Opinions

D.C. CFO: Federal tax cuts will benefit most residents

Unless District rates are lowered, some will see modest hike in local taxes

Unless District rates are lowered, some will see a modest hike in local taxes.

D.C. CFO Jeffrey DeWitt on Tuesday released a comprehensive analysis on the local effect of federal tax reforms enacted in December.

For a large majority of taxpayers, the tax-relief news is good.

DeWitt’s “Summary of the Effects of Major Provisions of the ‘Tax Cuts and Jobs Act’ on District Residents and Businesses” characterizes the legislation as “the most significant revision to the federal tax system since 1986.”

The report estimates “83 percent of District taxpayers will experience a decrease or experience no change in their combined net federal and District income taxes.”

Fully 64 percent of D.C. taxpayers will see a net drop in local and federal income taxes owed. The median combined tax decrease will be $1,159, totaling $670.6 million in the aggregate.

An estimated 19 percent will see no change to their combined federal and local income tax liability. Only 17 percent of D.C. taxpayers will see their total taxes increase, by a median amount of $929, collectively totaling $139.9 million.

The net tax-reduction benefit for all D.C. taxpayers resulting from the federal tax changes for combined federal and District income taxes will total $530.7 million. This will place more than half-a-billion dollars in the wallets of city taxpayers and the local economy.

Separating the tax liability changes affecting District taxpayers for federal taxes from D.C. tax liabilities results in slightly differing configurations.

Nearly three-in-four D.C. taxpayers, at 71 percent, will see a reduction in their federal taxes owed, by a median amount of $1,206, while 15 percent will experience no change. Only 14 percent of local taxpayers will experience a federal tax increase, at a median amount of $815. Those with a federal tax increase will collectively pay $109.1 million more, with this increased federal levy offset by $726.4 million in federal tax cuts, or a net reduction of $617.3 million for D.C. taxpayers.

Examining the effect of federal tax reform on D.C. income tax collections, 57 percent of District taxpayers will experience a tax decrease or no change in taxes owed, while 43 percent will see a local tax increase. The median D.C. tax reduction will be $88, while the median increase will be $336 and will mostly affect taxpayers with incomes between $50,000 and $200,000, as well as incomes up to $500,000.

Notably, despite the high-profile brouhaha regarding the new federal limitation on the State and Local Tax Deduction (SALT), and the panic-rush by some to pre-pay their top-end property taxes, only three percent of primarily higher-wealth residents will experience a tax increase as a result.

The D.C. income tax impact will increase the next-year city income tax haul by $56.4 million. Already-high business taxes will also rise by $2 million. The federal doubling of the estate tax exemption threshold, unless negated by local legislation, will reduce District revenue by $6.5 million. This nets a total $51.9 million additional tax revenues in FY2019.

These additional monies, however, void an essential component of recent local tax reforms.

Most states, as does the District, adopt federal definitions of income for tax simplicity. This results in income taxable at the federal level also being locally taxable and with federal exemptions also applicable. Under recent D.C. tax reforms, the personal exemption had gradually increased to match the federal amount.

However, with the new federal law eliminating the personal exemption – now replaced by a doubled standard deduction – some middle-to-upper income taxpayers will experience a slight local tax increase if the higher standard deduction does not offset their prior combined standard deduction and personal exemption.

Preserving the widely acclaimed and locally welcomed benefits of progressive D.C. tax reforms just completed will require lowering local rates.

Whether D.C. elected officials will have adequate fortitude to enact a very modest equalizing adjustment reducing local tax rates by a microscopic amount far less than one-percent while simultaneously demonstrating sufficient spine to stare down demands by “spend-more” groups for ever-increasing city expenditures is the question.

Mark Lee is a long-time entrepreneur and community business advocate. Follow on Twitter: @MarkLeeDC. Reach him at [email protected].

Opinions

Open or closed? No, not your bar tab

The swinging couple’s dream is the hopeless romantic’s nightmare

(Editor’s note: This is the first of a two-part feature on open relationships.)

Boy meets boy. Boy likes boy.

For the first time in a long time, boy feels that thing, that connection, that spark with boy.

Then one day boy grabs dinner with boy. Boy’s smiles and laughs throughout are equal parts sincere and excited. Boy wonders, is this the one? After all this time, has it finally happened?

