dip in values while everyone comes to terms with the changes in the new tax bill, we don’t anticipate a significant long-term effect at this point. This is certainly a change from our perspective just a few short weeks ago when the bill was still in draft form.

We have been following this bill closely and know how impactful these changes are to your life. We’re here to help you through this complex process. If you are thinking of buying or selling and wondering what these changes might mean for you and your bottom line, please reach out. We are always happy to help.

Allison Goodhart DuShuttle is lead agent for The Goodhart Group, Alexandria’s and McEnearney Associates’ top-producing real estate team. In 2015, she was nationally recognized by Realtor Magazine, being named to its “30 Under 30” club. Allison can be reached at 703-362-3221 or [email protected].

Real Estate

Real terrors of homeownership come from neglect, not ghosts

Mold, termites, frayed wires scarier than any poltergeist

Each October, we decorate our homes with cobwebs, skeletons, and flickering jack-o’-lanterns to create that spooky Halloween atmosphere. But for anyone who’s ever been through a home inspection there’s no need for fake scares. Homes can hide terrors that send chills down your spine any time of year. From ghostly noises in the attic to toxic monsters in the basement, here are some of the eeriest (but real) things inspectors and homeowners discover.

Every haunted house movie starts with a creepy basement, and in real life, it’s often just as menacing. Mold, mildew, and hidden water leaks lurk down there like invisible phantoms. At first, it’s just a musty smell — something you might brush off as “old house syndrome,” but soon enough, you realize those black or green patches creeping along the walls can be more sinister than any poltergeist.

Black mold (Stachybotrys chartarum) is particularly fearsome – it thrives in damp, dark places and can cause serious respiratory problems. It’s not just gross – it’s toxic and, while some types of mold can be easily cleaned up, removing black mold can cost more than an exorcism.

Have you ever heard strange buzzing or seen flickering lights that seem to move on their own? Before you call the Ghostbusters, call an electrician. Faulty wiring, outdated panels, and aluminum circuits from the mid-20th century are the true villains behind many mysterious house fires. Home inspectors can also find open junction boxes, frayed wires stuffed behind walls, or overloaded breaker panels that hum like a restless spirit.

Imagine an invisible specter floating through your home – something that’s been there since the 1950s, waiting for you to disturb it. That’s asbestos. Home inspectors dread discovering asbestos insulation around old boilers or wrapped around ductwork. It’s often lurking in popcorn ceilings, floor tiles, and even wall plaster. You can’t see it, smell it, or feel it—but inhaling those microscopic fibers can lead to serious illness decades later.

Lead pipes, once thought to be durable and reliable, are like the vampires of your water system – quietly poisoning what sustains you. The results of a lead test can be chilling: even a small amount of lead exposure is dangerous, particularly for children.

And it’s not just pipes – lead paint is another problem that refuses to die. You might find it sealed beneath layers of newer paint, biding its time until it chips or flakes away. This is why, when selling a property built prior to 1978, homeowners must disclose any knowledge of lead paint in the home and provide any records they may have of its presence or abatement.

Scratching in the walls. Tiny footsteps overhead. Droppings in the attic. It’s not a poltergeist – it’s pests. Termites, rats, bats, carpenter ants, and even raccoons can do more damage than any ghost ever could.

Termites are the silent assassins of the home world, chewing through beams and joists until the structure itself starts to sag. Rats and mice leave behind droppings that can spread disease and contaminate food. Bats are federally protected, meaning your haunted attic guests can’t just be evicted without proper precautions. And I once had a raccoon give birth in my chimney flue; my dogs went crazy.

Ever step into a home and feel the floors tilt under your feet? That’s no ghostly illusion – it’s the foundation shifting beneath you. Cracked walls, doors that won’t close, and windows that rattle in their frames are the architectural equivalent of a horror movie scream.

Foundation damage can come from settling soil, poor drainage, or tree roots rising from under the structure. In extreme cases, inspectors find entire crawl spaces flooded, joists eaten by rot, or support beams cracked like brittle bones. Repair costs can be monstrous – and if left unchecked, the whole house could become a haunted ruin.

Some homes hold more than just physical scares. Behind the drywall or under the floorboards, inspectors may uncover personal relics – old letters, photographs, even hidden safes or forgotten rooms. Occasionally, however, there are stranger finds: jars of preserved “specimens,” taxidermy gone wrong, or mysterious symbols scrawled in attic spaces.

These discoveries tell stories of the people who lived there before, sometimes fascinating, sometimes chilling, but they all add to the eerie charm of an old home, reminding us that every house has a history — and some histories don’t like to stay buried.

So, while haunted houses may be a Halloween fantasy, the real terrors in homeownership come from neglect, not ghosts. Regular inspections, good maintenance, and modern updates are the garlic and holy water that turn a trick of a home into a treat.

Valerie M. Blake is a licensed associate broker in D.C., Maryland, and Virginia with RLAH @properties. Call or text her at 202-246-8602, email her via DCHomeQuest.com, or follow her on Facebook at TheRealst8ofAffairs.

Real Estate

LGBTQ home ownership index 2025

Half of queer buyers have experienced or suspected discrimination

Half of LGBTQ+ buyers in the United States say they have experienced or suspected discrimination during the housing process, a new survey commissioned by Gay Real Estate has found. That single figure captures the reality behind one of life’s biggest milestones: buying a home is still not an equal journey for everyone.

