Living

Delve into a mature love story

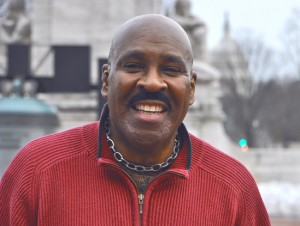

Local gay author Wyatt O'Brian Evans will read from his new book March 20 at the DC Center. (DC Agenda photo by Michael Key)

In a truly distinctive genre of LGBT literature — dubbed here “the stroke love story” — the blow-by-blow steamy sex doesn’t begin until page 115. And by then it will blow the whitewalls off your tires. That’s the welcome character of the new novel, “Nothing Can Tear Us Apart” by gay African-American writer Wyatt O’Brian Evans, a native Washingtonian.

Spoiler alert! This is not a Harlequin romance of the sort where the lovers court and spark and sulk and simmer but then the action suddenly ceases when the tight, straining bodice is finally torn away from the heaving bosom, or the sleek six-pack abs.

Read this novel, yes by all means, for its steamy sex scenes, for they truly sizzle with sexy-cool and super-hot, get-it-on, hard-core action. But first, also get to know the two lead gay characters: fabulously wealthy black entertainment mogul and stand-up comic Wes Kelly, and his lover Antonio Rios, also his fabulously muscled bodyguard. Get to know them first, in other words, as real, three-dimensional, “manly men of color,” real men, facing challenges in the relationship as they are caught up in the undertow and cross-currents of a powerful romance, their lives etched sharply in an intensely erotic love story, not as mere erogenous images.

Get to know them also on Saturday, March 20 when the author — now a resident of Silver Spring, Md. — brings them fully alive as they were formed in his imagination when he gives a book reading at the DC Center.

In an interview exclusive to DC Agenda, Evans acknowledged how much his protagonist Wes embodies his own identity but also that he is no carbon-copy cutout. “Some of me is Wes, some of me is not, but the core of me is,” declared Evans.

“Wes is like me in that he has core values,” pointedly including a belief in God and Jesus Christ, true also for Evans, who puts it bluntly about his own life: “I wouldn’t be here today without a strong belief in God and Jesus Christ,” adding, “I’m very spiritual — I pray several times a day.”

“Wes is like me, very loyal, sometimes to a fault, and he is affectionate — manly affectionate — and not afraid to show it,” said Evans. “I want to blow away all the stereotypes in this novel.” But the author believes he is unlike his creation in key respects, for while “Wes is no fool for love, he can be just a tad needy, and I’m not like that, oh no no no!”

Wyatt points out that Wes “enjoys power.”

“I also enjoy power,” Evans concedes, “but I don’t enjoy it probably as much as Wes does, in other words I’m a softer version of him.” In person, however, “soft” is the very last adjective that would come to mind, for Evans is powerfully gym-built with a cocoa complexion and gleaming pate and laughing eyes exuding sensuality and command, from years spent on the stand-up comic circuit — a career he plans to reactivate later this year.

In addition, Evans has had a long career as a journalist. He holds two bachelor’s degrees from George Washington University — in journalism and in political science — after graduating from D.C.’s McKinley Tech High School. His career in journalism really began in boyhood when, he recalls, “I created my own comic book company, and I would write dialogue, draw and color the panels. … I love to write, and journalism has always fascinated me.”

The novel is a fascinating blend of mature love story, dogged by the real-life challenges of worry over being cheated on, and also questions of vying for who’s on top (literally), as well as a seductively sexy and slam-bam account of nights and days spent in the proverbial sack, when all inhibitions are cast aside in a tangle of naked abandon. So rest assured that the novel is replete with happy endings, even if the ultimate happy ending remains in doubt until the very end — will they wed or will the green-eyed devil drive them apart?

Wes is stalked by a crime-lord eager to exploit suspicions Wes and ‘Tonio have about their mutual fidelity. For issues of monogamy and also partner abuse are just as central to this tale as are real-life credible tensions within the LGBT community, as seen in the relationship between Wes and ‘Tonio in veiled disquiet and even sometimes outright hostility between Latino brown and African-American black in what Evans calls “racism” pure and simple.

The ultimate purpose of the ideology of white supremacy, Evans believes, is “to prevent white genetic annihilation on Earth, a planet on which the overwhelming majority of people are classified as non-white by white-skinned people.”

Evans’ book reading takes place 6-9 p.m., Saturday, March 20 at the DC Center, 1810 14th St., N.W., and copies of ‘Nothing Can Drive Us Apart’ can be purchased then at a $20 special discount price. Copies can also be obtained for $24.95 at wyattobrianevans.net or directly from www.lulu.com/content/833337.