Boy takes boy home. Boys cuddle. Boys kiss. Boys have amazing sex. And in the glowing aftermath of what can only be described as a perfect night, boy spots an unnoticed ring.

“What’s that?” boy asks.

“My wedding ring,” the other replies. “I thought you knew.”

When I returned to D.C. in 2016, I quickly received a lecture on why open relationships were the future of queer love. Nearly eight years later, they’ve more than just sprouted among the gay scene – they’ve overtaken the landscape. Simultaneously, what became the swinging couple’s dream descended into the hopeless romantic’s nightmare.

It’s not all so bad given what comes with it: a lot of sex, particularly with hotties who were off-limits before. However, alongside that sex comes a minefield of rules and regulations open couples create but horny singles must abide by. One wrong move, and you’re the villain.

Truthfully, I’ve soiree’d with open couples before, both separate and together. On the bad end, things get awkward – particularly between me and the other partner. On the good end, I might come home satisfied, but the moment I hop on my couch to watch rerun television, I realize I’m back to where I started: alone.

If you’re like me and not yet onboard with an open relationship, it’s also easy to feel like a fish out of water. Queer social outings can sometimes become a Swinging 70’s Redux, with partners passed around like gay dishes at a potluck. Next up: ass, and lots of it.

This leads to another issue: in a scene full of open couples, detached sex is more than just accepted – it’s often expected. The moment you let emotional attachment enter the equation, you lose. Now even the singles are trained to run away, for your attachment may prevent them from jumping onto – or into – the next in their queue. And I can’t even get upset, for I’ve been that guy before.

For all these reasons, I wanted to dive further into the rise of open relationships. All I needed was someone in an open relationship willing to speak on the matter.

“That’s easy,” quipped my coworker, Chad. “Just open Grindr.”

Chad and I met working at the pub, and under similar circumstances; he lost his day job a few months after me losing mine. We quickly found solace in our shared circumstance, and now he and I hang in the kitchen of a gay bar divulging details of our sex lives and pining to meet the man of our dreams.

And Chad wasn’t wrong, for these days Grindr is chockfull of profiles in open relationships looking to play. Yet it turned out I wouldn’t need Grindr, for at that moment, in pranced our fellow coworker, Scott.

There’s no better way to describe Scott than this: They’re a bundle of positivity and joy. Oddly, I didn’t meet Scott at the bar but rather at a coffee shop in Petworth in 2018, where they were my regular barista. Little did I know we’d work together half a decade later. Life is funny that way, isn’t it?

Outside the bar, Scott is an actor in productions across the DMV. Naturally, they became my biggest inspiration for abandoning my career for the arts. Following a bar shift last summer we smoked a blunt and talked about it. They taught me to tune out the noise and follow my heart.

Together, Chad and Scott became my newfound support system. In a way we’re like the Three Musketeers – equally gay, just a lot more working class.

Of course, as soon as Scott entered, I had to ask: “Are you and your partner open?”

Scott smiled coyly. “Oh yes, honey.”

So as fate had it, here in the kitchen of a gay bar, I had both ends of the open/closed spectrum represented. On one side Chad, a self-proclaimed romantic seeking monogamy; on the other, the fully open Scott.

While there were many takeaways from our conversations on the matter, I distilled six truths in the debate between open and closed relationships. But please, take these with a grain of salt – I am just a barback, after all.

- Monogamy is rooted in tradition.

For many of us, gay or straight, finding our one and only was a dream of our youth. Mine was supposed to be Colby Donaldson from season 2 of the hit TV show “Survivor,” but life had other plans.

Yet many never dissect where this desire stems from. Our culture is inundated with stories of princesses rescued by their prince and true love’s kiss setting us free. There seemed to be a script we had to follow, and if we didn’t, no worries – God would simply banish us to hell.

This is a common starting point for both the monogamist and the open connoisseur. When I asked Chad what drew him toward monogamy, he replied, “Honestly, it was how I was raised: settle down, have kids, and carry on the family name. I didn’t have any non-traditional role models.”

Meanwhile, Scott’s past reservations toward open relationships were for similar reasons. “When I was younger, I was not pro-open relationship,” they told me. “I didn’t understand the intricacies of it. I didn’t understand the nuances of it. I also grew up in a very conservative, Catholic household.”

Both responses touch on a key argument in the pro-open saga: that closed relationships are often reflections of tradition, ranging from folklore to religion, and these traditions held queer people back for centuries. If queer means subverting these traditions, then monogamy is simply outdated. Or so they say.