Discrimination does not just hurt feelings. It limits access to neighborhoods, delays buying decisions, and pushes many to conceal who they are in order to secure housing. These patterns reveal the added weight LGBTQ+ people carry in a process that should be about opportunity and stability.

At Gay Real Estate, our mission is to connect LGBTQ+ individuals with trusted agents who understand these challenges and provide supportive guidance throughout the buying process. To explore this, we put together The LGBTQ+ Home Ownership Index 2025, which draws on new survey data to uncover these challenges, showing how identity influences every stage of the housing journey. From neighborhood choice to financing, here’s the data that highlights both the barriers and the resilience of LGBTQ+ buyers…

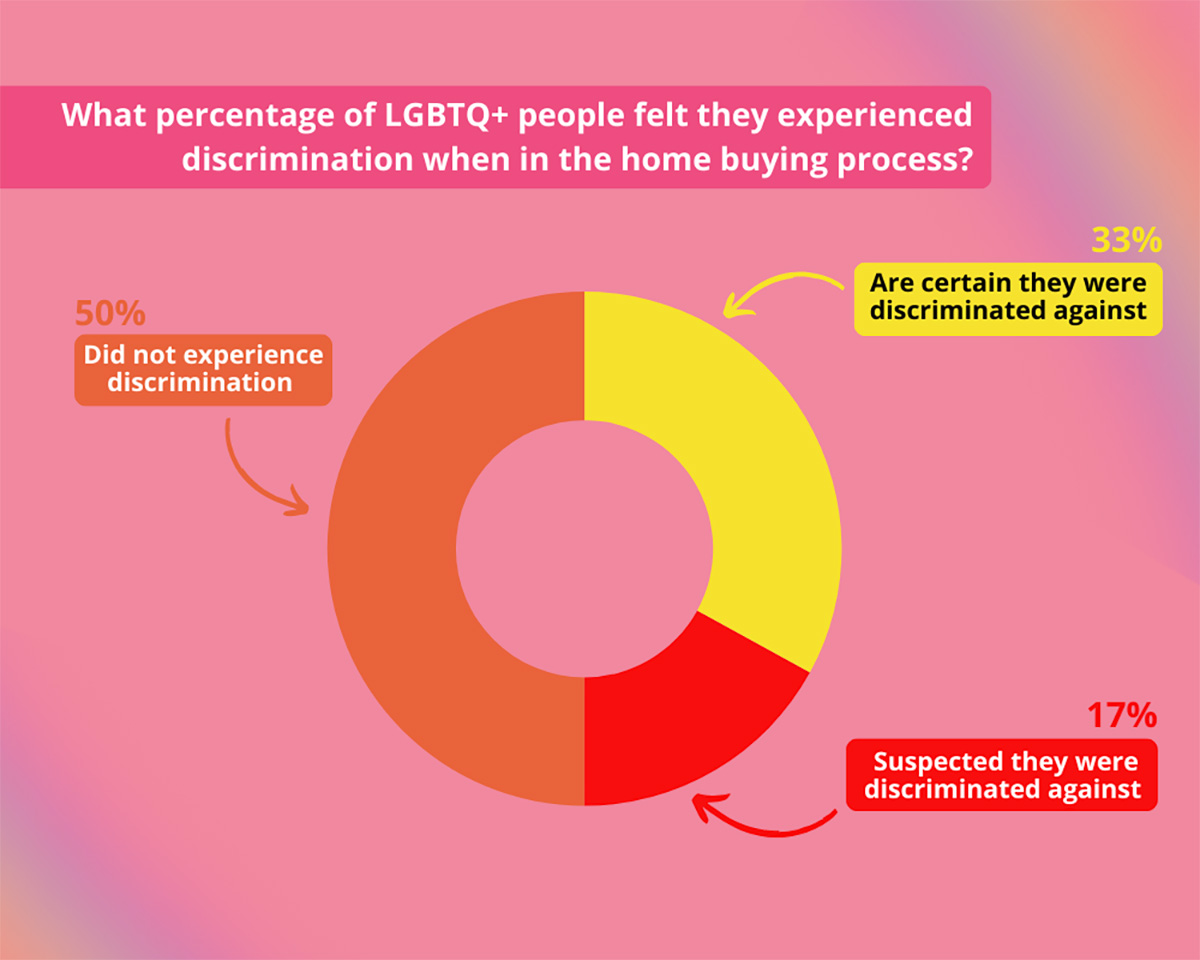

Discrimination Shapes the Homebuying Journey

Discrimination does not always take place in obvious forms. It might surface during an initial phone call, a property viewing, or even while negotiating terms. For LGBTQ+ buyers, these moments are often enough to alter decisions about whether to proceed at all. In fact…

- 33% have experienced discrimination due to their LGBTQ+ identity when in the home buying process.

- 17% suspected they were discriminated against, but could not be certain it was due to their identity.

- Combined, this means half of LGBTQ+ buyers report experiencing or suspecting discrimination.

For many, this ongoing risk changes the way they approach each stage of the process. Some hesitate to enquire about certain properties, while others walk away from negotiations when bias appears. These are not isolated frustrations but a pattern that continues to influence housing access nationwide.