Autos

Sport haulers: Jeep Grand Cherokee, Mercedes GLE-Class

Updated cabins, adept handling, and more

Now that March Madness and the Masters are over, it’s time for, well, everything else. For my husband and me, this means water sports, as in kayaks and rowing sculls, which is why we trekked to the Potomac for the George Washington Invitational regatta last weekend.

Alas, high winds splashed cold water on the event, canceling much of it. But there was still plenty of spirited camaraderie to rival “The Boys in the Boat.”

And I was reminded of my time years ago as a rower with D.C. Strokes, ferrying teammates to races up and down the East Coast. Back then my ride was a dated, rather cramped four-door sedan.

If only we could have paddled around in a sporty SUV like the two reviewed here. Now that would have been some smooth sailing (wink-wink).

JEEP GRAND CHEROKEE

$40,000

MPG: 19 city/26 highway

0 to 60 mph: 7.5 seconds

Maximum cargo room: 37.7 cu. ft.

PROS: Updated cabin, adept handling, strong towing

CONS: So-so gas mileage, no third row, pricey trim levels

IN A NUTSHELL: Rough, tough and buff. It’s doesn’t get much more butch than a Jeep. This year’s Grand Cherokee is no exception, with rugged looks, expert off-road capability and better-than-average towing capacity of 6,200 pounds.

There are a dizzying number of trim levels—more than a dozen—starting with the barebones base-model Laredo at an affordable $40,000. The lineup tops out with the Summit Reserve 4xe PHEV, which is almost twice the price at $76,000 and one of various plug-in hybrid versions available. Those plug-in hybrids can drive up to 25 miles on all-electric power before the four-cylinder gas engine kicks in. Otherwise, you can choose from a standard V6 or V8. Gas mileage on all trim levels is basically the same as the competition.

Where the Grand Cherokee really shines is in the handling. More refined than a Wrangler but less lavish than a Land Rover, this Jeep maneuvers just as well on city streets and highways as it does on bumpier terrain.

I tested the mid-range and mid-priced Overland, which comes standard with four-wheel drive and large 20-inch wheels. It also boasts a slew of niceties, such as quilted upholstery, panoramic sunroof and high-tech digital displays. These include a 10.25-inch infotainment touchscreen and rear-seat entertainment system.

The nine-speaker Alpine stereo, designed specifically for the Grand Cherokee, is pleasing. But I really wanted to hear the boffo 19-speaker McIntosh surround-sound system that Jeep also offers. Sigh, it’s only available on the premium Summit trim level.

MERCEDES GLE-CLASS

$64,000

MPG: 20 city/25 highway

0 to 60 mph: 6.6 seconds

Maximum cargo room: 33.3 cu. ft.

PROS: Lush interior, silky-smooth suspension, speedy

CONS: Some confusing electronics, tight third row, many competitors

IN A NUTSHELL: For a more high-class hauler, there’s the Mercedes GLE-Class. This midsize SUV is similar in size to the Jeep Grand Cherokee. But instead of seating five passengers, the GLE can carry up to seven. Sure, legroom in the optional third row may be tight for taller travelers, but it’s perfect for a cocky cockswain or two.

Six trim levels, ranging from the base-model GLE 350 to two high-performance AMG models. For eco-conscious buyers, the GLE 450e plug-in hybrid arrived earlier this year and can run on battery power alone for almost 60 miles.

My test car was the top-of-the-line AMG 63 S 4Matic, a head-turner in every way. Priced at a whopping $127,000, this GLE looks best in glossy black with the Night Package, which includes tasteful jet-black exterior accents and matte-black wheels. To complete the Darth Vader effect, there’s a deep, menacing exhaust rumble that’s downright threatening.

You expect such a ride to be wicked fast, and it is: 0 to 60 mph in a blistering 3.7 seconds. Yet the carbon ceramic brakes with their devil-red calipers are equally impressive in slowing things down quickly.

Inside, each GLE comes with two large digital displays on the elegantly sculpted dashboard. My favorite feature is the “Hey Mercedes” digital assistant, which responds to voice commands such as opening or closing the sunroof, operating the infotainment system or activating the climate controls.

It’s hard to find sport seats that are more comfortable, especially with the heavenly massage function (though those massage controls could be a bit more user-friendly.) For AMG models, the seats come with red-contrasting stitching and red seatbelts—a nod to the devilish demeanor under the hood.

Considering all the SUVs available in showrooms, few make quite the splash of a GLE.