- The desire to be open is biological.

Over time, Scott’s views on being open changed. “As I matured and grew into my queerness,” they started, “and saw friends with alternative lifestyles, I realized this is something I could be interested in.”

In Scott’s relationship, this led to an understanding of the core needs for them and their partner. “I knew my partner’s libido was higher than mine. For me, it came from a desire to allow my partner to experience something I wasn’t able to fulfill fully. I personally get a lot of pleasure knowing my partner can go out, meet people, and make connections, knowing at the end of the day we will be each other’s number one priority and person.”

Scott’s libido reference made me wonder: are open relationships taking off across the LGBTQ community, or specifically among sex-obsessed gay men? Realizing this conversation should probably be more inclusive, I made an arduous journey east – roughly 150 feet, to the front entrance.

Kelsey is a hot badass who works the door of the bar. She’s stylish, a fellow Aires like myself, and I once told Chad I thought she was Fabulous with a capital F. I realized then I’m getting gayer by the minute.

While Kelsey is currently in a closed relationship, she enlightened me to the status among lesbians. “It’s about 50/50 with the ones I know,” she replied. Honestly, this surprised me, mainly because I figured men were the ones dicking around.

Kelsey has also been in open relationships before, and she isn’t exactly closed to that route again. “I don’t think people were made for one person for the rest of their life,” she added. This reflected what Scott shared as well: “The human body craves sex to different degrees, and as you get older those degrees wax and wane.”

To me, both statements highlight that the desire to be with others sexually is natural for many, so caging that desire can feel confining. As queer people, we can all relate to that.

Next week: Part two looks at finding the right reasons for pursuing an open relationship.

Jake Stewart is a D.C.-based writer and barback.

Opinions

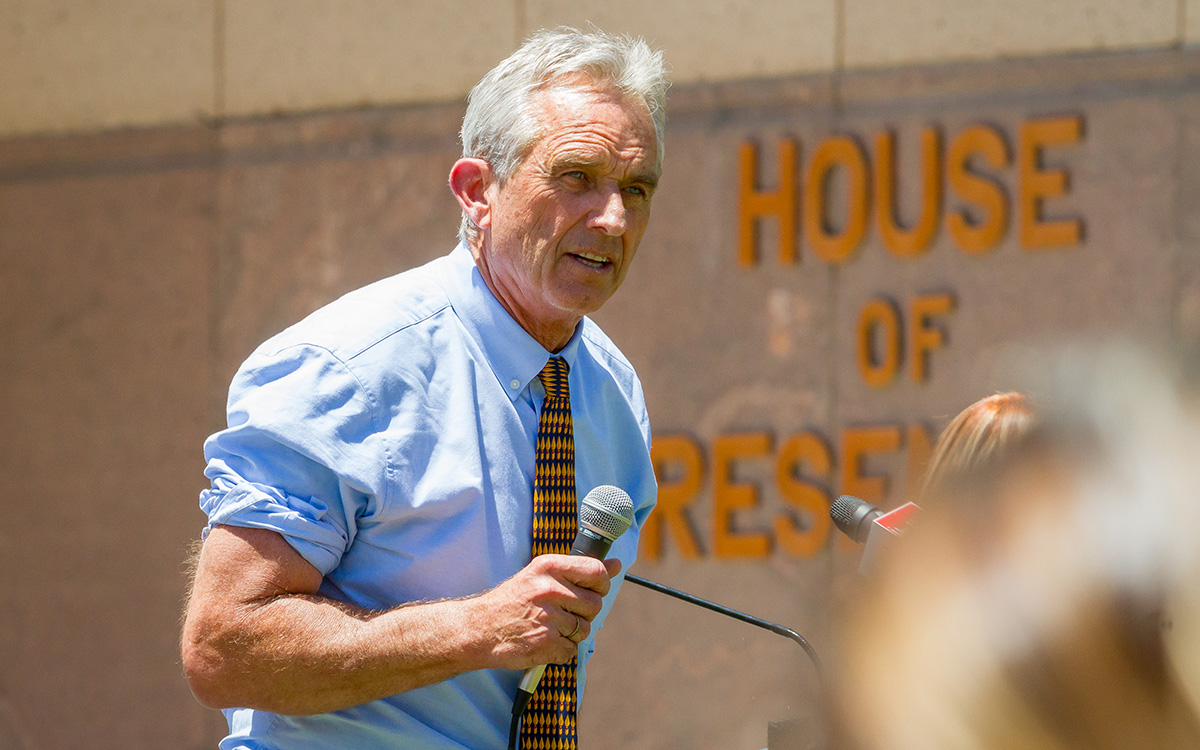

RFK Jr. a dangerous spoiler helping Trump

A reckless man now on the ballot in several swing states

Robert F. Kennedy Jr. is an embarrassment to his family, and to so many others like me who supported his father and uncle. He uses his last name to try to gain credibility and that is sad.