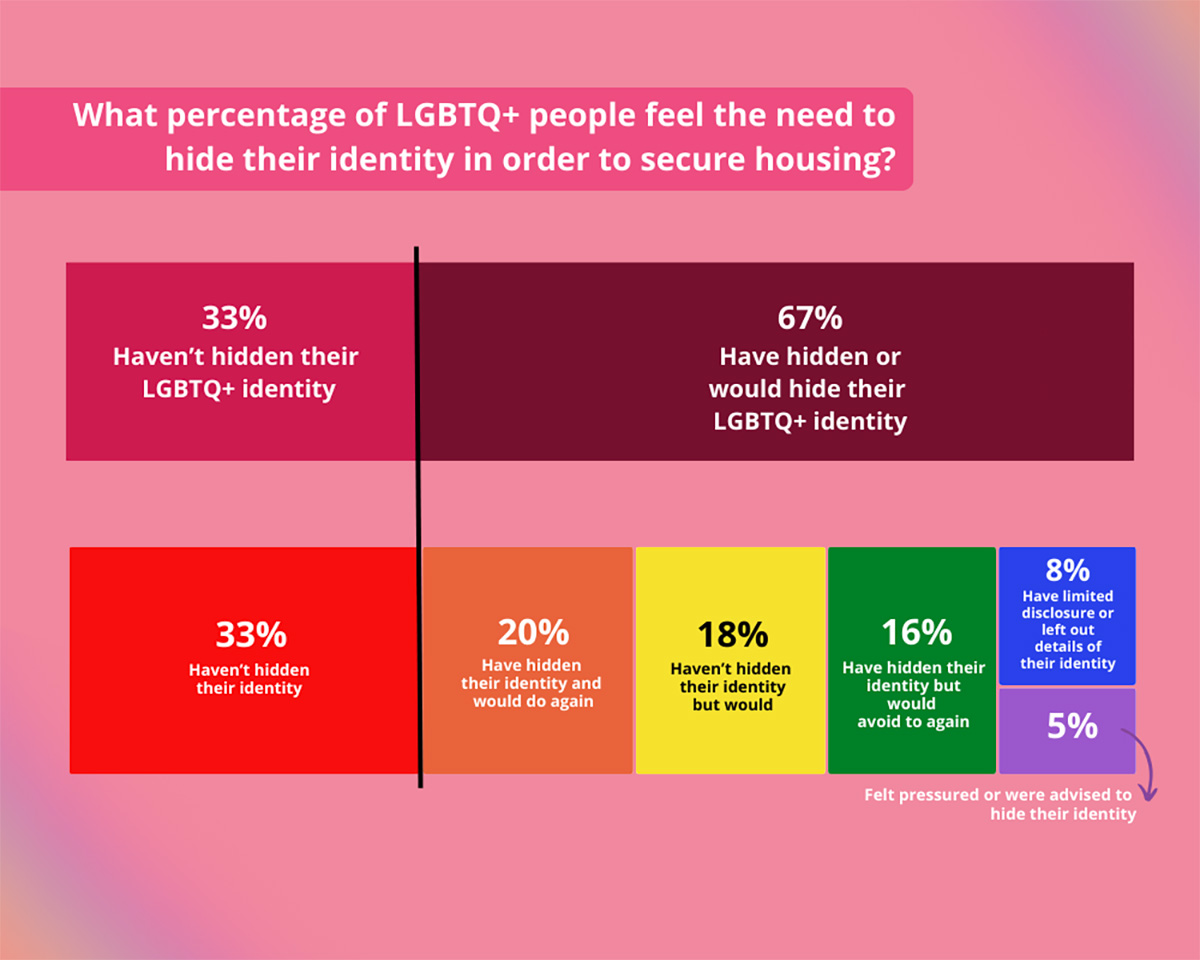

Why Many Feel Pressure to Conceal their Identity

A striking 67% of the LGBTQ+ people surveyed either have hidden, considered hiding their identity, were pressured to hide their identity, or had limited disclosure of their identity while navigating the housing market. This can occur during property viewings, mortgage applications, or even casual conversations with landlords and neighbors.

This concealment is not about preference but survival. LGTBQ+ homebuyers weigh the risk of being open against the potential of being denied, steered elsewhere, or subjected to worse terms. The reality is that many feel they must downplay who they are in order to secure something as fundamental as a home.