Real Estate

Boosting your rental property’s curb appeal

Affordable upgrades to attract and keep tenants happy

In the District of Columbia, the rental market tends to open up significantly during the springtime for several reasons. First, spring brings about a sense of renewal and change, prompting many individuals and families to seek new living arrangements or embark on relocations. Additionally, the warmer weather and longer daylight hours make it more conducive for people to explore housing options, attend viewings, and make decisions about moving. Furthermore, spring often coincides with the end of academic terms, leading to an influx of students and young professionals entering the rental market.

Landlords and property managers also tend to schedule lease renewals or list new vacancies during this time, capitalizing on the increased demand and ensuring a steady turnover of tenants. In the competitive world of rental properties, attracting and retaining quality tenants can be challenging. However, with some strategic upgrades, property owners can significantly enhance their units’ appeal without breaking the bank. From enhancing curb appeal to interior upgrades, here are some practical and cost-effective ideas to make your rental property stand out in the market.

Curb appeal

First impressions matter, and curb appeal plays a crucial role in attracting potential tenants. Simple enhancements like freshening up the exterior paint, adding potted plants or flowers, and ensuring a well-maintained lawn can instantly elevate the property’s appearance. Installing outdoor lighting not only adds charm but also enhances safety and security.

Interior upgrades

Upgrade the kitchen and bathroom fixtures to modern, energy-efficient options. Consider replacing outdated appliances with newer models, which not only appeal to tenants but also contribute to energy savings. Fresh paint and updated flooring can transform the look of a space without a hefty investment. Additionally, replacing worn-out carpets with hardwood or laminate flooring can make the unit more attractive and easier to maintain.

Enhance storage

Maximize storage options by installing built-in shelves, cabinets, or closet organizers. Tenants appreciate ample storage space to keep their belongings organized, contributing to a clutter-free living environment.

Improve lighting

Brighten up the interiors by adding more lighting fixtures or replacing old bulbs with energy-efficient LED lights. Well-lit spaces appear more inviting and spacious, enhancing the overall ambiance of the rental unit.

Upgrade window treatments

Replace outdated curtains or blinds with modern window treatments that allow natural light to filter in while offering privacy. Opt for neutral colors and versatile styles that appeal to a wide range of tastes.

Focus on security

Invest in security features such as deadbolts, window locks, and a reliable alarm system to ensure the safety of your tenants. Feeling secure in their home is a top priority for renters, and these upgrades can provide meaningful, genuine peace of mind.

Enhance outdoor spaces

If your rental property includes outdoor areas like a patio or balcony, consider sprucing them up with comfortable seating, outdoor rugs, and potted plants. Creating inviting outdoor spaces expands the living area and adds value to the rental property.

As landlords, investing in the enhancement of your rental properties is not merely about improving aesthetics; it’s about investing in the satisfaction and well-being of your tenants, and ultimately, in the success of your investment. By implementing these practical and affordable upgrades, you’re not only increasing the desirability of your units but also demonstrating your commitment to providing a high-quality living experience.

These efforts translate into higher tenant retention rates, reduced vacancy periods, and ultimately, a healthier bottom line. Moreover, by prioritizing the comfort, safety, and happiness of your tenants, you’re fostering a sense of community and trust that can lead to long-term relationships and positive referrals. So, let’s embark on this journey of transformation together, turning rental properties into cherished homes and landlords into valued partners in creating exceptional living spaces.

Scott Bloom is owner and Senior Property Manager of Columbia Property Management. For more information and resources, visit ColumbiaPM.com.

Real Estate

Real estate agents work hard for that commission

Despite recent headlines, buyers and sellers benefit from our expertise

With there being a lot of noise in the media lately as I am sure you have read and heard headlines like “Gone are the days of the 6% commission” and “End of the good days of Realtors,” etc., I wanted to re-run a very short article of the long laundry list of things that well versed real estate agents bring to the table to earn that seldom 6% commission. It’s typically split in half and it has always been negotiable).

As a real estate professional you will go on listing appointments and buyer meetings to not only attempt to gain business but in doing so you also educate the general public on what it is that we as real estate professionals do. I know what you’re thinking – and if you’ve seen my photo before you wouldn’t be wrong to assume that I am cast in “Selling DC” as the lead villain. I am just waiting for that phone call! But in all seriousness, when I sit down to come up with a list of things to prove to prospective clients the value in working with me as their real estate professional, I am pretty blown away at the items and qualities that a trusted professional representing you in a real estate transaction is responsible for managing a myriad of tasks, including but not limiting to the following:

• Have a pulse on the marketplace to truly understand exactly what is happening from a buying and selling standpoint while also understanding the economic side of things – not just looking at interest rates. Why are rates where they are? What employers are laying off and could cause an influx of inventory? What are the trends for individuals moving IN or OUT of an area looking like? Forecasting the marketplace of all things that truly affect real estate is vital.