His real claim to fame is being an anti-vaxxer and lying about what impact vaccinations will have on the health of the American people. Were it up to him, and God forbid he had been president during the COVID-19 pandemic, millions more Americans would have died. Because of his dangerous lies, many more will die of diseases once nearly eradicated, like measles.

Listening to RFK Jr. is difficult because of his voice. The cause of that is Spasmodic dysphonia, a rare neurological condition, in which an abnormality in the brain’s neural network results in involuntary spasms of the muscles that open or close the vocal cords. He has said, “I feel sorry for the people who have to listen to me.” I am also sorry for people who listen to him, but not because of his disability. I am sorry for those who listen to him because of the garbage he spouts when he speaks. He is actually a man with dangerous ideas, and one whose outsized ego could end up getting us Donald Trump as president.

Kennedy is an environmental lawyer who recently made the bizarre statement, “Biden is a ‘much worse’ threat to democracy than Trump.” Like Trump, Kennedy is forever making statements like that and then trying to weasel out of them like he has with this one. The statement reminded me of when Susan Sarandon said in 2016, “there is no significant difference between Donald Trump and Hillary Clinton.”

Kennedy recently sent out a campaign email saying the Jan. 6 Capitol Hill rioters were simply “activists.” Then when the blowback got too strong, he blamed that on someone else. Kennedy is a lawyer with no real government or foreign policy experience. Unfortunately, that doesn’t seem to matter to many Americans, even though Trump clearly proved it should. We live in an often dangerous, and very complicated, world. A president has to deal with issues that could mean life or death, such as the wars in Ukraine and the Middle East.

Like Trump, RFK Jr. is on his third wife. His current wife is the talented actress, Cheryl Hines. When asked whether she agrees with his views Hines said, “there are some political topics she differs on with her husband, which she did not disclose.” She did mention one and referenced “the time Kennedy, made a comparison to the Holocaust while delivering a speech at a rally against vaccine mandates. She assured her Twitter followers she found the comparison ‘reprehensible.’ We can all agree it was reprehensible but so is much of what RFK Jr. says.

Kennedy recently named Nicole Shanahan as his running mate. Her ex-husband is Sergey Brin, one of the founders of Google. She is a California lawyer involved in the tech field. It looks like she bought her way onto the ticket donating millions of dollars, including $4 million, toward the Super Bowl ad Kennedy produced. He will use her money to help get him on ballots across the nation. As of April 10th Kennedy is already on the ballot in Utah, and his campaign has gathered the necessary signatures to be on the ballot in New Hampshire, Nevada, Hawaii, North Carolina and Idaho, according to a recent campaign news release.

If he gets on swing state ballots, it heightens his chance of being a spoiler. The reality of this was touted by one of his staffers who when talking to a group of Republicans about the campaign in New York, said “The only way that Trump can even see the remote possibility of taking New York is if Bobby is on the ballot. If it’s Trump vs. Biden, Biden wins. Biden wins six days, seven days a week. With Bobby in the mix, anything can happen. How do we block Biden from winning the presidency? Again, that’s the number one priority for me.”

After the blowback, Kennedy said she didn’t speak for the campaign and let her go. But in reality, when looking at who to choose as my candidate I look at the people he/she surrounds themselves with. Who is advising them? I guess for Kennedy it doesn’t really matter since he won’t be elected. But it is time people like Kennedy stop trying to fool the American people into thinking they could win.

He will simply get the political epitaph ‘Spoiler’ if Trump wins. No one will remember him for anything else. Let’s pray, and work hard, to see that doesn’t happen.

Peter Rosenstein is a longtime LGBTQ rights and Democratic Party activist. He writes regularly for the Blade.