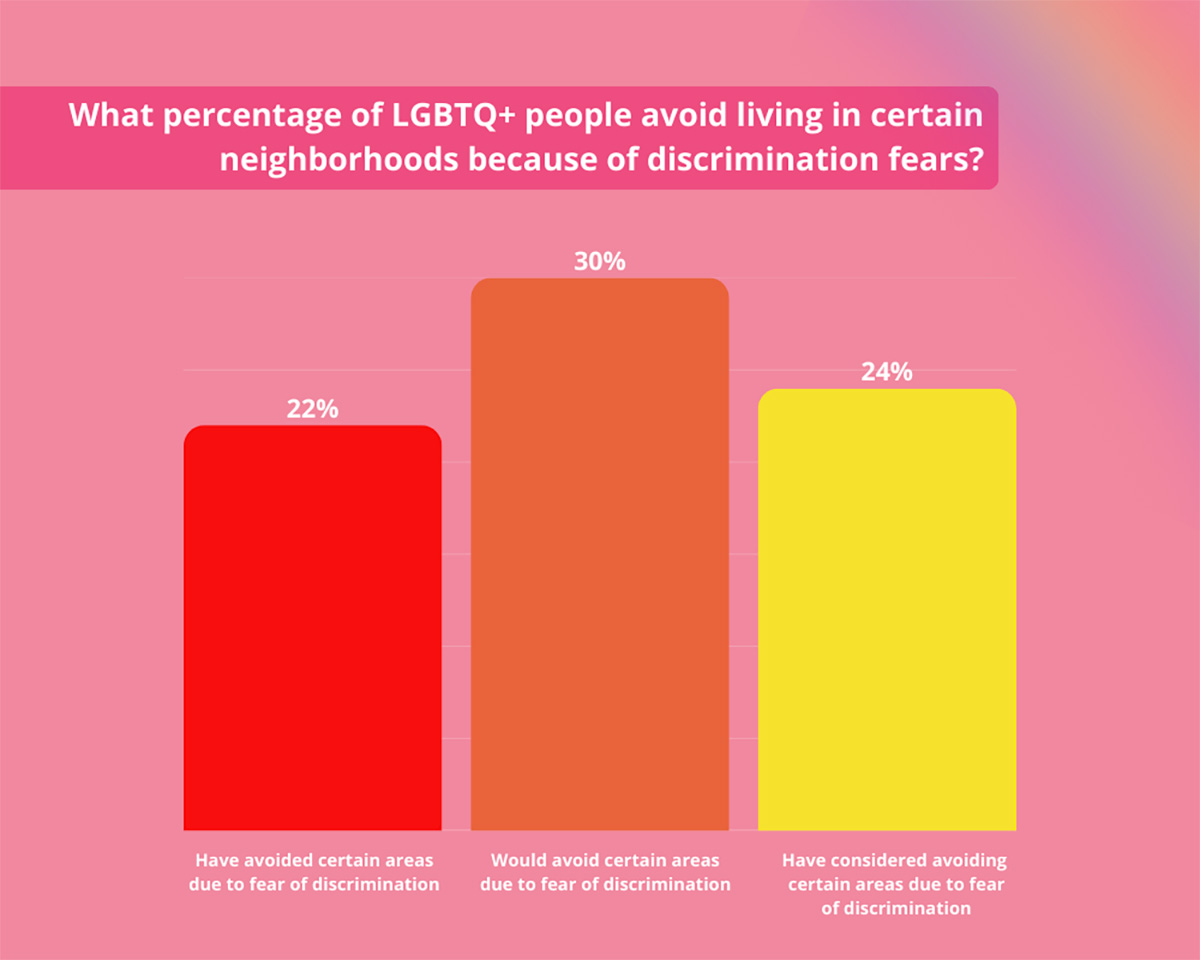

How Neighborhood Choice is Limited by Discrimination

Location is a defining factor in real estate, yet for LGBTQ+ buyers it’s not just about schools, commute times, or amenities. It’s also about whether they feel comfortable walking around the streets, holding a partner’s hand, or participating in local life. The survey results show how deeply these considerations shape decisions:

- 22% have avoided certain areas due to fear of LGBTQ+ discrimination.

- 30% would avoid areas in the future for the same reason.

- 24% have at least considered avoiding certain areas.

Feelings of unease extend beyond neighborhoods. Eight in ten report experiencing at least some level of discomfort or risk that changes their behavior. This might mean avoiding viewings at night, skipping certain open houses, or limiting their search to areas perceived as more welcoming.

Politics, Legislation, and Timing

The decision to buy a home often comes with timing questions about jobs, interest rates, and personal finances. For LGBTQ+ buyers, the political and legal climate can be just as influential, with 24% reporting that they have delayed buying a home, and 17% are considering delaying because of these concerns. On top of this, 12% have even decided not to buy at all.

Altogether, 53% report that political or legal conditions have directly shaped when or whether they buy. These delays are not about whether or not they can make the decision, but about careful risk management. Many want assurance that their rights and investments will be protected before taking such a significant financial step.