• Soft Skills – these are the skills often considered as customer service skills. The ability to be approachable by all types of people and ensure that you are open to receive information. Also – when telling you bad news – it’s important to ensure that it is done in a manner in which you, the receiver, will be pleasantly receptive.

• Pre-market vendors – not only are real estate professionals expected to market your home for sale or locate a home for you to purchase, we are also expected to have a list of pre-market vendors to which you can use for your lending needs, home inspection, title work, any fluffing and buffing needed pre market for the sale of your home such as a contractor, painter, landscaper etc. We have a book of extremely well vetted vendors that either I personally have used or past clients have used that can assist with your needs. This beats Googling for hours and accidentally choosing the wrong contractor. Section A of the pre-market vendor list includes those in which we real estate professionals use for marketing materials for your property – we will use the best photographers, have floor plans drawn for your property, video, staging, catering for brokers opens and the list goes on. Again – this is a well vetted list that we have worked on for years and done all of the heavy lifting and had those uncomfortable conversations when things are not properly executed – so you don’t have to.

• On Market Tasks – these are the tasks that most clients are unaware that we do. Oftentimes when a listing is on market – folks think that I am just cruising around in my convertible buying nice things. However I am in fact going around checking each listing on market to ensure that they are clean, the booties are replaced, marketing materials are stocked, light bulbs are all working, staging looks crisp and the list truly goes on. That of course, doesn’t include the tasks we do to properly market the property such as weekly email blasts, reaching out several times to follow up with showing agents to get their feedback, check the market to see what our competition looks like, what’s under contract and why, and again…..I could go on. Needless to say the most important and time consuming tasks are those that are done when the property is on market.

• “Contract to close” management – the term contract to close is pretty much what it sounds like – it’s what happens from the time we go under contract until we reach the closing finish line and you have those keys. Once a trusted real estate professional has fiercely negotiated on your behalf as a buyer, the fun starts. Again pops up this vendor list – helping guide you though selection of a home inspector, termite inspector, etc. for the inspections. A title attorney is needed (depending on your jurisdiction) and any other vendors for quotes like renovations, etc., that you might want done to the property. Once the inspection is completed and we go through possible re-negotiations then we must ensure that the lender has the documents needed from you completed in order to have the appraisal done to prove the value of the home you are under contract for. Now we are getting into the weeds – but once we are on the other side of things and the appraisal comes back at value and the loan is clear to close then we are at the finish line to your new home.

A similar story can be told if you are selling your home. The appraisal is a very important part of the checklist as that is the value in which your home is worth. The appraiser is a third party that neither the buyer, seller, lender or myself have any allegiance to. I do, however, have the duty to educate said appraiser on why I chose the listing price and how I came up with that value.

• Post-market vendors. As mentioned before, a real estate professional should have a book of well vetted vendors from which to choose. Looking at the list of vendors now that we are on the other side of the table – I can provide a cleaning person, HVAC contractor, someone to repair the sprinkler system, a dog walker, the best caterers and bakery in town. Further down the road I am able to provide a wonderful wealth manager who can tell you what to do with that piece of real estate you purchased some time ago and we could go on for days.

While you are fully entitled to not use a real estate agent during your real estate transaction, I do believe that it is well within the realm of possibilities to say that without one there would be loose ends not completely tied up, things mismanaged and possible delays that could cost real cash. All of that aside, it is also such a truly wonderful experience to work alongside a trusted professional that at the end of the transaction becomes a new friend and family member. Real estate professionals love what they do, they love real estate and people and sheepherding you through the home buying or selling process is what it’s all about to us.

Justin Noble is a Realtor with Sotheby’s international Realty licensed in D.C., Maryland, and Delaware for your DMV and Delaware Beach needs. Specializing in first-time homebuyers, development and new construction as well as estate sales, Justin is a well-versed agent, highly regarded, and provides white glove service at every price point. Reach him at 202-503-4243, [email protected] or BurnsandNoble.com.

-

State Department2 days ago

State Department2 days agoState Department releases annual human rights report

-

Maryland4 days ago

Maryland4 days agoJoe Vogel campaign holds ‘Big Gay Canvass Kickoff’

-

Politics3 days ago

Politics3 days agoSmithsonian staff concerned about future of LGBTQ programming amid GOP scrutiny

-

The White House1 day ago

The White House1 day agoWhite House debuts action plan targeting pollutants in drinking water