Opinions

The High Road – Walking the Pathway to National Cannabis Legalization

Grassroots organizing has been the driving force behind shifting public perception and pushing for policy changes in the cannabis industry

As we gear up for a major election year, the buzz around cannabis legalization is getting louder. Policymakers are starting to see the need for comprehensive reform, while advocates and small business owners in the industry are cautiously optimistic about the future. But let’s not kid ourselves, this system was designed to keep certain communities out, and it’s crucial that we continue to address these deep-rooted inequities as we blaze the trail forward. A step towards legalization that doesn’t prioritize equity and dismantle the barriers that have held back marginalized groups would be a major bummer. In this op-ed, we’re going to take a groovy journey through the evolution of grassroots organizing in the cannabis industry and highlight the importance of social equity in achieving true national cannabis legalization and boosting our humanity along the way.

Over the years, I’ve been right in the thick of it, helping to build grassroots organizations like Supernova Woman and Equity Trade Network. These groups have been on the frontlines, fighting for cannabis programs in Oakland and San Francisco. I’ve also rocked my own brand, Gift of Doja, and organized the first Cannabis Garden at a major neighborhood street fair, Carnaval San Francisco. I even served as the chair of the first Cannabis Oversight Committee in the nation. But the real magic has always happened in when working in coalitions. Each individual and organization brings a unique piece to the puzzle. Grassroots organizating is as challenging as crafting a democratic society but is worth the effort in generating workable implementable solutions. Collective efforts have been game-changers in shifting public opinion and paving the way for major policy changes at both the state and local levels.

As we navigate the path towards cannabis legalization, lobbyist and lawmakers can’t forget about the small business owners who have been grinding to build their dreams. Political advocacy and lobbying are important, but if we’re not uplifting the voices and experiences of those who have been fighting on the ground, we’re missing the mark. Big companies can hire lobbyists, but small business owners don’t have that luxury and if we are not in the room we are on the table. Coalitions allow for us to be in the room when we can’t physically be there. Our communities, especially people of color, have been hit hard by systemic oppression, from over-policing to mass incarceration and limited economic opportunities to limit our ability to be in the room of power and decision making.

Social equity needs to be front and center in any cannabis legalization efforts. It’s not enough to just remove criminal penalties or create a legal market. We need to actively work on repairing the damage caused by years of prohibition. That means fighting for resources, investment, and low-interest loans for small businesses. It means creating a tiered fee and tax structure that doesn’t crush the little guys. And it means opening up equity programs to all industries, not just cannabis. Social justice without economic access and repair is like a joint without a lighter – it just won’t spark the change we need. We have a responsibility to evolve the economy and break down unnecessary barriers. Activism, social justice, and economic reform are all connected, man.

Industry leaders, culture creators, advocates, and consumers alike, we all need to step up and promote social equity. It’s on us to support initiatives that provide resources, mentorship, and funding for individuals from affected communities to enter the legal cannabis market. And let’s not forget the power of our wallets. Buying from companies that align with our values and support the work we believe in can send a powerful message. Voting with our dollars might just be more impactful than showing up at the ballot box.

As we head into a major election year, the cannabis industry is at a crossroads. It’s a time for drumming up voter interest and for candidates to make promises that grassroots organizations have fought hard for. Small business owners will be navigating a tricky landscape, but we can’t lose sight of the power of collective work. By keeping social equity at the forefront, we can undo the harms of the past while building new frameworks that will shape a brighter future for all.

In conclusion, grassroots organizing has been the driving force behind shifting public perception and pushing for policy changes in the cannabis industry. But let’s not forget that true national cannabis legalization can only be achieved if we address social equity. It’s time for us to come together, listen to the voices of those most impacted, and walk the high road towards a future where cannabis legalization isn’t just about business opportunities, but also about healing and empowerment for all communities. Let’s light up a joint of social justice and blaze a trail towards a better tomorrow.

Nina Parks, Co-Founder of Equity Trade Network & Supernova Women [email protected]

-

Africa4 days ago

Africa4 days agoCongolese lawmaker introduces anti-homosexuality bill

-

District of Columbia18 hours ago

District of Columbia18 hours agoReenactment of first gay rights picket at White House draws interest of tourists

-

World4 days ago

World4 days agoOut in the World: LGBTQ news from Europe and Asia

-

Arizona22 hours ago

Arizona22 hours agoAriz. governor vetoes anti-transgender, Ten Commandments bill