The Cost of an LGBTQ-Friendly Area

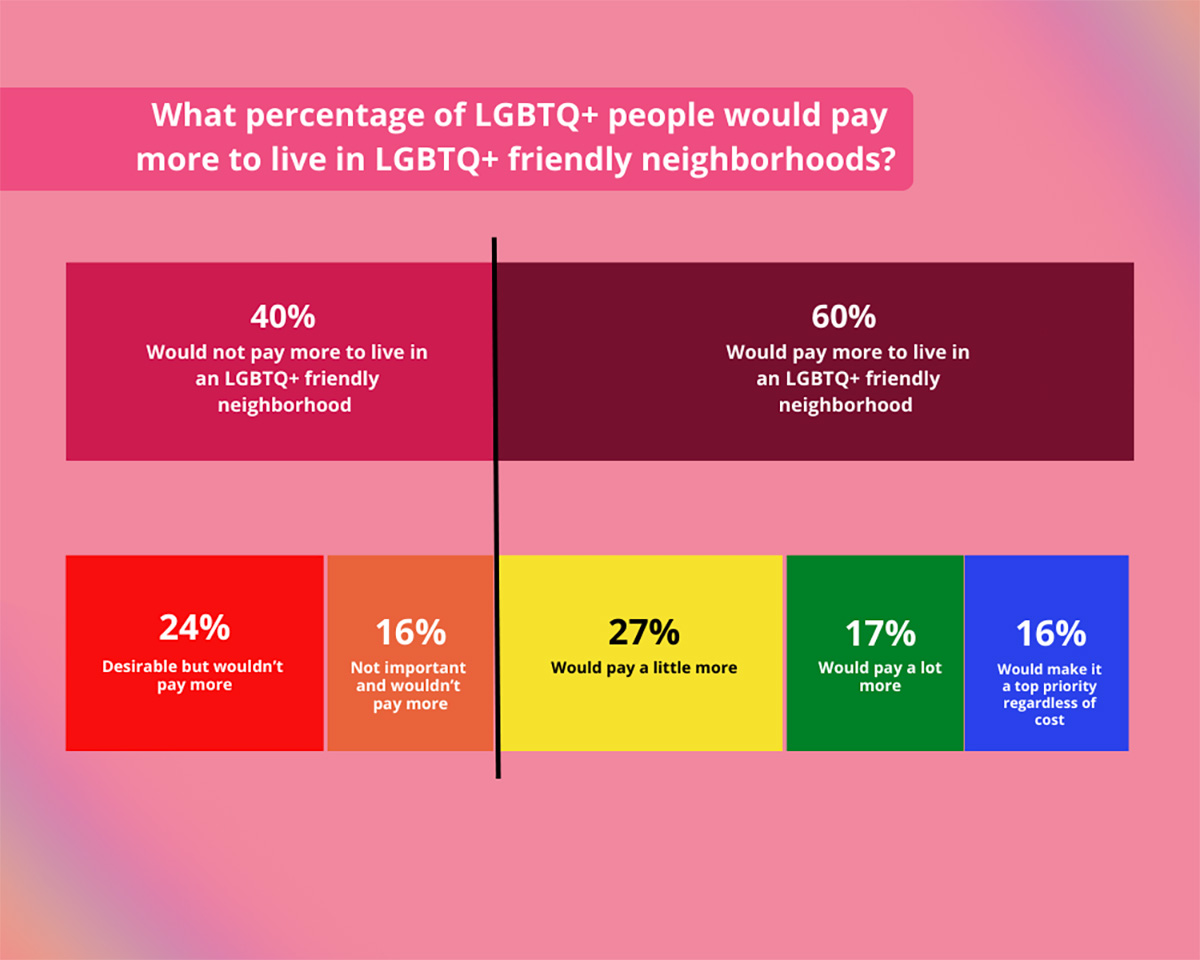

For most people, cost is the single biggest factor in choosing where to live, yet 3 in 5 LGBTQ+ buyers are willing to pay more to live in areas they know will be affirming.

Combined, 60% are willing to trade financial savings for the stability and predictability of an affirming environment. This is not treated as a luxury but as a necessity, one that enables people to live more freely and fully in their own homes.

LGBTQ-Friendly States and Cities

When it comes to LGBTQ+ friendly places to buy a home, certain U.S. states and cities stand out. Our recent survey of 700 respondents revealed which areas are top of mind for prospective LGBTQ+ homeowners.

California

Leading the way, California was cited by 17.6% of respondents. Homebuyers here highlight strong legal protections, vibrant communities, and the availability of LGBTQ+-friendly real estate agents in California as key factors when deciding on timing and location.

New York

Close behind is The Big Apple, with 16.7% of respondents naming the state. Buyers appreciate its inclusive neighborhoods and the broad choice of agents experienced in supporting LGBTQ+ clients, making the process smoother and safer.

San Francisco

At the city level, San Francisco was mentioned by 9.7% of respondents. The city’s historic LGBTQ+ culture and welcoming communities make it a top pick for those seeking both social connection and secure homeownership.

Los Angeles

Cited by 7% of respondents, LA offers diverse neighborhoods and a strong network of supportive real estate professionals, helping buyers feel confident in their timing and choices.

Atlanta

Mentioned by 5%, Atlanta is increasingly recognised for its progressive neighborhoods and growing LGBTQ+ community, providing new options for LGBTQ+ homeownership in the South.

Why LGBTQ-Friendly Agents Matter

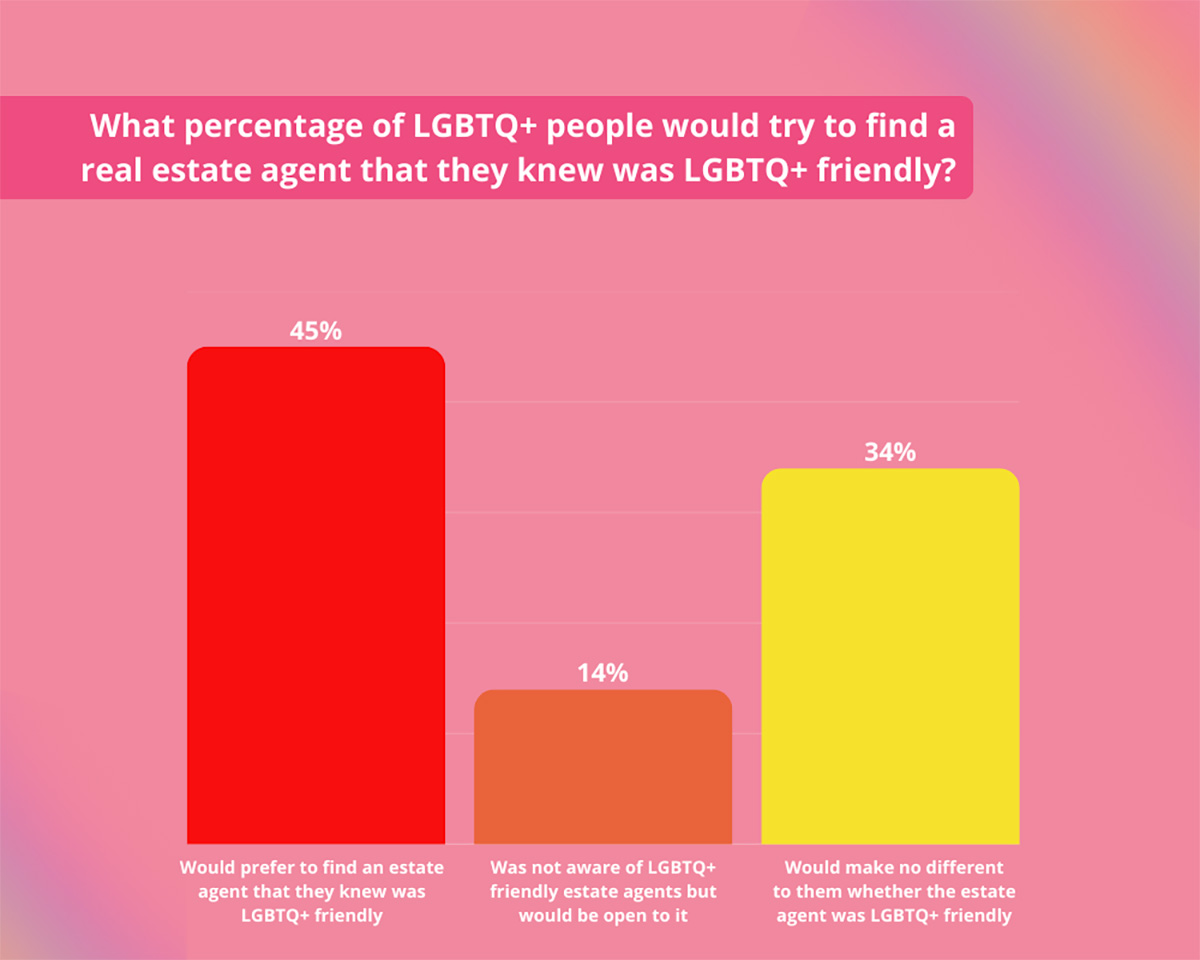

Choosing a realtor is about more than just market expertise. For LGBTQ+ buyers, it can also determine how comfortable they feel disclosing personal information, how they are treated during negotiations, and whether subtle steering is avoided.

45% of respondents agreed that they are more likely to choose an LGBTQ+ friendly real estate agent over a general agent, while 14% were not aware this was even an option, but expressed interest nonetheless.

That means nearly 6 in 10 are either actively seeking or open to working with an LGBTQ+-friendly agent, like those at Gay Real Estate. For many, aligned professionals mean fewer risks of bias, more transparent conversations, and better overall outcomes.

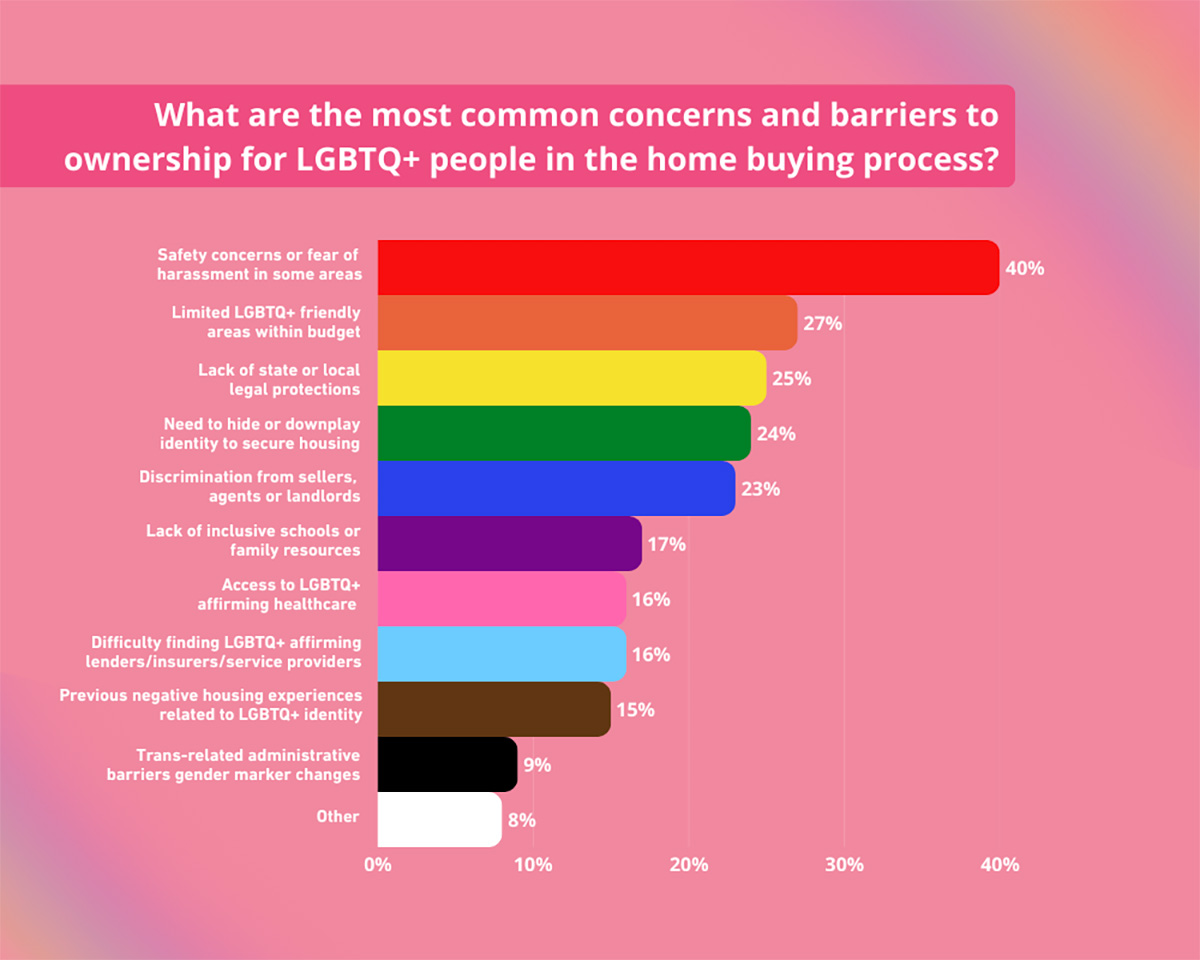

The Barriers to Ownership

The survey also reveals how multiple obstacles stack together, slowing or even stopping LGBTQ+ buyers from achieving homeownership. These barriers are not minor inconveniences but compounding pressures that reduce choice and delay progress. Key obstacles reported include:

- Concerns about harassment in certain areas.

- Struggling to find LGBTQ+-friendly areas within budget.

- Lack of local legal protections.

- The need to hide or downplay their identity to secure housing.

- Direct discrimination from sellers, agents, or landlords.

- The lack of inclusive schools and family resources.

- Access to healthcare.

- Facing negative housing experiences related to their LGBTQ+ identity.

In total, that’s 76% of the community that reports facing at least one barrier connected to their discrimination or identity.

Patterns of Incidents

Discrimination is not always obvious, but it may leave a paper trail. Survey respondents reported harassment, exclusion, and unfavorable terms across many different stages of the buying process, including:

- Harassment, derogatory comments, or intimidation (9%).

- Being steered to or away from certain areas (7%).

- Discrimination by a landlord or property manager (5%).

- Discrimination by a seller or real estate agent (5%)

- Being refused a viewing or property (4%)

- Being offered worse terms, higher prices, or additional conditions (4%)

Recognizing these patterns is the first step, but buyers should also document these incidents, keep written records, and work with agents who can support them in escalating issues when necessary.

Moving forward with support

Buying a home is never just about property. It’s about belonging, stability, and being able to live authentically. The LGBTQ+ Home Ownership Index 2025 shows how discrimination, concealment, and external pressures continue to shape this journey, but it also highlights the resilience of those navigating it.

At Gay Real Estate, we believe no one should have to compromise their identity to find the right home. Our network of LGBTQ+-friendly agents is here to provide knowledgeable, affirming support from the first search to closing day.

If you’re ready to start your home search with an agent who understands your needs, connect with an LGBTQ+ friendly real estate agent today.

Methodology

A survey of 700 people from the USA was commissioned by Gay Real Estate. Respondents were all a part of the LGBTQ+ community to provide real-life experiences and accurate results.

For more information visit GayRealEstate.com.

Real Estate

How a gov’t shutdown impacts D.C. real estate market

Prices normally drop, then rebound after reopening

As we enter week three of the latest government shutdown, Washington feels quiet, both in the halls of Congress and in the open houses around our city. Agents and sellers will tell you with a defeated lilt in their voice that, despite lower rates and a relatively strong economy, listings are sometimes just not selling — no matter the price drops.

And yet, despite this depressed sentiment held by so many in the industry, the numbers are telling an almost entirely different story. The latest statistics available through the main regional multiple listing service (MLS), BrightMLS, show that not only is sales volume up since September 2024, but so is the median sale price. In fact, overall listing inventory is not skyrocketing as so many on social media would have you believe — it’s actually on par with this time last year too. So how can the vibe be so mismatched with the data?

First, to go deeper into the numbers, the new listings in August of 2024 were just over 850, and in 2025 there were 816 in the same month. September of 2025 saw only 100 more new listings than September 2024. Meanwhile the number of units sold in both months this year were higher, and September of this year was actually higher by about 10%.

The median values data also tell a happy story: the median sale price in September of this year is $677,500, which is up a whopping 12.7% over the median sales price of $601,250 in September of 2024. On a year to date basis, the numbers are more modest, but still show an overall 2% increase in values.

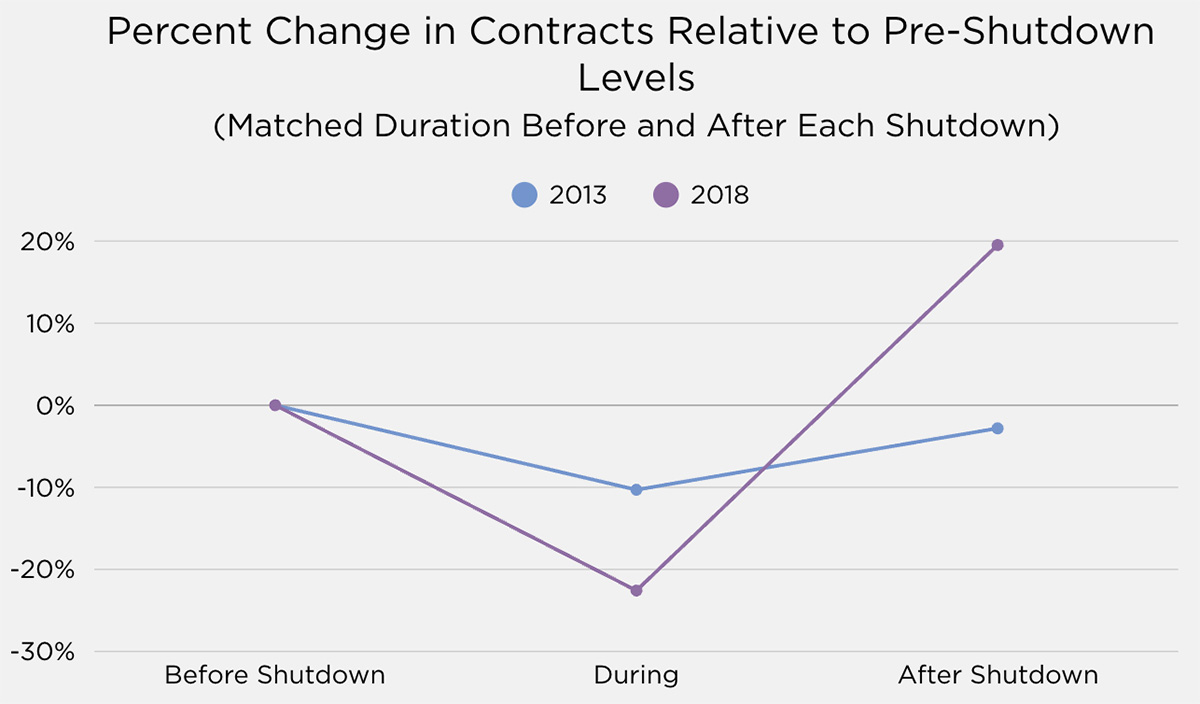

Justin Levitch, the data whisperer and president of RLAH Real Estate, went a step further to explore the impact of previous shutdowns on the market to predict the effects of this one on our market. He found that in the weeks leading up to previous shutdowns, and the time of the shutdowns themselves, and the weeks after them, there was a noticeable drop in market activity, between 10% in 2013 and over 20% in 2018. But in both cases, the market basically rebounded just after the shutdown occurred: in 2013, the number of contracts signed vs. a ‘normal’ time period was down just a hair at around 3% under normal, but in 2018, contracts signed shot up to 20% above normal in the weeks following that event. Thirteen days into our current shutdown, new contracts are already down about 20% from their average over the last three years, so here’s hoping for a 2018-style rebound when this shutdown ends– assuming it does.

Levitch continues his analysis with a question about how the shutdown may also intersect with another market question about this fourth quarter versus last year’s: Q4 in 2024 saw the largest increase in closed sales over any previous year’s quarter since before 2022, at over 16%. This is undoubtedly a result of two back-to-back rate drops that occurred around election time last year. With a rate drop recently in the books, we could be poised for another similar bump this quarter, especially if it happens again. But with the shutdown firmly in place, will that still happen? That is certainly the big question on all our minds.

Markets like this are tough for buyers and sellers to understand and navigate, because even with the data to chew on, a clear path toward meeting their goals is not always apparent. That’s why choosing a capable and thoughtful Realtor as a guide is so critical. Experience dealing with tough markets, perseverance to see a strategy through to successful closing, and systems to ensure the plan is going according to plan are all essential elements to look for in your partner.

If you find that combination, whether with a team like Bediz Group or another agent, you might become one of these happy stats, and not watching others win from the sidelines.

David Bediz is the owner of Bediz Group, LLC at RLAH Real Estate, and also owns Home Starts Here, a loan brokerage. Both are licensed in D.C., Maryland, Virginia and Delaware and exist to serve the needs of buyers and sellers in every price range. Bediz Group has been awarded the Best of Gay DC award at least five times, including this year. More at www.bediz.com or 202-642-1616.

-

District of Columbia1 day ago

District of Columbia1 day ago‘Sandwich guy’ not guilty in assault case

-

Sports2 days ago

Sports2 days agoGay speedskater racing toward a more inclusive future in sports

-

Celebrity News4 days ago

Celebrity News4 days agoJonathan Bailey is People’s first openly gay ‘Sexiest Man Alive’

-

Opinions5 days ago

Opinions5 days agoNew York City mayoral race gets nasty but Mamdani will win